Syllabus: Impact of automatic stabilisers

"Automatic stabilisers are features of the tax and transfer systems, that tend by their design to offset fluctuations in economic activity without direct intervention by policymakers. When incomes are high, tax liabilities rise and eligibility for government benefits falls, without any change in the tax code or other legislation. Conversely, when incomes slip, tax liabilities drop and more families become eligible for government transfer programs, such as food stamps and unemployment insurance, that help support their income."

Source: http://www.taxpolicycenter.org/briefing-book/background/stimulus/stabilizers.cfm

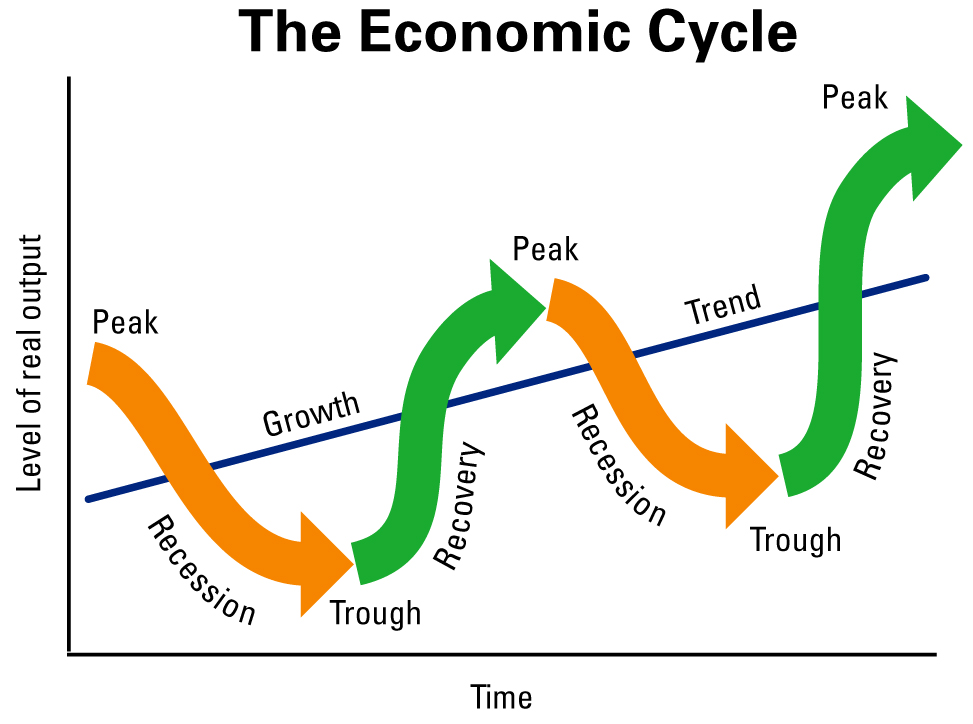

In

section 2.1, you discovered that real GDP fluctuates over time and that

these create short term business or trade cycles. Economies move

through the following cycle:

In

section 2.1, you discovered that real GDP fluctuates over time and that

these create short term business or trade cycles. Economies move

through the following cycle:

- Peak/boom

- Downturn/ recession

- Trough/depression

- Recovery/expansion; leading back to a peak/boom

Income taxation and transfer payments can act as non-discretionary fiscal policy, in that they automatically have the effect of lessening the business cycle.

During times of expansion, when real GDP is growing, incomes will be increasing. If the country has a progressive tax, such as an income tax, in place an increasing proportion of those incomes will be paid to the government as incomes rise and transfer paymnents such as unemployment benefit will decrease. This represents a leakage and a reduction in injections from the circular flow of income and is not spent goods and services. The effect of this is to reduce the rate of growth of GDP.

Similarly, during times of recession when real GDP is falling, incomes will fall as unemployment increases. Transfer payments, such as unemployment benefits, will increase and tax revenue will decrease ensuring that consumption does not slow-down in the same proportion as falling employment income. Real GDP, therefore, does not continue to fall at the same rate.

Fiscal drag

We have shown the effect of automatic stabilisers dampening down the business cycle and bringing about certain amount of stability in output, employment and income. However, automatic stabilisers can sometimes cause problems if the economy is in a depression with a great deal of unemployment. The stabilisers can reduce the upward effects of the multiplier as the governments tries to kick start a recovery by increasing government spending. Incomes will not increase as rapidly as hoped, because additional taxation causes some of the injections to be leaked from the circular flow of income. Similarly, if governments want to introduce a discretionary deflationary policy to close an inflationary gap, the existence of transfer payments will not enable the desired reduction in consumer spending to happen as fast as the government may want. In both cases, the discretionary policy is being dragged back by the stabilisers, hence the term, 'fiscal drag'.