Page 01

Topic pack - introduction

Welcome to this Triple A Learning topic pack for business organisation and environment. The pack has a wide range of materials including notes, questions, activities and simulations.

A few words about Navigation

So that you can move to the next page in these notes more easily, each page has navigation tools in a bar at the top and the bottom. These tools are shown below.

![]() The right arrow at the top or bottom of the page will take you to the next page of content.

The right arrow at the top or bottom of the page will take you to the next page of content.

![]() The left arrow at the top or bottom of the page will take you to the previous page.

The left arrow at the top or bottom of the page will take you to the previous page.

![]() The home button will take you back to the table of contents for the pack.

The home button will take you back to the table of contents for the pack.

The pack is split into a series of sections and to access each section, the easiest way is to use the table of contents on the left-hand side of the page. To return to the full table of contents, please click on the 'home button' at any stage.

Higher level extension material

Some of the material in this pack relates to the higher level extension topics in the Business and Management guide. This material is marked by icons as follows:

This icon indicates the start of the higher level extension material.

This icon indicates either:

- The higher level extension material continues on the next page or

- The higher level extension material continues from the previous page

This icon indicates the end of the higher level extension material.

To start viewing the contents of the pack, please click on the right arrow at the top or bottom of the page.

Terms and definitions

One of the key things you need to be sure to know are the definitions of all key business terms. In this section we give you explanations and definitions as well as some flash cards, crosswords and word searches to help you practice them.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Click on the right arrow at the top or bottom of the page to start looking at the definitions.

Aims of the business and management course

The aims of the business and management course at HL and SL are to:

- promote the importance of exploring business issues from different cultural perspectives

- encourage a holistic view of the world of business

- enable the student to develop the capacity to think critically about individual and organizational behaviour

- enhance the student's ability to make informed business decisions

- enable the student to appreciate the nature and significance of change in a local, regional and global context

- promote awareness of social, cultural and ethical factors in the actions of organizations and individuals in those organizations

- appreciate the social and ethical responsibilities associated with businesses operating in international markets.

Assessment Objectives

Having followed the business and management course at HL or SL, students will be expected to:

- demonstrate knowledge and understanding of business terminology, concepts, principles and theories

- make business decisions by identifying the issue(s), selecting and interpreting data, applying appropriate tools and techniques, and recommending suitable solutions

- analyse and evaluate business decisions using a variety of sources

- evaluate business strategies and/or practices showing evidence of critical thinking

- apply skills and knowledge learned in the subject to hypothetical and real business situations

- communicate business ideas and information effectively and accurately using appropriate formats and tools.

In addition to the above, students at HL will be expected to:

- synthesize knowledge in order to develop a framework for business decision-making.

Topic One Structure

Unit one has eight core sub-topics and one HL extension

1.1 Nature of business activity - notes

This section looks at the nature of business activity, what a business does and how it does it. It examines the functions/departments of a business and the inputs used to create goods and services.

By the end of this section you should be able to:

- Identify inputs, outputs and processes of a business

- Describe the various business functions and explain their role

- Explain the nature of business activity in different sectors: primary, secondary and tertiary

- Analyse the impact of changes in economic structure on business activity

The nature of business

A business is set up because the founders believe they have found a product or service, which will both satisfy customers and provide a level of returns to meet their needs.

Customers have needs and wants. A need is generally a product or service required for survival, such as food, clothing or shelter. In addition, customers have wants, which are things they would like to have, but are not necessary for immediate survival, such as cars, television and laptops. Of course the nature of needs and wants varies from country to country, and region to region. In hot climates the need to keep cool, will mean most buildings are fitted with air conditioning systems, whereas in cold climates, the need will be for better insulation and heating.

The resources used to produce goods and services are scarce as they are limited in supply, but the needs and wants of customers are infinite. Therefore, resources must be rationed in some way and this occurs through the business charging a price for their outputs. The success of a business is measured by whether customers are willing to pay this price, and also whether after paying for all the costs of the business the owners can make a profit that justifies the risks of setting up the business in the first place.

The resources used to produce goods and services are scarce as they are limited in supply, but the needs and wants of customers are infinite. Therefore, resources must be rationed in some way and this occurs through the business charging a price for their outputs. The success of a business is measured by whether customers are willing to pay this price, and also whether after paying for all the costs of the business the owners can make a profit that justifies the risks of setting up the business in the first place.

Markets, customer and consumers

A market is a place or a process which brings together buyers and sellers so goods, services and information can be exchanged. Markets vary in size, range, and location. They may be physical in the sense of a shop or restaurant, or may be virtual as in the case of an e-commerce transaction.

The purchasers of the product in the market place are customers. However, those who enjoy the product or serve are consumers. In most cases these are one and the same. If you buy and then eat an ice-cream, you are both the customer and the consumer. However, if a parent buys an ice-cream for their child, the parent is the customer and the child is the consumer. This is a very important distinction in business, because when a firm is planning how to market their product they have to decide whether the customer or the consumer is most influential in the purchasing decision.

Try to avoid misspelling 'Customers'. One of the most common spelling mistakes in examinations, and indeed courseworks, is reference to 'Costumers' - these do exist, but they make costumes!

Business activity

In this, the first section of the IB course, we look at business organisations and the various different types and classifications of organisation that exist. All of these organisations take part in what is called Business Activity. Think about what business activity means to you and what it involves and then follow the link above to see how your thoughts compare with ours.

So let's start to look at this in more detail. We are now aware of what business activity is, but let's examine what we mean by a 'business'. First, what do you think a Business is? Have a think about this and then move on to the next page where we will look at this in more detail.

What is a business?

The term 'business' is used to describe all the commercial activities undertaken by the various organisations, which produce and supply goods and services.

The term 'business' is used to describe all the commercial activities undertaken by the various organisations, which produce and supply goods and services.

A business has many features. It is:

- A decision making organisation

- made up of groups of workers (employees), managers, directors and shareholders

- which exists in association with customers, suppliers, competitors, the environment, local, national and other governments

- that uses factors of production

- to produce and sell goods and/or services

- so as to make a profit.

Decision-making

Firms and business studies are all about making and taking decisions. The basic decisions are:

- What to produce - what good or service - and for how long?

- How to produce and in what quantity?

- Who to sell the goods or services to - how to distribute?

Some decisions may have significant consequences. Companies deciding, for instance, to change location or products may invest large sums in their decisions. Poor decisions may result in the closure of the business itself. These types of decisions are called 'strategic' or high level decisions. Businesses need to get these decisions right.

Less important decisions, such as what brand of paper to use, have less important consequences. These day-to-day decisions are referred to as 'tactical' or 'low level' decisions. It is important, however, to remember that too many poor tactical decisions could affect the longer-term strategy. For example in a sports team, the team may be able to cover up for one or possibly two players not playing well. However, if everyone is having a 'bad day' the team will lose!

The business world is dynamic. Little stays the same for long. Management has to detect changes and take decisions on how to react to change on a regular basis. We will learn over the course of this topic and later topics, a whole range of techniques that make decision-making easier. These will be considered as business tools that assist decision making. However, remember, these techniques do not make decisions, people do. A skilled craftsman knows what tool to use and when.

Businesses also have to plan their progress. They aim first to survive, then to grow. This means they normally follow a formal planning cycle designed to address the following questions:

- Where are we now?

- Where would we like to be in the future?

- How are we going to get there?

- How will we know when we arrive?

This framework is a shorthand outline of the strategic decision-making process.

The Classification of a Business

In the same way that individuals have distinct personalities and characteristics, so do businesses. Classifying things help us to understand and define them. The following are ways that we can classify and group businesses, all of which will be examined in detail during this topic:

- By sector - there are two main sectors: private and public. The private sector includes all organisations owned, controlled and managed by private individuals for the purpose of making a profit. The public sector refers to organisations owned, controlled and managed by the government (or state) to provide essential goods and services for the general public. Governments play a role in the production of goods and services that are underprovided by the private sector, such as health and education.

- By level of activity - essentially this describes how close the business is to the customer in the distribution chain. For example, those businesses involved in the extraction of raw materials, such as oil, are very early in the distribution chain, whereas those which own retail outlets are much later in the chain and close to the final customer

- By size - we often classify businesses as small or large, but what do these terms mean? Unfortunately, this classification is complicated by the fact that there are number ways of measuring business size, such as capital employed, market share, sales turnover, profit and the number of employees.

By legal structure -The way that a business is set up affects its legal rights and responsibilities.

Inputs: Factors of production

To produce goods or services, a firm must use a range of resources. These resources are called the factors of production or factor inputs. These resources are categorised into four groups:

To produce goods or services, a firm must use a range of resources. These resources are called the factors of production or factor inputs. These resources are categorised into four groups:

- Land - this is the land itself, the factory site, for example. It also covers unprocessed raw materials derived from the earth or water.

- Labour - the services given by all employees of the business. A labour-intensive business is one that has a high proportion of labour inputs, normally because labour is relatively cheap.

- Capital - money, or the assets such as buildings, plant and equipment, which it has bought and uses in the production process. Capital can be thought of as anything used to produce something else. Money is capital only when it is used to buy business assets such as machinery and raw materials. A capital-intensive business depends more heavily on capital than the other factors of production. This is often because labour is relatively expensive.

- Enterprise - that 'spark' or idea which the founder or entrepreneur provides. This will include the planning that brings together the other three factors of production.

The provider of each factor receives a reward for being involved in production:

- Land owners receive rent

- Employees receive wages and salaries

- The providers of capital receive interest

- Entrepreneurs get to keep the profit - if there is any - for their risk-taking in setting up the business process and for their additional responsibilities and decision making in the business process.

Processes: Business functions

A business is usually split into a series of different departments. Each department has a specific function in the operation of the business. For example, the accounting department will be responsible for the management of all financial matters relating to the business. This might include managing the businesses bank accounts, invoicing customers, collecting debts and so on. Each of these different functions is a crucial part of the overall business.

Human resources function (Human Resource Management or HRM for short)

Firms need people and the human resources department is responsible for the management of people. The responsibilities of the HR department will include:

Firms need people and the human resources department is responsible for the management of people. The responsibilities of the HR department will include:

- Recruitment - the process of finding appropriate people for a given role. This includes advertising a vacancy, selecting candidates for interview, managing contracts of employment, job descriptions and so on.

- Training - both new and existing staff will need training to help them develop and improve their skills and this will be the responsibility of the HR department.

- Pay - people work for money and this process needs managing. How much is each job worth, what other benefits do employees get (pension entitlement, fringe benefits and so on), what happens when people are sick? All these questions and issues are dealt with by the HR department.

- Employee relations and welfare - this includes pay negotiations with employees, disciplinary procedures, considering grievances of employees as well as health and safety, social activities and so on. All these will usually be handled by the HR department.

Human Resources - labour or workforce

Human resources is a collective term for the people within a firm. They are often described and classified by their function:

- Owners - the nature of ownership depends on the legal structure of the firm. The owner may be one person (sole trader) or a group of individuals (partners), or ownership may rest with a group of shareholders.

- Directors - people appointed by the owners to look after their interests. Some directors are also employees. These are the executive directors who are responsible for the day-to-day management of the firm. The senior executive director is the Managing Director or the Chief Executive Officer (CEO). The other directors, the Non-Executive Directors, only sit on the Board and are expected to watch and advise both the board and the owners.

- Managers - people responsible for the planning and control of the business.

- Employees - people who operate the business on a day-to-day basis.

People may be in more than one group. An employee may also be a shareholder, for instance. This can cause a serious conflict of interest.

Accounting and finance function

Accounting and finance function

The accounting and finance department are responsible for all issues related to the management of money and the flows of money around the business and between the firm and other firms or customers. The Accounting function involves the collection, recording, presentation and analysis of financial data. This may include 'management accounts' for the directors of the firm to view on a regular basis or the public or 'financial accounts' for anyone to view (if the firm is a public limited company). The Finance function, on the other hand, is concerned with raising the money required for all business operations and the decision-making on how and where that money should be spent.

The responsibilities of the finance function include:

- Sources of finance -decisions about the most appropriate source of finance for each activity.

- Cash flow -the way in which money moves in and out of the business. It is important to balance and manage these flows. If too much money flows out at a given time, the firm is in danger of insolvency.

- Credit control - the process of collecting debts and managing payments. At any given time a firm will be owed money by its customers and may owe money to its suppliers.

Marketing function

This is seen by many as the heart of the business as the marketing department tends to have the most direct contact with customers. It is important to realise that marketing is not the same as 'selling', but is a much broader concept. The responsibilities of the marketing department may include:

This is seen by many as the heart of the business as the marketing department tends to have the most direct contact with customers. It is important to realise that marketing is not the same as 'selling', but is a much broader concept. The responsibilities of the marketing department may include:

- Researching the market - identifying market opportunities, examining the nature of customers and potential customers, understanding the target market for the good or service, testing consumer reaction to potential products and so on.

- New product development - the marketing department will often work together with the production department to develop new products and services. The marketing department will test if there is a market for the product, identify the features or characteristics that the product requires and may carry out test launches of the product in advance of the full product launch.

- Marketing mix - the marketing department will develop the mix of strategies that will help with selling the product. This includes the pricing of the product, the promotion, the nature of the product and the distribution channels for the product.

Production function (Operations Management or OM for short)

The production function is perhaps the clearest of all. It may also be called the 'operations' function of the firm. However, as with marketing, there is more to the production function than immediately meets the eye. The responsibilities of the production department may include:

The production function is perhaps the clearest of all. It may also be called the 'operations' function of the firm. However, as with marketing, there is more to the production function than immediately meets the eye. The responsibilities of the production department may include:

- New product development - in association with the marketing department

- Research and development (R & D) - R&D refers to systematic investigation or innovation; the outcomes of which are new or improved materials, products, devices, processes, or services. Prototypes of new products may be tested by the marketing department with potential customers.

- Production planning - the production department will consider the layout of the facility, the optimum location of production, the method of production, the type of machinery and so on.

- Quality control - the quality of the product or service is crucial if the reputation of the firm is to be maintained and enhanced.

- Distribution - the production department will organise the distribution of the good or service to the customers. This may be through middlemen or 'intermediaries' such as retail shops or agents or direct to the customer through e-commerce.

- Purchasing and stock control - the production department is responsible for the purchase of stocks or raw materials required for production.

Outputs: Goods and services

The output of a business is goods and services. These are destined either for other firms or for the domestic consumer. Goods are solid items that can be seen and touched (tangible or visible items) such as shoes, food, cars, golf clubs, Manchester United or Barcelona football strips and beef burgers.

Services (invisible or intangible items) are things that cannot be seen or touched, but have visible results, such as services provided by hairdressers, doctors, dentists, solicitors, and banks. Customers pay for skill and experience that they do not possess, or would prefer to purchase to save time. Services can be split into personal or commercial (business) services, although there are often overlaps between the two. For instance, banks offer financial services to both individual and business customers.

The table below categorises types of goods or products:

| Consumer products | Producer products |

|---|---|

|

FMCG's (Fast Moving Consumer Goods) Items bought on a regular basis. Examples are food in a supermarket, papers and magazines etc. Each item has little value. |

ConsumablesItems with a short life and little value. Examples would be raw materials, packaging, paper, lubricants etc. |

|

Consumer durables A good which lasts through many uses and has a long-term value. They are bought infrequently. Special items are:

Other examples are furniture, cars etc. |

Capital goods Plant and Equipment used to produce consumer goods. Examples are pumps and motors, filling machines and computers. Not intended for sale as they are the 'life blood' of the business. |

Sectors of the economy

Sectors of the economy

If you would prefer to view this interaction in a new web window, then please follow the link below:

It is important to remember that the most significant economic activity in many countries exists between businesses, rather than between businesses and consumers. This type of activity where one business sells to another is often called 'B2B' activity (Business to Business).

In this section we are looking at profit organisations - that is organisations whose main objective is usually profit maximisation. We are going to look at this in the context of starting a small firm. We will be looking at the problems of setting up a business either in manufacturing or in the tertiary sector, and examining any legal requirements.

Changes in Economic Structure

Structural change refers to adjustments in the relative importance of different sectors of an economy over time, usually measured in terms of their share of output, employment or total spending.

Since the industrial revolution, structural change in most countries involved shifts from subsistence agriculture to commercial agriculture, an increase in the relative significance of manufacturing and, at a later stage, a shift toward service industries. Structural change also involves shifts between the regions of large national economies, and changes in the composition of a country's imports and exports.

There are many models of economic development and arguments about the stages through which countries travel as they develop. None of these are really relevant to business and management except in the sense that changes in the relative significance of economic sectors will have effects on demand and employment conditions in an economy.

The IMF classifies countries into three main categories:

- developing countries (LEDCs)

- transitional or newly industrialising countries (NICs)

- industrial countries (MEDCs)

Generally speaking, developing countries are characterised by subsistence primary production (mainly agriculture) and low levels of income per head. As these countries develop they go through a process of Industrialisation, which refers to the move from an economy dominated by agricultural output and employment to one dominated by manufacturing. This will have the effects such as:

- Urbanisation

- More capital-intensive industries

- Increases in GDP and living standards as per capita incomes increase

- Increasing employment opportunities

As development proceeds there is a move towards tertiary or service based sector activity as the main contributor to output and employment. This will have effects such as:

- Higher household incomes and changes in consumption patterns towards luxury goods

- Increasing specialisation

- An increase in demand for personal services such as financial planning, hairdressing and personal health

- More leisure time and greater spending on industries such as entertainment, sport and travel

- The growth of technology and communication related industries

Development does not always fit neatly into this primary to secondary to tertiary model. Some developed economies, such as New Zealand have been able to use automation to make their primary industries more efficient and several more economically developed countries, like Japan and Germany, retain a significant manufacturing base by value.

All three sectors of an economy are interdependent in the sense that each sector relies on the others. For example, the largest global manufacturers also require finance, raw materials, energy supplies and transport.

As Business and Management students you need to have an awareness of the effect on relationships within and between countries as they develop. The obvious examples are China and India. As they develop rapidly, the movement of goods and services between countries increase as do the opportunities for employment in related industries. Demand patterns will also change in relation to the accessibility of imported goods and services.

1.1 Nature of business activity - questions

In this section are a series of questions on the topic - Economic structure. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Case study - a case study with associated questions

- In the news - questions based around a topical business news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Economic structure

Economic Structure

| Country/Area | Agriculture (%) | Industry (%) | Services (%) |

|---|---|---|---|

| World (average) | 37.5 | 22.1 | 40.4 |

| European Union (average) | 5.6 | 27.7 | 66.7 |

| Azerbaijan | 38.3 | 12.1 | 49.6 |

| Cambodia | 67.9 | 12.7 | 19.5 |

| Cameroon | 70 | 13 | 17 |

| China | 39.5 | 27.2 | 33.2 |

| Estonia | 2.8 | 22.7 | 74.5 |

| Iceland | 4.8 | 22.2 | 73 |

| India | 52 | 14 | 34 |

| Israel | 2 | 16 | 82 |

| Japan | 4 | 28 | 68 |

| Nepal | 76 | 6 | 18 |

| Singapore | 0 | 23.8 | 76.2 |

| Taiwan | 5.1 | 36.8 | 58 |

Source: CIA Factbook

Singapore and Hong Kong were reported to be the most competitive countries according to the 2010 World Competitiveness Index. A detailed explanation for these rankings is to be found in the press release that accompanied the publication of the Index

Assignment questions

- Examine the breakdown of economic activities in the countries listed above and group the listed countries into developing, transitional (NICs) and developed countries

- Analyse the factors that contribute to a country's competitiveness

- Discuss the consequences for a country as it moves from being manufacturing-focused to service-focused.

Self-test questions - economic structure

1 |

Sectors of the economyCan you match the following business to the sector of the economy that they operate in? If you need some hints, there are links to their web sites underneath the questions. |

2 |

Sectors of the economyCan you match the following business to the sector of the economy that they operate in? If you need some hints, there are links to their web sites underneath the questions. |

The websites of the firms in the questions above are:

3 |

Sectors of the economy

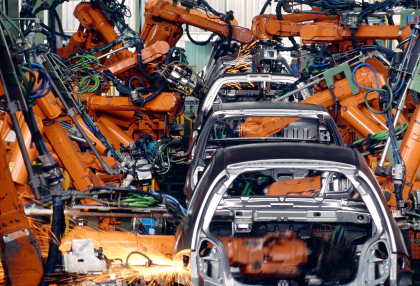

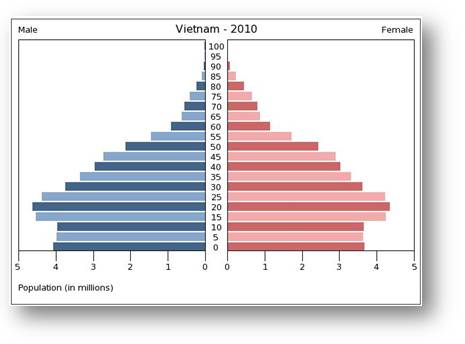

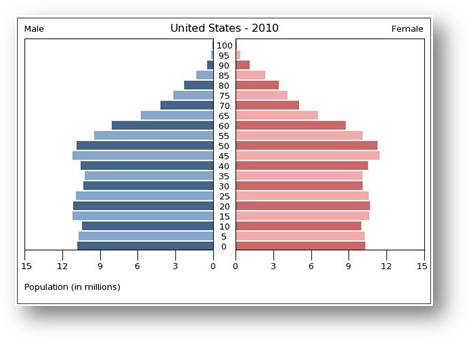

In what sector of the economy is the product shown in the photo below produced?

|

4 |

Sectors of the economy

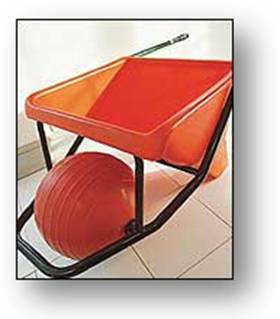

In which sector of the economy is the product shown in the photo below produced?

|

Factors of production - self-test

1 |

Factors of production

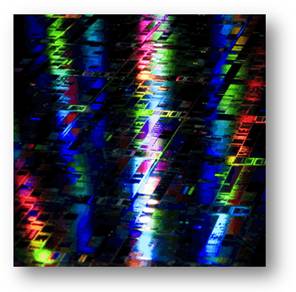

How would you classify the factor of production shown in the image below?

|

2 |

Factors of production

How would you classify the factor of production shown in the image below?

|

3 |

Factors of production

How would you classify the factor of production shown in the image below?

|

4 |

Factors of production

What factors of production are evident in the photo below?

|

5 |

Factors of production

What factors of production are evident in the photo below?

|

6 |

Factors of production

How would you classify the factor of production shown in the image below?

|

1.2 Types of organisation - notes

In the previous section we looked at the nature of business activity and what a business is. We now move on to look at the nature of organisations in the private and public sectors and how we start a new business and the various different types of business organisation. We then examine the nature of non-profit organisations and public private enterprise.

By the end of this section you should be able to:

- Distinguish between organisations in the private and public sector

- Explain the reasons for setting up and organisation and the processes required

- Analyse the problems new set-ups face

- Distinguish between different types of organisation and identify their key features

- Analyse how ownership and control differs between different organisations and evaluate the most appropriate form

- Analyse the separation of ownership and control

- Compare and contrast the objectives of non-profit and profit making organisations and analyse their impact

- Analyse the relationship between organisations in the public and private sector

- Explain the nature of public-private enterprise and analyse the costs of co-operation

Private and public sector

Most of the businesses or organisations that we have looked at so far have been in the private sector of the economy. These are any organisations owned, controlled and managed by private individuals, usually for the purpose of making profit.

Most of the businesses or organisations that we have looked at so far have been in the private sector of the economy. These are any organisations owned, controlled and managed by private individuals, usually for the purpose of making profit.

The public sector is the government sector of the economy - don't muddle this with the general public - they are the private sector! This is referred to as public ownership. It was considered that the government would act in the interests of the population by providing vital services, even if there was no profit in this provision. Merit goods are goods, such as medical care and education, which might not be provided to all of the population by the private sector as there may be no profit here. Government may allow access to all people even if they cannot afford to pay. This is because the government believes the provision of these goods is in the interests of society.

Public ownership is much less common these days as it is believed that businesses are much more efficient if they are privately owned. In the past few decades (since the start of the 1980s) many businesses around the world have been privatised. This means that they have been changed from public ownership to private ownership. However, the balance between public and private ownership varies considerably from country to country. In recent years, several governments have begun to create partnerships with the private sector, which may run some aspects of public sector services such as hospitals and schools, even though these services have not been privatised. These are called public/private partnerships or enterprises, and are to be found in areas such as education and transport. Here the state organises the delivery of the service, while private companies provide some, or all, of the infrastructure.

SUMMARY of types of organisations in the private and public sectors

Summary of types of organisations

Why not search around government web sites in your country to find data on the proportion of private and public companies?

Privatisation

Privatisation is the selling of nationalised or state-owned industries to private investors, moving the organisation from the public to the private sector.

It is claimed that privatisation:

- Reduces costs - the profit motive, and competitive pressures will drive costs down. Often a state regulator ensures that private firms do not exploit their monopoly position in the market.

- Increases choice

- Increases quality

- Encourages innovation and invention

- Brings market forces into play in a positive manner for the consumer

- Saves the government money - the costs of the nationalised industries would be replaced by income from business taxes

- Widens share ownership in the population

Privatisation also has some possible problems:

- Monopolies will be in private hands e.g. transport

- Loss of equity - the general public loses a valuable resource

- Externalities - the private firm may not be so careful about creating pollution and other external costs, as they are only responsible for paying private costs (in other words the rewards for the four factors of production).

Privatisation in many countries has been accompanied by the introduction of deregulation, but also the appointment of regulators to reduce the opportunity for exploitation. These regulators are expected to act as 'watchdogs' to protect consumers and other stakeholders.

Deregulation

Deregulation is the removal of government rules, controls and restrictions on production and trade.

Some industries have in the past been government monopolies to protect them from competition. Deregulation is the removal of these government controls from an industry. Regulators control or regulate privatised monopoly industries.

Starting a business

There are six main stages to starting a new business:

- Identifying a business opportunity and a target market and generating ideas about meeting the needs and wants of that market

- Producing a business plan

- Selecting the correct form of business organisation

- Surviving the first few months of operations

- Raising the initial finance from personal savings, family or friends, redundancy payments or borrowing.

- Choosing a suitable location

Starting a new business is extremely risky and businesses are particularly vulnerable in the first 18 months to two years of operation. Indeed, about half of all new businesses fail within this period.

Why is the failure rate of new businesses so high?

Inadequate initial capital

- Start-up costs are very high, e.g. the purchase of equipment and raw materials and the expense of buying or renting business premises. Recruitment and training costs can be significant as well as legal fees and marketing costs.

- Initial demand and sales revenue may be low as the new business has no brand recognition or customer loyalty. Indeed it may take several months before the business can produce any goods and services.

- Cash flow problems resulting from the combination of the two points above, which may kill it before it has the chance to trade successfully.

- Market research has been poor and there is inadequate demand for the goods and services produced by the business.

- Changes in the external environment e.g. the economy may move into recession or new competitors enter the market.

- Other businesses 'steal' or copy their idea

- Falling foul of unknown and/or un-researched legal restrictions, such as business registration, licences and insurances.

- Poor marketing and failure to supply sufficient goods and services to satisfy orders or meet future demand

- Uncompetitive prices - small businesses do not have many economies of scale, which means that costs, and therefore, prices are higher than competitors.

- Poor location as the result of a lack of finance. The best retail and office locations tend to be very expensive.

- The personality of the entrepreneurs - do the founders have the commitment and drive to make the business successful if this entails long hours and disruption to family and social life?

If setting up and establishing a new business is so risky, what are the incentives for individuals to start a business?

- they want to be an entrepreneur (a risk-taker and decision-maker)

- they want to be their own boss, work for their own interests and have some autonomy

- they want to plan, organise and enjoy the satisfaction of building something that is their creation

- they enjoy a challenge

- they think they have a good idea for a good or service and believe they can produce these better than their competitors

- they have special skills that others do not have or are in short supply

- they want to earn a profit and 'get rich'!

What factors make a business likely to succeed and survive?

Inevitably, there are elements of good luck and good timing involved in business survival. However there are some common elements which underpin this success:

- Having a business idea which will sell in a competitive market place. Ideally, this idea should be different to products and series already on sale, creating a USP or Unique Selling Proposition (or point) for which customers are prepared to pay a price providing a profit. This, of course, is extremely difficult, given that most markets already have huge choice. Can the founders truly discover something different or innovative that will persuade buyers to give up their tried and tested products? Alternatively, some businesses have been successful producing a so called 'me too' product to start with and go for a marketing edge. 'Me too' products are basically adapted copies of existing products or services. However, it is essential that these products do not infringe the patents, trademarks and copyrights of other firms.

- Targeting a market segment large enough to support the business and provide a profit, and providing the opportunity for future growth.

- Conducting adequate market research regarding the USP and the target market

- Possessing appropriate business skills and a desire to succeed.

- Adequately protecting their goods and services and intellectual property rights (IPR) such as brand names and logos by establishing:

- patents to protect products from copying by other firms

- registered trademarks to protect logos, slogans and help build brand image and reputation

- copyrights to protect ideas and artistic work, such as software, music, newspapers, books and films.

Producing a successful product or service: a case study - James Dyson

Producing a successful product or service: a case study - James Dyson

In 1974, James Dyson, an unknown industrial designer decided to become an entrepreneur starting a business with his sister and her husband to make the Ballbarrow. This was the first significant update of the wheelbarrow since the medieval era. Dyson's innovation used a plastic ball instead of a wheel for easier manoeuvrability. Like nearly all of Dyson's inventions, the idea for the Ballbarrow was driven by personal frustration, because his wheelbarrow kept getting stuck in the mud when he was working in the garden.

In the late 1970s, Dyson had the idea for an innovative vacuum cleaner that would not lose suction as it picked up dirt. Five years and 5,127 prototypes later, the 'G Force Dual Cyclone' arrived and revolutionised the vacuum cleaner market. James Dyson offered his invention to major manufacturers. However, no manufacturer or distributor would launch his product as it would disturb the valuable cleaner-bag market worth $500 million every year, so Dyson launched it in Japan in 1986 selling direct to customers through catalogues. The G Force quickly emerged as a cult favourite, despite its rather high price tag. Dyson was forced to sue other companies for patent infringements, and the cases dragged on for years and nearly bankrupted him.

After failing to sell his invention to any major manufacturer, Dyson was forced set up his own manufacturing company and in June 1993 opened his first research centre and factory in the UK.

After failing to sell his invention to any major manufacturer, Dyson was forced set up his own manufacturing company and in June 1993 opened his first research centre and factory in the UK.

Dyson products quickly began to dominate markets around the world, becoming the largest selling upright vacuum cleaner in Western Europe, The USA and Australia. Naturally, following the success of the 'bag less' technology other major manufacturers began to market their own versions, some copying aspects of Dyson's cyclonic vacuum cleaners. Dyson sued Hoover UK for patent infringement and won around $5 million in damages.

The company continues to expand, experimenting with new ideas and technologies (see the Dyson web site for details of their products). In 2006 Dyson launched a fast and hygienic hand dryer, using a 400 kmh. stream of air.

A further development of Dyson's new air technologies is the innovative series of Air Multiplier fans using new design to draw in air and amplify it up to 18 times, producing an uninterrupted stream of smooth air with no blades or grill. Dyson continues to be one of the innovative manufacturers in the world.

- Define the terms:

- USP

- Entrepreneur

- Explain why Dyson wanted to set up his business.

- Analyse the problems that start-up businesses, such as Dyson face.

- Discuss the importance of protecting intellectual property rights for high technology companies like Dyson.

Also see: World News/James Dyson

A good or a service?

A service firm is usually easier and cheaper to set up than a production firm, because there are fewer requirements to invest in materials, machinery, land and buildings as well as patents. There are fewer implications for cash flow as the business will not need to keep stock.

There are still opportunities for excellent services, including those sold and/or distributed online. For example, most new software is downloadable, rather than being purchased using a CD. Online businesses are relatively cheap to set up and have fewer barriers to entry. However, during the 1990s, thousands of internet based companies were launched, commonly called 'dot-coms'. Most of these spectacularly crashed in the early part of the millennium, wiping out approximately $5trillion in market value from 2000 to 2002. The problem was that many of the business ideas were poorly researched and the products and services of a poor quality. Many of the online businesses failed to set up efficient physical distribution services and deliveries were delayed. The moral to the story is that business success rests on the quality and demand for product and service, not just the technology surrounding it.

Sites that bring buyers and sellers together offer a potentially lucrative business opportunity. There are many 'big-boys' in the market place such as eBay and online shopping and price comparison such as Kelkoo. However, there are still specialist markets, which may not be saturated and where competition may be lower. Perhaps the founder enjoys playing war games such as Warhammer or Dungeons and Dragons? Could a hobby be turned into a business opportunity? Basing a business on a personal interest will certainly be motivating.

You may like to have a look at the following sites in relation to these issues:

- Ebay (http://www.ebay.com)

- Kelkoo (http://www.kelkoo.com/)

- Warhammer - Megaminis (http://megaminis.co.uk/epages/eshop196361.sf)

Market research

It is possible to identify a market opportunity through reliable and valid market research.

Market research is classified into two groups:

- Field research - also known as primary research. Designed and executed specifically to identify a particular product or problem. This is 'first hand data' as it has never been collected before.

- Desk research - also known as secondary research. Based on old, existing data and information. It is, therefore, 'second hand data'. This may be available within the firm, or published externally. Much of the data will be in the public domain.

The former is cheaper, but potentially inaccurate. The latter is expensive, but good if it is done well. This is an example of yet another potential business trade-off.

These concepts are covered in more depth in the marketing topic.

Starting the ball rolling - beginning the planning process

Once a decision has been made to set up a new business, the founders should ask:

- Where the business is going?

- How it will get there?

- How the owners will measure and monitor progress, especially in terms of sales and cash flow?

These are basically the three questions that underpin all strategic decision-making. We will examine these questions in some detail in the strategic topic.

The business often attempts to answer all these questions in its business plan (see topic 1.6). A business plan for a small new firm may fulfil the same role as the mission statement does for a large corporation. It sets out the overall intentions of the business in terms of objectives and strategic direction and therefore underpins the firm's decision making, by setting targets and providing benchmarks for actual performance including forecasts for profit, revenues and cash-flow.

A major function of the plan is to support any application for funds, such as a bank loan. If a bank loan is required, the first thing that the bank manager is likely to want to see is the formal business plan. This tells the bank how serious the founders are, and how well they have researched the business, the market and the products and services it will sell.

Profit-based organisations - legal structure

Most organisations that operate in the private sector do so to make profits for the owners. The effectiveness of a business will be influenced by the choice of legal structure, which will determine how a business is financed, managed and organised, and its prospects for growth.

Most organisations that operate in the private sector do so to make profits for the owners. The effectiveness of a business will be influenced by the choice of legal structure, which will determine how a business is financed, managed and organised, and its prospects for growth.

Legal structure

When a firm sets up, the basic choice is whether to be an unincorporated or an incorporated business. The main difference is that in an unincorporated firm, the 'owner is the business', and is legally responsible for everything. For incorporated firms, the firm is a legal entity in itself. It has rights and responsibilities, distinct from those of the owners.

Incorporation is like a birth - a legal entity is created with rights, responsibilities and 'legal personality' - just like a newborn baby. The company has a legal personality. If, for instance, a person steals from a company, it is the company itself that prosecutes the offender, not an individual manager.

An important difference between incorporated and unincorporated businesses is that of limited liability. An unincorporated business has unlimited liability. The owner is responsible for all debts of the business and if necessary his/her personal possessions (assets), such as a house, can be seized to pay business debts. An incorporated business is owned by shareholders. Every shareholder (owner) has limited liability. In the event of the business failing, the shareholders can only lose up to the value of their investment. Their liability for debts is therefore limited to the maximum value of the shares they hold. So if a shareholder has $400 of shares in a company, which goes out of business owing large sums of money, the shareholder can only lose a maximum of $400.

Businesses which possess limited liability must say so after their name, e.g. 'ABC Limited.

This acts as a warning to any individual or organisation that does business with the limited company that, on a liquidation, debts may not be paid. A shareholder's personal possessions cannot be sold to pay for these outstanding debts.

There are four main types of business organisation, and these all have their advantages and disadvantages for the business itself, and also for external organisations and individuals with which the firm deals. We look here at common features of these business organisations. However, they may differ from country to country. One useful exercise is to search online to find out more detail about business structures in your country. The common international legal structures are:

Unincorporated organisations

The business and the owner/owners are seen legally as being one and the same. If you sue a sole trader for debt, for example, you sue the individual owner of the business. The owner is entitled to all the profit, but is also personally liable for all the debts. The owner has unlimited liability and all of his assets may be sold to pay any outstanding debts after the business assets have been sold e.g. the owner's house and car could be seized by legal representatives of the creditors. Sole traders and partners have unlimited liability.

Owners pay personal income tax, at whatever rate the government sets. As the owner's income increases the marginal rate of tax, also increases. There may come a time when the percentage rate of income tax, is higher than the corresponding rate of tax paid by a similar company. This may be an incentive to incorporate.

There are two types of unincorporated businesses:

Sole trader (sole proprietor)

Sole trader (sole proprietor)

Most new small businesses are set up as sole traders.

- This is the simplest legal structure. It is easy and cheap to set up. There are few formalities, although the sole trader may need to apply for licences or to register the name of the business. The income of the business is the sole trader's income and liable for personal tax. Raising finance for future growth of the business is usually more difficult for a sole trader than a company, and potentially more expensive as interest is likely to be higher because of the increased risk. Sole traders will usually need some security to support borrowing, often their house, and the loan potential is limited. They stand to lose everything if the business fails and may become bankrupt. This situation is called unlimited liability. Some businesses, however, stay sole traders for a long time, even when they are large and even international. JCB, the digger firm, operated as a sole proprietorship for many, many years.

- Sole traders deal directly with the national tax authority, and all profits are treated as income, and taxed accordingly. There are no shares or shareholders. It can be hard to raise money through the banks because of the unlimited liability and lack of security. Many sole traders are small businesses that sell services such as taxi drivers, plumbers, decorators and electricians. As the business is the owner, a sole tradership ceases to exist when the owner retires or dies; it lacks legal continuity.

Although a sole proprietorship is owned by a single owner, it may have many employees. Never say in an exam that a sole trader is where the business is owned and run by one person.

Sole traders have no shares or shareholders. Do not call them companies!

Summary

Advantages of a sole trader:

- Cheap and easy to set up with few legal formalities

- The owner receives all the profits

- Decision-making is quick as only one person makes the decisions

- Being 'your own boss' can be motivating (self actualising)

- Privacy and confidentiality as public accounts are not required

- Flexibility and the ability to offer a personal service

Disadvantages:

- Unlimited liability - risks personal assets

- Limited sources of finance

- Limited managerial skills as the owner is responsible for all business functions

- High risks - sole traders have few economies of scale and therefore higher costs. They are vulnerable to competition from larger businesses with lower costs.

- Workload and stress - owners may be 'workaholics' knowing that any profit is down to them

- Lack of legal continuity

- No one to bounce ideas off

Partnership

A Partnership is owned by two or more people. For most ordinary partnerships, the maximum number of partners is limited by law to twenty, but like many forms of business structure, this varies from country to country.

A Partnership is owned by two or more people. For most ordinary partnerships, the maximum number of partners is limited by law to twenty, but like many forms of business structure, this varies from country to country.

- The ownership, profit and liabilities are shared between partners. There is more work necessary to set up a partnership than a sole tradership. Generally, a legal agreement - the Deed of Partnership - must be drawn up by a lawyer. There is one major problem of a partnership and that is the responsibility carried by partners. Partners are responsible for losses, 'wholly or severally'. If they all can pay, they will share the debt, but if only one has any assets then this partner will pay all. In other words they still have unlimited liability. A whole section of the law covers partnerships, and they can be difficult to set up and run.

- Many professional firms are partnerships. Most firms of lawyers, accountants, vets and architects are partnerships. They have the necessary skill and knowledge to draw up the correct partnership agreement.

- Partnerships have to be re-established if one partner leaves or dies, as this event invalidates the Deed of Partnership.

The owners of sole traders and partnerships run their businesses and make all major decisions. Sole traders and partnerships cannot sell shares in their business to other people. This can be a significant restriction on them raising capital for expansion. In some countries certain occupations, such as doctors and lawyers, are prevented from incorporating, as there may be a conflict of interest between clients and owners. For instance, if doctors are set up as private companies, is the main obligation to make profits for the shareholders or to treat sick patients even if they have no money?

Summary

Advantages of a partnership:

- Greater financial strength than sole proprietorship as there are more investors

- The owners receives a share of all the profits

- Decision-making can be shared between partners who may be specialists, allowing for the division of labour

- No responsibility to shareholders

- Privacy and confidentiality as public accounts are not required

Disadvantages:

- Unlimited liability - risks personal assets

- Limited sources of finance compared to companies

- Decision making may be slower than sole proprietorships, as more owner are involved. This may leads to disagreements and conflicts

- High risks - sole traders have few economies of scale and therefore higher costs. They are vulnerable to competition from larger businesses with lower costs.

- Workload and stress - owners may be 'workaholics' knowing that any profit is down to them

- Lack of legal continuity - if one partner dies or leaves the partnership is legally dissolved as the Deed of Partnership is invalid. Redrawing the Deed is expensive.

- A mistake by one partner has legal and financial consequences for all partners.

Unlimited liability, difficulties in raising finance and taxation issues may make businesses change their legal form to become incorporated.

Incorporated organisations

Companies are essentially organisations owned by their shareholders. The business and its owners are separate legal entities and there is a separation of control and ownership with the owners appointing managers to run the business on their behalf.

Incorporated firms are legal bodies in their own right. Companies may be known as joint-stock companies or corporations in North America.

Be careful not to confuse public limited companies or corporations which are in the private sector and owned by private individuals with Public Corporations which are owned by the government.

Companies have legal continuity as they continue to exist even if the owners change (i.e. shares are sold on stock markets). Shares are just a slice of the business and signify what proportion, in monetary value, of the business is owned by each individual shareholder. In some countries, shares are called stocks. However, in other countries stocks and shares have different meanings.

Firms pay corporation tax. This is usually a flat rate, and stays the same proportionately, even if profits increase.

The owners of the companies have limited liability; they are only responsible for their investment in the firm through their share capital. The maximum they can lose, on a liquidation, therefore, is the value of their shareholding - personal assets cannot be seized to pay for the debts of the business. This can be a major advantage over being the owner of an unincorporated firm. The owners of the business are its shareholders.

There are two types of company:

Private limited company (Ltd)

Private limited company (Ltd)

- Most companies start as private limited companies. They can be set up quickly and cheaply, and firms of lawyers are set up which specialise in this. Many private limited companies are family businesses as there is less risk of a takeover. Shareholders in private companies can put restrictions on the sale of shares.

- To become a limited company, its owners have to prepare legal documents, including the Memorandum and Articles of association and be registered with the national government. The Articles lay out the internal rules of the business, such as the calling of meetings, the types of shares and the power of the directors. The Memorandum details any relationship between the business and its external environment. It shows the objectives of the business, the address of its head office and its maximum share capital. These documents can sometimes be bought 'off the shelf' by firms that sell 'shell' companies as their product.

- Limited companies have to prepare and publish each year a set of legal accounts, which have to be checked and approved (audited) by independent accountants. These can sometimes be bought 'off the shelf' by firms that sell 'shell' companies as their product.

- The owners also have to prepare and publish each year a set of legal accounts and should send these to the appropriate government organisation each year.

- There has to be at least one director, but other requirements are few. Shares can be sold, privately, but not on the national stock market. There is no minimum capital requirement, however. Shareholders have limited liability. That means they can only lose their share capital; creditors cannot claim any other assets. Private companies are hard to take over without the agreement of the existing shareholders. Equally, they may be hard to sell.

- Many private limited companies are family businesses as there is less risk of a takeover. With private companies, any owner wishing to sell their shares must offer them to existing shareholders first. This protects the original owners from losing their control of the business.

Public limited company (plc)

These are the public companies whose shares are traded on national and international stock exchanges.

A flotation or an initial public offering (IPO) occurs when a private limited company issues shares to the public for the first time seeking capital to expand. The company becomes a public limited company and is listed one, or several, stock exchanges.

With a public limited company qualifying shares are sold on the Stock Exchange to the general public. Anybody can buy them, and if a shareholder buys 50% of the shares plus one more, they can control the business by outvoting all the other owners and appointing their own representatives as Directors. This is because shareholders receive one vote for every share they hold. In practice, not all shareholders vote when they have the opportunity (often only 2 - 3% bother!), so practical control can be achieved with fewer than 50% of shares.

A considerable amount of finance is usually required to become a plc as the company must usually have a minimum share capital which is more than many entrepreneurs can afford. There may also be many other requirements such as:

- A minimum number of directors.

- A fully qualified Company Secretary (the chief administrative officer responsible for all legal affairs).

- Legal accounts prepared each year and sent to the appropriate national government organisation.

A plc can be taken over without the agreement of the present Directors. If the firm is performing well shares will sell easily - in fact they will be in high demand.

The law sets out a series of requirements governing the formation and operation of companies, which are shown below:

The legal differences between private and public limited companies

|

Private Limited Company (Ltd) |

Public Limited Company (plc) |

|

|---|---|---|

| Memorandum of Association | Must state that the company is a public company | |

| Name | Must end with the word 'Limited' or the letters 'Ltd' | Must end with plc, or the words in full |

| Minimum Authorised Capital | None | Varies according to local law, but usually a set limit |

| Minimum shareholders | 2 | 2 |

| Minimum Directors | 1 | 2 |

| Retirement of Directors | No age set, unless the firm is a subsidiary of a plc, when they must retire at 70 | Must retire at 70 |

| Issue of shares to the public | No advertising to the public. Sale by private agreement only | May do so on the Stock Exchange, by means of a Prospectus. |

| Company Secretary | Anybody | Must be professionally qualified as a Company Secretary |

| Accounts | Small and medium size companies may submit shortened accounts | Must file full accounts and Directors reports with national government. |

| Meetings | Proxy (a representative of the shareholder) may address the meeting | A proxy cannot speak at a public meeting. |

Some of these requirements may differ in detail between countries, but this gives a useful guide as to the basis of incorporation of firms.

In incorporated companies, plc's or limited companies, the decision makers (the Executive Directors) are often not the owners; it is the shareholders who are. This separation (often called 'divorce') between ownership and control can cause major problems, as has been seen with firms like Enron and WorldCom, where Directors do not always act in the interest of the shareholders.

Typically a new business will start as a sole trader, and then become a private limited company as soon as possible. It will then 'go public' (float shares), when it thinks it is appropriate.

It is possible to set up as a private limited company quite easily and cheaply these days as shell companies are available to buy, i.e. companies where all the legal requirements have been completed, but the purpose is left very general. A good advisor can select the right one providing instant limited liability.

Summary

Advantages of companies:

- Companies have access to large amounts of capital by selling shares, although private limited companies cannot advertise their shares for sale publicly, which limits the capital available

- Money raised by selling shares is permanent capital and never has to be repaid, unless the business is liquidated. Unlike loans which require interest to be paid, companies pay a dividend to shareholders, but the amount is decided by the company itself and may not be paid at all when profits are low or losses made.

- Companies benefit from legal continuity

- Directors are often shareholders which provides an incentive to improve performance to maximise dividends

- As companies tend to be larger than sole traders and partnerships, they enjoy economies of scale which should result in lower costs and therefore lower prices and/or higher profit margins

- Companies have many managers and employees who can be specialists improving the efficiency and performance of the business

- Larger organisations are likely to have better customer recognition and may be more trusted by the public who know more about them.

Disadvantages of companies:

- Lack of confidentiality and privacy since companies must produce audited accounts, which are available to the public. Private limited companies can restrict access to these accounts more easily than Plcs who must produce annual reports containing their final accounts

- Large firms may be less agile and flexible as diseconomies of scale set in

- Large firms may provide a more standardised and less personal service

- The costs of setting up a company can be high, because of the legal requirements involved

- The original owners may lose control of their own businesses, especially in the case of Plcs where sales by any shareholder are unrestricted

Other types of private sector organisations

Co-operatives

A co-operative is an organisation run by a group of people, each of whom has a financial interest in its success and how it is managed. That group may be the producers (agricultural co-operative), the workers (workers co-operative) or the customers (retail co-operative). The profits of the co-operative will be shared on an individual basis. Co-operatives are found across all sectors, but their importance differs from country to country. In Europe, co-operatives are popular in agriculture and retailing. Much of the wine industry in Europe is organised on a cooperative basis. Almost all of Japanese farmers belong to Nokyo, one of the largest co-operatives in the world

Most co-operatives are registered as limited liability companies.

1 |

Business organisationsMatch the following descriptions to the appropriate type of business organisation. |

Whenever you look at a business look carefully at how they are owned and where they operate. Are they simply a small local organisation? Are they privately owned or are they a limited company or partnership? Are they part of a larger national company? Are they perhaps part of a multinational group?

When you stop looking at this screen and next go out (which could be in the next few minutes) - have a look at the first five businesses you see and see if you can answer the above questions about them. Why not use the web to investigate a little bit more about them? You may be surprised.

Non-profit organisations

Most businesses that we will be looking at during the course operate in the private sector of the economy. That is, they are privately owned by individuals or shareholders and we assume that their main aim is to maximise profits.

However, there are many other types of business organisation that you may also come across during your course. One of these is a non-profit or not for profit organisation. In a way the name speaks for itself, but this doesn't mean that they don't make a profit; just that it is called a surplus. They may have a surplus of income over expenditure, but this will be ploughed back in for the benefit of the members or beneficiaries. Non-profit organisations may be clubs, charities (NGOs), pressure groups or other similar organisations that have some of the same aims as a private business, but profit isn't one of them!

Non-governmental organisations

Non-governmental organisations (NGO's for short) are organisations that may take part in business activity (as we have described it) and operate in the private sector, but their interests are more likely to be the development of the community and run for the benefit of others.

NGO's are non-profit organisations, which are independent from government. In the US they may be more commonly known as PVO's - private voluntary organisations.

The purpose of NGO's are hugely varied. They may be environmental organisations, voluntary groups, specific public-interest groups, scientific organisations or perhaps religious organisations. Examples include:

Why not browse around their web sites to see what they do? These are large international NGO's. Can you find examples of local and regional NGO's where you live?

For more detail, why not have a look at the Wikipedia article on NGO's. You can do that in the window below, or follow the previous link to open the article in a new window.

Charities

Charities are a form of non-profit organisation with the key function of fundraising to support a chosen cause or a group of individuals. Charities tend to be run along business lines, because they aim to maximise their donations and minimise costs.

They seek to educate and inform the public about the cause they are supporting and may act as a pressure group by lobbying government to increase resources allocated to underprivileged or excluded groups with the aim of improving social welfare. They may also seek to raise awareness of a social problem such as homelessness or medical issues such as AIDS.

Since charities do not sell in the conventional sense, they still use marketing to increase profile of their cause and to create brand awareness. Many charities use celebrity endorsement to raise their public profiles. Charities are often run by a combination of professional managers and full-time employees working alongside individual volunteers.

Charities need to be registered and restrictions may be placed on their operations. Governments impose obligations to report fully on their financial position. It is not unknown for bogus charities to be setup and for funds to end up in the pockets of unscrupulous founders.

Large companies may wish to associate themselves with charitable organisations to raise their ethical credentials. Donors to charities may receive tax allowances.

Oxfam

Oxfam works with more than 3,000 local partner organizations to assist people living in poverty exercise their human rights, assert their dignity as full citizens and take control of their lives.

Oxfam works with more than 3,000 local partner organizations to assist people living in poverty exercise their human rights, assert their dignity as full citizens and take control of their lives.

Oxfam concentrates on three interlinked areas of work:

People need help in an emergency. Oxfam delivers aid, support and protection and helps communities develop the capacity to cope with future crises. Click on this link to see examples of current emergencies.

With the right support poor people can take control, solve their own problems, and rely on themselves. Oxfam funds long-term work to fight poverty in thousands of communities worldwide. Click on this link to see where Oxfam works.

Poverty isn't just about lack of resources. In a wealthy world it's about bad decisions made by powerful people. Oxfam campaigns hard, putting pressure on leaders for real lasting change.

- Define the terms:

- NGO

- Celebrity endorsement

- Produce a 500 - 750 word report to send to a potential corporate donor:

- Outlining Oxfam's purpose

- Providing examples of Oxfam's work

- Explaining how a donation to Oxfam can help a company's marketing and corporate image and provide competitive advantage.

Pressure groups

Pressure groups are groups without political power, but which aim to influence the political, or decision-making, process. They have specific interests and attempt to influence businesses, people and government to help achieve their objectives. They may have a very narrow focus (e.g. a local group trying to prevent the building of a road), or they may have broader focus (e.g. environmental groups like Greenpeace). These groups are often referred to as single-cause or multi-cause groups.

Pressure groups are groups without political power, but which aim to influence the political, or decision-making, process. They have specific interests and attempt to influence businesses, people and government to help achieve their objectives. They may have a very narrow focus (e.g. a local group trying to prevent the building of a road), or they may have broader focus (e.g. environmental groups like Greenpeace). These groups are often referred to as single-cause or multi-cause groups.

Pressure groups can be split in all sorts of ways. These include:

- Local community groups - groups campaigning on specific local issues to try to improve an area or achieve a particular outcome.

- Environmental groups - groups trying to achieve an improved environment and prevent businesses and other from polluting excessively.

- Employee groups - these could include trade unions, which are trying to achieve better conditions for their members or perhaps other professional associations representing the interests of a particular group.

- Consumer groups - these are groups, which represent the interests of consumers and campaign to ensure that consumers get a fair deal from firms.

- Social groups - groups who campaign for changes in society. These may be political changes to give people improved rights or to reduce any discrimination against minority groups.

Can you think of a group that comes under each of these headings in your country?

Pressure groups will try to influence in a variety of ways:

- Lobbying politicians - pressure groups will often try to get politicians to support their cause and raise issues in government. If these changes are implemented firms may be constrained in their behaviour and suffer increased costs of operation.

- Lobbying Boards of Directors - pressure groups may often try to lobby firms directly and find sympathetic directors. They may even try to persuade the firm of their social responsibilities. In some cases they could even become shareholders and try to influence through active shareholding.

- Organising direct campaigns - pressure groups may try to influence consumers to boycott particular firms or products. For example, Greenpeace tried to organise consumers to boycott Esso over their involvement in President Bush's campaign and the subsequent refusal to sign the Kyoto Treaty.

- Lobbying investors - there has been a significant growth in recent years in 'ethical investment'. This may make many investors more open to influence from pressure groups to ensure that they only invest in ethically responsible ways.

- Preparing media campaigns - many pressure groups will aim to get as much media attention as possible for their cause. This will help raise the profile of the issue and if firms don't react appropriately, their public image may suffer. This may have a negative effect on their marketing.

The extent to which pressure groups are able to influence issues will depend on various factors, including:

- Their size - this can be financial size as well as their organisational ability.

- The popularity of their cause and their ability to mobilise the public.

- Their access to politicians - this will be a key determinant of their ability to influence the political process.

- The reputation of the pressure group and the respect they have from the general public.

The ability to organise pressure groups has been helped by the internet and social networking groups such as Facebook and MySpace. For instance, following the oil spill in the Gulf nearly a million people signed up to several Facebook campaigns to boycott BP products.

Public-private enterprise