Government fiscal policy

Fiscal Policy

Fiscal policy involves the Government changing the levels of taxation and government spending in order to influence Aggregate Demand (AD) and therefore the level of economic activity.

The purpose of Fiscal Policy is:

- to reduce the rate of inflation to the target laid out by the government or central bank (most developed economies set a target for HICP of 2%)

- to stimulate economic growth in a period of a recession.

- to stabilise economic growth, avoiding the 'boom and bust' economic cycle.

Finance ministers use fiscal policy to alter the activity rates of the economy. They budget for either a surplus or deficit in their spending patterns in an attempt to influence economic behaviour.

Expansionary (or reflationary) fiscal policy

This involves increasing aggregate demand (AD) in an economy by:

- increasing government spending and/or,

- reducing direct and/or indirect taxes

The effect is to:

- increase consumers spending because they have more disposable income

- create a government budget deficit or cut a budget surplus

Deflationary (or tight) Fiscal Policy

This involves decreasing aggregate demand in an economy by:

- cutting government spending and/or,

- increasing direct and/or indirect taxes

The effect is to:

- reduce consumer spending

- reduce a budget deficit or create a government surplus

Fine Tuning:

This involves maintaining a steady rate of economic growth through using fiscal policy. However, given the number of economic variables, this is extremely difficult to achieve.

Automatic Fiscal Stabilisers

Governments are aware that there are some fiscal controls that work without government intervention. These are called automatic fiscal stabilisers.

- If the economy is growing, people will automatically pay more taxes (VAT and Income tax) as they earn more and the Government will spend less on unemployment benefits. The increased tax and lower government spending, will act as a check on aggregate demand

- In a recession, the opposite will occur with tax revenue falling but increased government spending on benefits, thus naturally increasing the level of aggregate demand

The Multiplier Effect

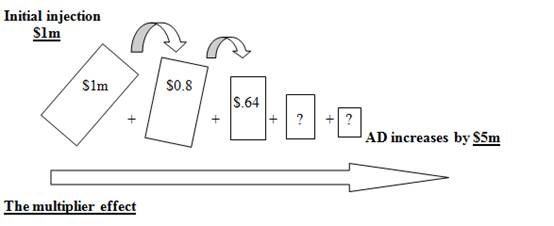

An increase in government spending of say $1m will not just increase spending by that amount - there will be a multiplier effect. These are the knock-on effects in spending that will happen as a result of the initial boost.

For example, an increase in spending on health to build new hospitals will benefit construction companies, which will spend more perhaps on investment as well as wages and this will result in further spending, which will further be passed on to other firms.

This is similar to a domino effect, except each successive domino is smaller. For example if the profits of an entrepreneur rise, he or she has two options; to spend the additional profit or save it. Most individuals will choose to save some and spend the rest.

Let's assume that on average the entrepreneur spent 80% of any additional income received. If the entrepreneur earns an additional $1m profit, so spending in the economy will increase by $800,000. Let's say the entrepreneur purchased a yacht. Then the yacht builders will receive an additional $800,000, but will also spend some of this and save the rest. Assume they spent 80% on a new boat yard, so the constructors of this yard will receive $640,000. They the construction company will spend or save etc. So the initial increase in aggregate demand of $1m had led to an additional demand in the economy of:

$1m + $800,000 + $600,000 ...and so on = final increase in aggregate demand.

There is a formula to work out the total extra aggregate demand based on the decisions to spend or save, but it is clear that the initial injection of $1m leads to a greater increase in aggregate demand through the multiplier effect. In the diagram below the multiplier effect is 5, as the initial increase in spending of $1m results in an increase in overall spending in the economy of $5m

Can you complete the final two boxes?

There are two main types of taxation:

- Direct taxes - these are taxes on income e.g. income tax and corporate taxes. Income tax is a progressive tax - in other words, it takes an increasing proportion of a person's income as their earnings get higher. The aim of this tax is to help redistribute income as well as raise revenue for the government.

- Indirect taxes - these are taxes on expenditure and include sales taxes as well as any 'excise duties' which are taxes on tobacco, alcohol, petrol and so on. These taxes tend to be more regressive in nature - in other words they are more difficult for the less well off to pay as they represent a higher proportion of their income. If VAT is 20% for example, and a rich person and a poorer person buy sofa for $1000, then both purchasers will pay VAT of $200. This obviously represents a higher proportion of the poorer person's income

Fiscal policy changes will affect business significantly and as a Business and Management student you need to be prepared to discuss these changes. Think carefully about issues like:

- Corporate tax changes: Will the changes encourage or discourage investment? Will firms be looking to relocate to take advantage of lower taxes elsewhere? Will the changes leave firms with more or less internal funding for R&D and other product development?

- Direct tax changes: Will people have more or less money to spend and therefore what will happen to demand for the product or service? Have the tax changes affected higher income earners and lower income earners to the same extent? If wealthier consumers are badly affected by tax changes, they may but fewer luxury items. If a business focuses on the luxury market, it is likely to be affected more than those concentrating on staple or necessity good. All of this will depend on the sensitivity of the firm's goods and services to any changes in customer (income elasticity of demand). Also of importance is whether tax changes will influence employee's motivation to work and/or whether the firm will be under pressure to increase wages to maintain disposable income?

- Indirect tax changes: Will the tax changes increase or reduce demand? How price elastic is the demand for goods affected by the tax change? In addition, tax changes may alter the operational costs of a business such as energy charges.