Syllabus: Fiscal policy and its impact on potential output

Syllabus: Evaluate the view that fiscal policy can be used to promote long-term economic growth (increases in potential output) indirectly by creating an economic environment that is favourable to private investment, and directly through government spending on physical capital goods and human capital formation, as well as provision of incentives for firms to invest.

Long Term Economic growth is depicted as a shift in

LRAS to the right (ie an increase in the production potential of the

economy or full employment real gdp)

Figure 1 Increase in Production Potential (Y1 to Y2) Neoclassical

Figure 1 Increase in Production Potential (Y1 to Y2) Neoclassical

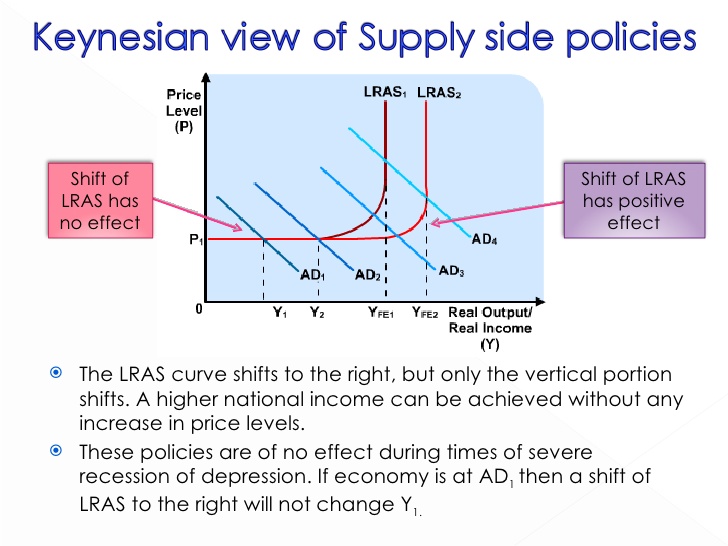

Figure 2 Increase in Production Potential Keynesian

Supply-side policies are policies that aim to increase the

capacity of the economy to produce. However, it is also possible for

fiscal policy to act on the level of supply and government will often

use fiscal policy as one of their key supply-side policy tools.

Income tax may have an effect on people's incentives to work. This will be true at most income levels.

If income tax at low income levels

is too high, people may choose to remain unemployed, or not to seek,

employment. This is an economically rational decision, because it may

be more rewarding to stay on benefits when other expenses of

employment, such as transport and child-care, are factored in. This

situation is often referred to as a 'poverty trap', because the

unemployed cannot improve their financial position.

If income tax on high levels of income is too high, people (Entrepreneurs) may choose not to work so hard or take risks. Ultimately, they could make the choice to leave a particular country if taxes in other countries are significantly lower This 'flight' out a country to seek lower taxes elsewhere is called a 'brain drain', when the process involves large numbers of the most talented and skilled in a population.

Supply-side fiscal policies can include:

- Cutting the lower and basic rates of tax to open up the gap between the earnings in work and the benefits of those who are unemployed, to ensure people have an incentive to work

- Increasing the level of tax-free personal allowances for the same reason

- Reducing the top rate of tax to encourage enterprise, risk-taking and the incentive to work harder

- Government spending on health and education and infrastructure such as roads and railways.

The intended effects of these supply-side policies are known as

'microeconomic effects', although bear in mind that they may have

macroeconomic effects as well. Whether, or not, supply-side policies

work in the way they are intended, or whether they may are desirable,

is considered in (Pages 56 and 57)

In a nutshell, free market economists favour using fiscal policy as a means of affecting incentives (Long Run).

While Keynesians favour using fiscal policy to directly affect economic activity through Aggregate Demand (Short Run).