Depreciation AO2, AO4

AO2 You need to be able to: Demonstrate application and analysis of knowledge and understanding Command Terms: These terms require students to use their knowledge and skills to break down ideas into simpler parts and to see how the parts relate: Analyse, Apply, Comment, Demonstrate, Distinguish, Explain, Interpret, Suggest

AO4 You need to be able to Demonstrate a variety of

appropriate skills. Command Terms These terms require you to demonstrate

the selection and use of subject-specific skills and techniques: Annotate,

Calculate, Complete, Construct, Determine, Draw, Identify, Label, Plot, Prepare

|

Depreciation

If you buy a brand new car one day and drive it around for the day and then decide you want to sell it - could you expect to receive the same amount you bought it for? Probably not - so we say the value of the car has depreciated. Therefore depreciation is the loss in value of an asset due to wear and tear and/or the passing of time |

Capital expenditure goes to the balance sheet, because the assets owned by the company have increased but does not go

directly to the profit and loss account as a one-off expense.

Look at the following example.

Example Maze Green Yachts plc

The company buys a new injection-moulding machine for $600,000, which it will use to make parts for its boats for the next 10 years, the estimated life of the machine.

The $600,000 is clearly capital expenditure, so goes to the balance sheet in the full amount (increase in fixed assets), as does the spending of the cash (decrese in current asset thus maintaining the balance of the BS. This illustrates the principle of double entry and equal and opposite effects. Buying the machine has two consequences. Maze Yachts:

- increases an asset - the injection-moulding machine (fixed assets↑)

- decreases an asset - cash (current assets ↓)

The question is how the cost of the machine should be recorded in

the profit and loss account. Instead of showing a massive one-off

expenditure item when the machine is bought - suggesting a large loss

in that one year - the cost of the machine is spread over the life-time

of the machine in regualr 'expenses', which allows a clearer view on

profits each year. This 'expense' in effect reduces the value of the

asset until it is no longer useful (here after ten years) and this

reduction in value of the machime is called depreciation expense.

The cost of the machine should be spread across its useful life, so that a charge is made against profit each year equal to the value of the 'wear and tear' resulting from its use in production. In this case, 10% of its value is added to the costs for each of the next 10 years' profit and loss accounts. Thus an allowance for the purchase of capital items is made using the device known as depreciation

Depreciation is subtracted on the balance sheet each year and put into the profit and loss account as a cost or expense. However, no money actually moves; it is merely an accounting or book entry. Depreciation is an allowance, not a monetary cost.

Not all fixed assets are depreciated. Over a period of time, property is likely to increase in value or appreciate. Firms deal with this by periodically revaluing these assets in the balance sheet to reflect market or resale value

So the question is - how can the depreciation rate be calculated?

There are a variety of methods used by firms to calculate the depreciation of fixed assets. However, the two main methods (and the two you need to know for the IB) are:

- Straight line method

- Reducing balance method

1. Straight-line depreciation (SLD) AO2, AO4

This method, also known as the fixed instalment method, is the most commonly used method of depreciation. It is also the easiest method to understand and calculate.

NB: Depreciation formulae are NOT on the formula sheet provided in the IB examination - you must memorise

Once the annual depreciation provision has been calculated, this will remain the same for each year the asset is in use. The formula for calculating the annual rate of depreciation is as follows:

![]()

Historic cost refers to the initial cost to buy the asset

Residual or scrap value is the amount the asset could be sold for at the end of its useful (to the business) life

The scrap value (sometimes known as either residual value or

disposal value) will, in most cases be an estimate. It is common,

keeping in line with prudence, to have a zero scrap value - due to the

uncertainty of any estimate - and recognising the asset may not be in a state to resell.

For example the Maze Green Yachts (above) figures show a

historic cost of $600 000 and an asset life of 10 years therefore the

straight line depreciation methd will lead to the BS and the P&L

sheets showing depreciation of $60 000 each year for the 10 years of

the assets useful life.

Further example

Example 1

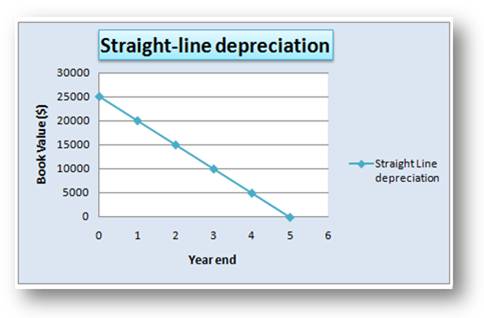

A delivery vehicle was bought for $25,000. The firm plans to keep it for five years and then trade it in for $3,000 (in effect the trade in value becomes the scrap value).

Example 1 - answer

The depreciation to be charged would be:

![]()

If, after four years, the vehicle had no trade-in value, then the charge for depreciation would have been:

![]()

This amount of depreciation would appear in the profit and loss account as a debit entry (i.e. a charge against the profit) for five years running. The balance sheet value would reduce by the depreciation provision each year for five years. In other words, the balance sheet value of this asset would fall each year by $5,000 for five years running until the assets has no value in the balance sheet - because it has no value to the firm!

Straight-line as a percentage

It is fairly common to express straight-line depreciation as a percentage. This simply means that a percentage of the original cost of the asset will be charged as the depreciation. For example, if an asset cost $10,000 and depreciation is to be calculated at 10% on cost - this would mean that we should charge 10% x $10,000 ($1,000) as the annual depreciation for each year that we have the asset.

The percentage quoted under the straight-line method will also tell us how long we expect the asset to last, for example:

10% - 10 years

25% - 4 years

20% - 5 years

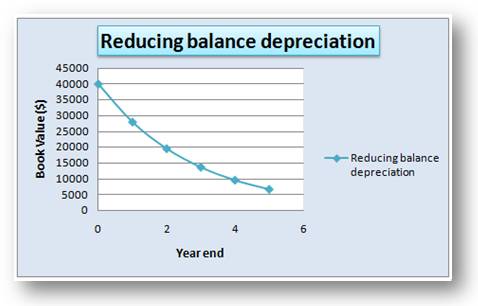

2. Reducing (declining) balance method AO2, AO4

In this method, the annual depreciation is based on a percentage of the asset's net book value (i.e. what the asset is worth in the firm's accounts). The net book value of an asset is calculated as follows:

Net book value = original cost - accumulated depreciation

As the depreciation charged against an asset builds up over time, the net book value of an asset would decrease. Therefore, although the percentage used in this method remains constant, the depreciation charge (in $) will become smaller, the longer we have the asset.

This method is also known as the diminishing or declining balance method.

The percentage rates chosen for reducing balance may seem as if they are chosen randomly, without any real explanation. However, there is a formula, which takes into account the cost, the scrap value, and the expected lifespan of the assets. This formula calculates the percentage that should be used. We do not include it here because it is not a requirement of the course for you to know the formula and it is, without any doubt, one of the most complicated formulae you would ever be likely to see!

Example 2

Equipment is bought for $40,000 with a residual value of approximately $6500. The depreciation is to be charged at approximately 30% per annum using the reducing balance method.

Example 2 - answer

The calculations for the first three years would be as follows:

| $ | |

|---|---|

| Cost | 40,000 |

| First year depreciation (30% x $40,000) | 12,000 |

| Net book value after first year | 28,000 |

| Second year depreciation (30% of $28,000) | 8,400 |

| Net book value after second year | 19,600 |

| Third year: depreciation (30% x $19,600) | 5,880 |

| Net book value after third year | 13,720 |

| Fourth year depreciation (30% of $13,720) | 4,116 |

| Net book value after fourth year | 9,604 |

| Fifth year: depreciation (30% x $9,604) | 2,881 |

| Net book value after fifth year | 6,723 |

With this method, the depreciation can continually be charged until the asset loses all of its value. If there is a scrap value for the asset as in this example, this method will depreciate the value down to the scrap value rather than to zero. However, as this shows, it is difficult to find the depreciation percentage to achieve the exact scrap value.

Remember, both methods can be quoted using percentages for the depreciation.

- Straight line is a percentage of the cost of the asset

- Reducing balance is a percentage of the net book value of the asset.

Strengths and weaknesses of both methods

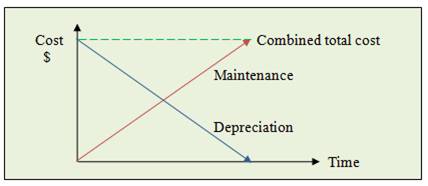

Notice that with the reducing balance method, the depreciation provision per year will start off relatively large and will gradually get smaller. It has been commented that this method of depreciation is superior to the straight-line method, because it is more realistic with asset valuations - assets do lose more of their value in the earlier rather than the later years.

In addition, the total cost of a machine or vehicle is made up not just of the purchase price, but the maintenance costs as well. In the early year when the asset is new, the maintenance costs are low, but the depreciation charge is high. In the later years when the asset is older, the maintenance costs tend to increase, but the depreciation charge falls. So the combined value of depreciation plus maintenance is relatively constant.

However, the counter-argument is that calculating annual amounts for depreciation should not be primarily concerned with providing realistic values for asset values - it is simply an accounting method of 'spreading' the cost of the asset over its useful life.

Example 3

A firm has just bought a machine for $30,000. It will be kept in use for four years, and then it will be disposed of for an estimated amount of $2,000. The question asks for a comparison of the amounts charged as depreciation using both methods.

Straight-line method: ($30,000 - $2,000) / 4 = $7,000 per annum

Reducing balance method: 50 per cent will be used.

See if you can calculate depreciation using both methods and then follow the link below to see how you got on.

Example 3 - answer

This example illustrates the fact that using the reducing balance method has a much higher charge for depreciation in the early years, and lower charges in the later years.

Also when using reducing balance, unless we use a percentage rate with decimal places, we are unlikely to get exactly to the scrap value at the end of the life of the asset

In theory, it does not really matter which method is selected. With both methods, the full costs of the asset will pass through the profit and loss account over its lifespan, although in each individual year different amounts will appear, depending on which method is selected. In practice this may be important to mimise tax liabilities. In addition, some countries require that one of the methods be used.