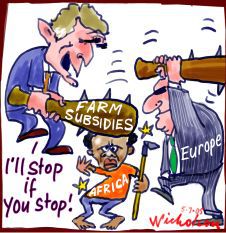

Types of protectionism - Subsidies

Syllabus: Explain, using a diagram, the effects of giving a subsidy to domestic producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.When analysing the effects on stakeholders of subsidising domestic producers so they can reduce prices and compete better with cheaper imports it is best seen in a subsidy diagram. So you are going to construct a diagram - active economics - step by step.

1. Have ready an A4 sheet of paper (you may want graph paper), a pencil, pen and ruler (you can also have an eraser ready)

2.

Draw 2 axes for price and quantity, a supply and demand curve (make

this big and clear). label these Sdom and Ddom for domestic S and D

3. This time DO NOT draw your dotted lines and equilibrium price (Pe) and quantity(Qe) - it will only get in the way

4. Draw a horizontal line well below the equilibrium to represent supply at the world price - assuming that domestic consumers can buy as much from the world market at the world price as they want to without affecting the world price. Many countries supply goods compared with domestic demand, therefore perfectly elastic.

Now work out and indicate on your diagram:

(i) The equilibrium quantity (Sworld = Ddom) label it Qe

(ii) Of that equilibrium

quantity how much is produced by domestic producers? Label it Qdom

(iii) How much is therefore imported from the world market.

5.

The government subsidises a particular good (think USA subsidising

cotton): Subsidy on the production of a good shifts supply curve

downwards by the amount of the subsidy so draw this on your diagram

(Sdom + Sub)

Now letīs summarise where we are:

(i) Identify Qdom before the

subsidy and Qdom with subsidy (Qdom+sub)

(ii) Identify Qe before the

subsidy and after the subsidy - has it changed?

(iv) Identify the amount it costs the taxpayer (represented by the government)

Given the stakeholders (domestic producers, foreign producers, consumers and the government) evaluate from this analysis who wins and who loses from the imposition of a tariff.

What

price do consumers have to pay compared with the world price they used

to pay? How much can consumers buy compared with pre-quota amount?

How much is the total domestic sales? Qdom + Sub so dom sales increases - producers benefit

How much is now imported? Qdom +Sub to Qe

By how much have imports been reduced? So foreign producers lose out.

There is a cost to government - how much?

Are subsidies a better option than tariffs or quotas would you say?

Can you reason through the deadweight losses? (the presentation below is a beautiful explanation of the effects of quotas, using a diagram)

Giving a subsidy - calculation

Syllabus: Calculate from diagrams the effects of giving a subsidy to domestic producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.For higher level, you need to be able to understand how to calculate the impact of a subsidy on a market. You will need to calculate this from linear demand and supply functions and to be able to calculate the change in consumer expenditure and the domestic and overseas firm's revenue from the diagram. The presentation below goes through this. Click on the screenshot, or link below, to open the presentation. It will open in a new web window. You will need a headset or speakers to listen to the explanation.

If you have trouble opening this it could be because of the browser you are using - Google Chrome seems to work best