Syllabus: Fiscal policy and short-term demand management

Syllabus: Explain how changes in the level of government expenditure and/or taxes can influence the level of aggregate demand in an economy.Aggregate Demand and Budgets

The AD curve is shifted by changes in the components of AD (C+I+G+X-M). Therefore the government can attempt to influence the level of Real GDP produced and in turn affect government objectives: inflation, unemployment, economic growth.

Reflationary or expansionary fiscal policy (Shifting AD to the right)

Governments may choose to employ reflationary or expansionary fiscal policy in

times of recession or a general downturn in economic activity. In this

situation, they will use fiscal policy to stimulate the economic

activity. They may do this by lowering taxes (withdrawals) in some form or by increasing government expenditure (G - injection).

Governments may choose to employ reflationary or expansionary fiscal policy in

times of recession or a general downturn in economic activity. In this

situation, they will use fiscal policy to stimulate the economic

activity. They may do this by lowering taxes (withdrawals) in some form or by increasing government expenditure (G - injection).

If they lower indirect taxes then this will lower the prices of the taxed goods and encourage more consumption expenditure (C).

Alternatively, they could lower direct taxes increasing disposable incomes (take-home pay) and encouraging greater consumption (C). Either way the level of demand in the economy should rise and stimulate economic growth.

Reflationary fiscal policies can include:

- Cutting the lower, basic or higher rates of tax

- Increasing tax-free allowances

- Increasing the level of government expenditure

The effect of these policies should be to boost aggregate demand and the equilibrium level of income.

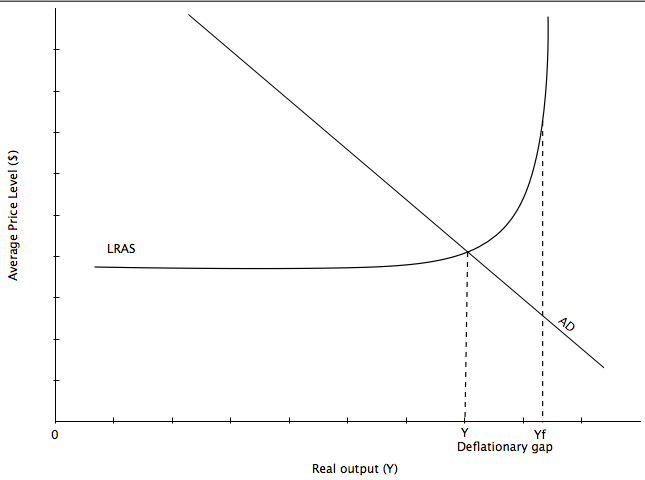

First, remember a deflationary gap (Keynesian) is when

equilibrium (Y) Real GDP is lower than Full Employment Real GDP

(asa shown in the digram on the left). The government may choose to use

a reflationary policy to shift AD to the right and bring the economy

closer to Full Employment (Yf).

Syllabus: Construct a diagram to show the potential effects of expansionary fiscal policy, outlining the importance of the shape of the aggregate supply curve.

However, reflationary policy may cause demand-pull inflation. Keynesians would argue that reflationary fiscal policy is appropriate where there is spare production capacity (demand deficient unemployment) as they believe that the economy can settle at any equilibrium level of output. Their view of reflationary policy can be seen in Figure 2 below.

Reflationary policy shifts AD to the right but the closer to full

employment (vertical section of AD) the more the effect will be on the

price level

rather than on Real Output (Real GDP).

For Keynesians, any increase in AD on the horizontal section of the AS curve will not be inflationary because there will be spare resources firms can use to increase output without increasing costs of production. Prices will only increase when the economy approaches full employment and can only be inflationary as the AS curve becomes vertical.

Figure 2 Reflationary fiscal policy - Keynesian analysis

Deflationary fiscal policy (Shifting AD to the left)

Syllabus: Explain the mechanism through which contractionary fiscal policy can help an economy close an inflationary gap.

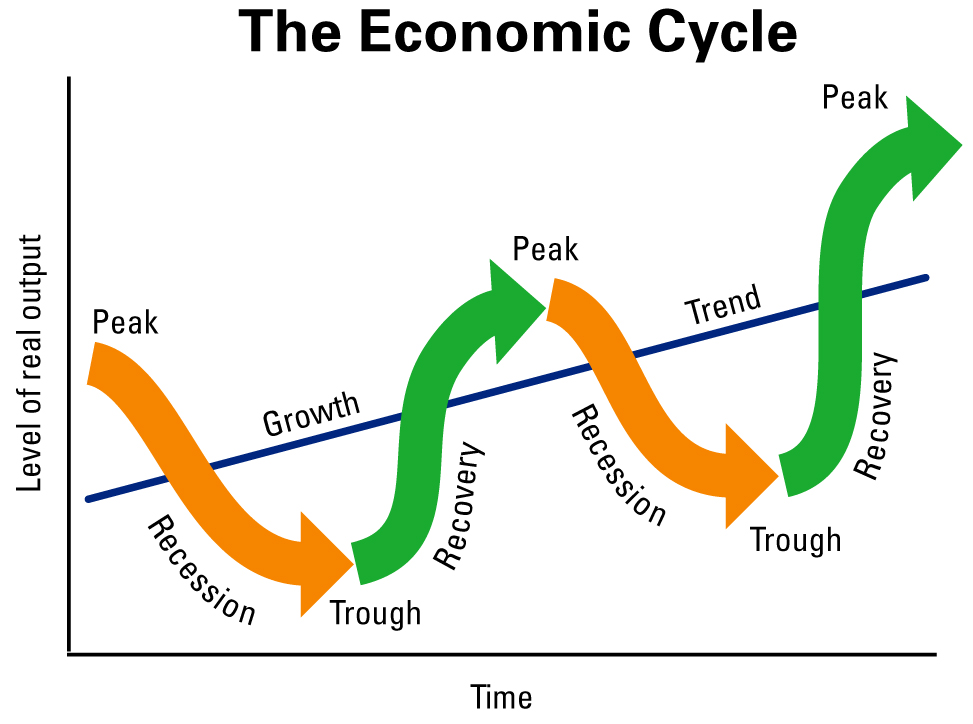

Deflationary fiscal policy is likely to be most appropriate in times of economic boom (remember business cycle).

If the economy is growing at above its capacity (short run Peak or Boom), this is likely to cause inflation and balance of payments problems.

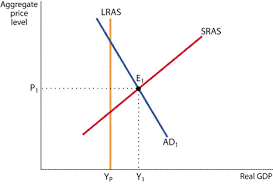

Figure 3 Inflationary Gap (Yf to Y1)

To slow the growth of the economy, the government could increase taxes in some form and/or reduce government expenditure. Either of these should reduce the level of demand in the economy and, therefore, the level of economic growth. The government may increase indirect taxes, which will result in higher prices for goods and services if firms maintain their profit margins. This should deter consumers from purchasing the same quantity of goods and services. Alternatively, the government may increase direct taxes, which will leave people with less money in their pockets and discourage spending.

Syllabus: Construct a diagram to show the potential effects of contractionary fiscal policy, outlining the importance of the shape of the aggregate supply curve.

Figure 4 Closing the Inflationary Gap (Yf to Y1)

Deflationary fiscal policies include:

- Increasing the lower, basic or higher rates of tax

- Reducing the level of personal allowances

- Reducing the level of government expenditure

The effect of these policies will be to shift the aggregate demand curve from AD1 to AD2, as in Figure 4 above, to return to Full Employment.