Sources of government revenue

Syllabus: Explain that

the government earns revenue primarily from taxes (direct and

indirect), as well as from the sale of goods and services and the sale

of state-owned (government owned) enterprises.

In order to provide all the goods and services governments are expected to provide they need funding. Whether this is directly providing health, education, security (eg police, army, fire department etc) or subsidising merit goods (solar energy, pharmaceuticals, research and development, The Arts etc) they need to raise (collect) revenue.

Taxes

Tax systems include direct taxes (income tax, profit tax, capital gains etc) and indirect taxes (sales taxes - VAT, GST; excise taxes - tobacco, alcohol, import)

Sale of Goods and ServicesWhen governments own and run enterpises (usually utilities) they charge for the goods and services they sell (eg electricity, gas, clean water) and there are charges for non-utilities such as museums, national parks, toll roads etc)

The government budget is a statement that sets out all revenue streams coming into the government treasury departments and all the expenditures made by the government (or public sector, which includes municiple and local government as well as national government).There can be a

budget deficit (expansionay on the economy because spending - injection- is greater than tax revenue - withdrawal).

budget surplus (contractionary on the economy because spending - injection- is less than tax revenue - withdrawal)

budget balance (no net effect on the economy because spending - injection- is equal to tax revenue - withdrawal)

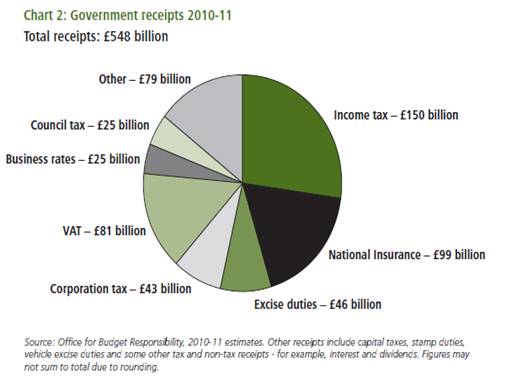

below is a look at the government budget in the UK as an example of the concepts explained above:

The government budget

Sources of government income

Source: From 2011 UK Budget http://www.hm-treasury.gov.uk/d/junebudget_complete.pdf

Task (1) - sources of government income (UK)

The above chart shows how the UK government raises its revenue. Find out what each of these different forms of collecting revenue relate to.

| Income source | Brief explanation |

|---|---|

| Council tax | |

| Business rates | |

| VAT | |

| Corporation tax | |

| Excise duties | |

| National insurance | |

| Income tax | |

| Capital tax | |

| Stamp duties | |

| Vehicle excise duties | |

| Interest and dividends |

Task (2) - sources of government income (other country)

Build an equivalent table to that in Task (1) for your own country.