Changes in break even

In examinations, you may be required to modify break-even charts as the basis of a decision making process. Here you will be given a complete chart for the initial situation and then be asked to analyse the effects of changes in price or costs by analysing the impact on break-even quantity for the firm. The question may ask you to do this graphically or by using a quantitative method.

Changing any of the variables in a break-even chart will lead to a different break-even quantity. This will be important to the management as it may impact on strategic decision-making in the firm. It is likely to have real life consequences for those working for the business, as the firm may adjust its resourcing levels in response to any changes.

We will use a case study to illustrate potential changes and strategic impact.

Armornet computer cases

Armornet produces one model of computer cases in a range of different colours. The cases offer exceptionally protection for netbook computers from impact, water and liquid damage and temperature change. They are designed for frequent travellers and for those professional who take their netbooks into high risk environments, such as construction sites. At present they are produced in relatively small numbers using a batch process.

Armornet produces one model of computer cases in a range of different colours. The cases offer exceptionally protection for netbook computers from impact, water and liquid damage and temperature change. They are designed for frequent travellers and for those professional who take their netbooks into high risk environments, such as construction sites. At present they are produced in relatively small numbers using a batch process.

The firm has gained a high reputation for quality and customer service and recently won an award from a major travel magazine. At present given the firm's resources, the maximum production in any month is 100 cases. They are presently working at capacity.

The following are details of pricing and costs.

Pricing: $1200 per case

Fixed costs: $640 000 per annum

Variable costs: $400 per case

The firm employs 4 full-time staff (two of whom are directors of the business) and 2 part-time administrative assistants. The cases are assembled in a small industrial unit using standardised parts from 3 different suppliers; two of which are overseas. There are no direct competitors offering the same specifications, but two other manufacturers produce cases at a lower price with lesser protection. However, the directors believe that one of these competitors, Airsquare is working on a higher specification product which will be sold for approximately $1000 and could be considered a substitute.

Using the break-even formula, the break-even point and margin of safety should easy to calculate? Can you calculate these in your head? Click here to see the answer to check.

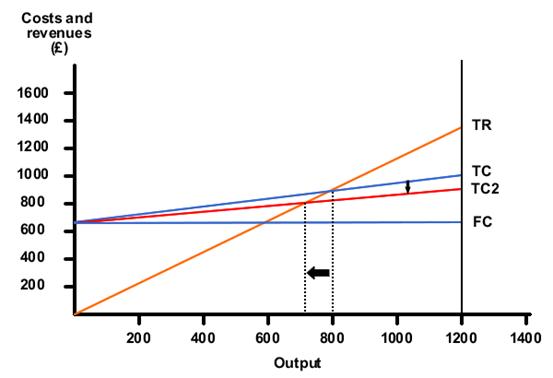

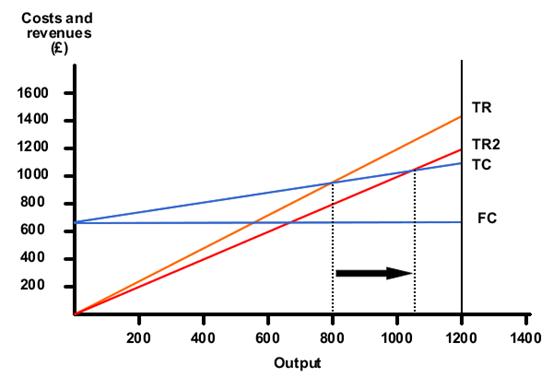

Changing the price

Assuming that Airsquare introduces a cheaper case priced at $1000, Armornet will have to consider whether to match this price. If they decide to lower their price from $1200 to $1000, this will lower the total revenue curve from TR to TR2, with the effect that the break-even quantity increases from 800 units to 1067 units. The margin of safety will fall from 400 units to only 133. Profit will also fall significantly from $320 000 to only $80 000.

Armornet can use this information to underpin its strategic decisions. It may be that they will consider some of the following:

- Is $80 000 profit sufficient to ensure the security of the business and allow adequate funds for future development?

- Will reducing the price affect the reputation of its product?

- Can the business increase its production capacity?

- Can the business differentiate its product and retain its premium price?

- Is the business able to reduce its costs to retain its present profit margin?

- How price sensitive is the product, since the firm is working at capacity?

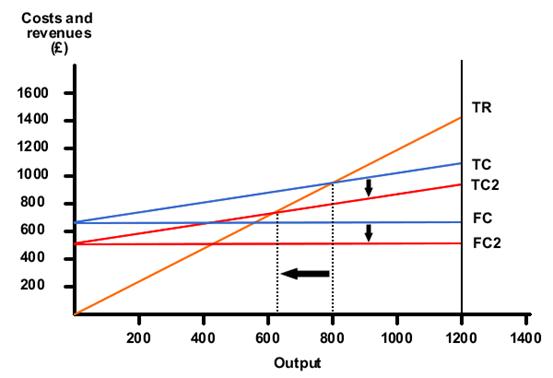

If the business chooses to examine its cost base, it will look at ways of reducing its fixed and/or variable costs.

Changing the fixed costs

As you will already know, fixed costs are costs that do not vary with output. Fixed costs include payments such as:

- Rent

- Office salaries

- Advertising

- Insurance

- Depreciation

It is possible that Amornet may find saving in fixed costs. It might move premises to a unit with lower rent; directors may accept lower salaries or the firm may reduce its advertising spend. All of these options are likely to have negative consequences. Moving may have associated costs and may be to a less advantageous location, lower salaries may affect motivation and reduced advertising may negatively affect sales.

Assuming fixed costs are reduced to £500 000, the effect will be to reduce the fixed cost line from FC to FC1 which will lower total costs as well, so reducing the break-even point from 800 to 625.

Changing the variable costs.

Variable costs are costs that change in direct proportion with output. The most common examples are raw materials and commission on sales. Armornet may seek to find cheaper suppliers. Of course, if this was simple it would probably have been done before. Cheaper suppliers may be less reliable and quality may not be as good, potentially compromising the brand's image. If a cheaper supplier is found, who is prepared to supply at £300 per case, the TC line will lower to TC2 (as TC + VC + FC), so lowering the break-even point from 800 to 711 units.