A consumer price index

Syllabus: Explain that inflation and deflation are typically measured by calculating a consumer price index (CPI), which measures the change in prices of a basket of goods and services consumed by the average household.

In most countries inflation is measured by using a weighted price index. This may be called something like the 'Consumer Price Index'. What is it in Brazil?

In most countries inflation is measured by using a weighted price index. This may be called something like the 'Consumer Price Index'. What is it in Brazil?

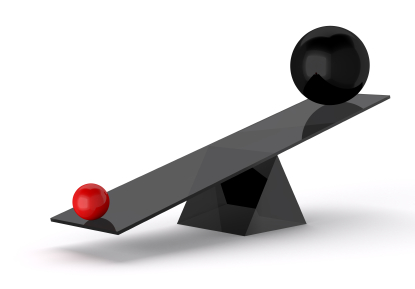

However, what do we mean by a weighted index and why does it need

weighting? Prices of all goods change, but some goods are more

important (have a more significant effect on real income) than others.

If the price of a major food item (Rice) goes up by 10% and

the price of shoelaces goes up by 100%, we don't want shoelace price

increases to have anywhere near the same impact on the measure of

inflation (CPI).

This is because we spend a large proportion of our income on food and usually hardly any on shoelaces. We therefore weight each price change to reflect its importance in our spending. Prices of goods which we spend a lot on get higher weights. Those that are relatively less important get lower weights.

There are THREE main general stages to calculating a weighted index. These are:

- The use of a survey to decide on the weights to be used. The survey will usually try to measure the way in which families spend their income so that the weights can reflect average spending patterns on a typical basket (metaphor for a given collection) of consumer goods.

- The recording of price changes. This is often done monthly to get a figure for inflation and a number of prices may be collected for the same set of goods. This is to reflect regional differences or differences resulting from selling it in different locations.

- Each price is then multiplied by its weight. This ensures that the inflation measure is appropriate for the way in which the people in the economy spend their money. (the weights are usually fractional and sum to 1 but could be formed to sum to 100)

Syllabus: Construct a weighted price index, using a set of data provided.

You will be given prices and weights so just follow the process

price times its weight divided by 100 (You can skip this if the weights are already decimal fractions - think about it)

A really straightforward explanation is here:

Calculating a weighted Price Index

Syllabus: Calculate the inflation rate from a set of data.

This slideshare is a detailed explanation of how to calculate a CPI

The annual percentage change in a CPI is used as a measure of inflation so to calculate the inflation rate from given (or calculated) Price Indices use this formula for each given good in each year:

Simple (Unweighted) CPI

Formula: Current Year Price X 100 The base year index must always be 100 since the numerator

Base Year Price and the denominator are the same.

If the price of all food is $150 in the Base Year and it increases to $240 in the next year (Current Year) then

240 X 100 = 160

150

Second do the same for all the other goods (see slideshare slide 7) and then sum all these indices and divide by the number of goods

492.5 = 123.1 (the sum of the indices is 492.5 and the number of goods is 4)

4

Comparing the current year with the base year (of 100) then inlation is 23.1%

Weighted CPI

Is the same as above except this time use the current year index times its weight

240 X 100 = 160 (as above) now multiply by its weight which is 4 - given in data

150

240 X 100 = 160 X 4 = 640

150

Now add all the weighted CPIs and divide by the Sum of the weights (here the sum is 10)

1365 = 136.5

10

Therefore the rate of inflation (comparing with base year which must always be 100 remember) is 36.5% this time

The slideshare takes you through this process in step by step detail but sometimes this amount of detail is confusing as you try to sort your way through it and for some people they intuitively get it so donīt need the detail. This why I have summarised everything.