Asymmetric Information

Syllabus: Explain, using examples, that market failure may occur when one party in an economic transaction (either the buyer or the seller)

possesses more information than the other party.

Syllabus: Evaluate possible government responses, including legislation, regulation and provision of information.

| Asymmetric means that two things are not perfectly balanced and so asymmetric information in economics is when either the buyer or the seller has more information than the other. |

For markets to function perfectly, all parties to an economic transaction should have perfect knowledge about the transaction.

For markets to function perfectly, all parties to an economic transaction should have perfect knowledge about the transaction.

ie terms of the contract, the products and services that form the subject of the agreement and the prices in the market.

Asymmetric information can be used as a source of power in determining the outcome of the transaction. As a consequence, the market will not achieve allocative efficiency, because one of the parties - normally the consumer, pays a higher price for a product than they would have done if they had perfect knowledge. In a perfect market, consumer and producer surplus will both be maximised at the market price.

A common example of where the buyer pays more for a good than is socially efficient is where the seller knows much more about the characteristics of that good than the buyer. For example where:

- the seller of a product knows it is faulty

- commercial ideas with technical aspects are hard to describe contractually, but privately known by innovators

- labelling of food products use alternative terms for ingredients consumers would normally avoid, e.g. various names for sugars such as glucose, sucrose and fructose

- firms may have no incentive to provide consumers with information in markets with a public good aspect

It is also possible that the consumer has more information than the seller. For example, purchasers with specialist knowledge of antiques may be able to buy a antique for a price less than its true market value from a private seller, who does not have this expert knowledge.

The Market for Lemons: Quality Uncertainty and the Market Mechanism" is a 1970 paper by the economist George Akerlof which examines how the quality of goods traded in a

market can degrade in the presence of information asymmetry between

buyers and sellers, leaving only "lemons" behind.

George Akerlof which examines how the quality of goods traded in a

market can degrade in the presence of information asymmetry between

buyers and sellers, leaving only "lemons" behind. A lemon is an American slang term for a car that is found to be defective only after it has been bought. Suppose buyers can't distinguish between a quality car (a "peach") from a "lemon". Then they are only willing to pay a fixed price for a car that averages the value of a "peach" and "lemon" together (pavg). But sellers know whether they hold a peach or a lemon. Given the fixed price which buyers are willing to buy at, sellers are only willing to sell when they hold "lemons" (since plemon < pavg) and leave the market when they hold "peaches" (since ppeach > pavg). Thus the uninformed buyer's price creates an adverse selection problem which drives the quality cars from the market. Adverse selection is the market mechanism that leads to a market collapse. Akerlof's paper shows how prices can determine the quality goods being traded on the market. Low prices drives away sellers with quality goods leaving only the lemons behind. Akerlof Michael Spence and Joseph Stiglitz jointly received the Nobel Memorial Prize in Economic Sciences in 2001 for their research related to asymmetric information. |

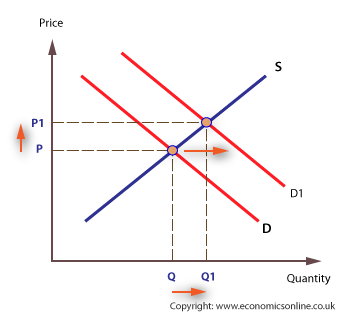

Diagramatic approach

Suppose the demand for second hand cars can be split into 2

separate demands: The demand for low quality cars and the demand for

high quality cars. The second hand car dealer knows this and they know

the quality of their cars. However buyers do not have this information

so in checking the adverts and sales lots for information they have to

resort to averages. Therfore there is an average demand and a

consequent average price for a given make and model of car.

The diagram below shows this average demand as D1. The

equilibrium price is P1. However if the buyer had better information

their demand for lower quality cars would be lower, at D and the seller

would receive a lower price, P. Since

they actually receive the higher price of P1, they are happy to sell low quality cars.

they actually receive the higher price of P1, they are happy to sell low quality cars.

However, using the same diagram, D represents the average demand and set of prices buyers are willing to pay and D1 the demand for higher quality cars and the prices consumers are willing to pay. The sellers who possess all the information remember, are unhappy to receive P, the average price instead of P1 the price that reflects the higher quality. Therfore they do not want to acquire better quality cars to sell on their lots they prefer to sell lower quality cars at the higher average price.

The point Akerlof (et al) made is that in this situation the

market fails because good quality cars (Peaches) are not traded and are

pushed out of the market by low quality lemons. The consumer suffers.

The government has a number of policy tools at its disposal to correct asymmetric information and to control externalities. These include taxes, education programmes and production regulation intended to increase the flow of information to consumers. Government may decide to intervene in the market to require producers to disclose critical information, such as mandatory product labelling. The objective of this government intervention may not be to alter consumption behaviour in particular, but to increase informed consumption. However, these measures can be expensive and ineffective and perceived as government interference in the free market.

The growth of computer ownership with access to the internet has reduced the opportunities for asymmetric information, as consumers are able to access greater details on products, prices and customer reviews.

ToK Essay possibility?

ToK Essay possibility?