Trading and profit and loss accounts AO2, AO4

AO2 You need to be able

to: Demonstrate application and analysis of knowledge and understanding Command

Terms: These terms require students to use their knowledge and skills to

break down ideas into simpler parts and to see how the parts relate: Analyse,

Apply, Comment, Demonstrate, Distinguish, Explain, Interpret, Suggest

AO4 You need to be able to Demonstrate a variety of

appropriate skills. Command Terms These terms require you to demonstrate

the selection and use of subject-specific skills and techniques: Annotate,

Calculate, Complete, Construct, Determine, Draw, Identify, Label, Plot, Prepare

The profit and loss account is shorthand for the full title of 'the trading and profit and loss account'. The main purpose of operating a commercial organisation is to make a profit.

The profit and loss account is shorthand for the full title of 'the trading and profit and loss account'. The main purpose of operating a commercial organisation is to make a profit.

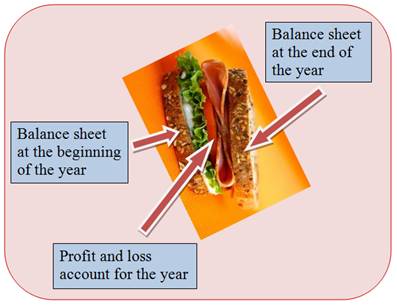

This account summarises a firm's trading (Sales and costs) results for a specific year and shows how the resulting profits were used, or the losses were financed. It is sometimes compared to a 'video' of the year's activities.

It is conventional to give the last year's profit and loss account figures alongside the most recent version to allow for comparison and the identification of trends.

The profit and loss account for a trading year is sandwiched between two balance sheets. The balance sheets provide snapshots at points in time; in this case at the beginning and end of the trading year.

The Format of the Trading and Profit and Loss account is shown on Page 91 of the IB BM Syllabus

If you would prefer to view this interaction in a new web window, then please follow the link below:

The meaning of profit

When discussing profit, an important question to ask is - which profit? The profit and loss account identifies three types of profit:

Gross profit

This is simply 'sales less cost of goods sold'. For a shop it is the difference between the buying in price and the selling price. It represents the mark-up the shop makes on every unit sold.

Forlorn Yachts sells its product for $50,000 but spends $20,000 on bought in components. Mark up = $30,000 or 150%. Profit = $30,000. Profit margin = 60%.

Net profit before interest and tax (NPBIT)

This is the gross profit with the costs of running the business deducted. These expenses include the costs of labour, services, rents, rates etc., but not interest on loans and company taxation. This is a good basic measure of the performance of a business and is used in performance ratios, because the management have no control of the levels of interest and taxation charged. If tax, was 100%, there would be no profit at all, but this would not be the fault of the management!

Net profit after interest and tax (NPAIT)

Tax and interest are now deducted, leaving a figure of more interest to the shareholder, because this is the pot from which there dividend is paid. In practice, firms are often able to reduce their tax liability by using tax allowances and other methods and employing good accountants.

Why is profit before tax and interest a good measure to base comparisons on? Look at the following example.

| Compare plc - profit performance ($k) |

|---|

| Year | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|

| Sales | 200 | 300 | 400 | 500 |

| Gross profit | 100 | 150 | 200 | 300 |

| Gross profit/sales | 50% | 50% | 50% | 60% |

| Net profit before interest and tax | 50 | 70 | 100 | 200 |

| Net profit before interest and tax/sales | 25% | 23% | 25% | 40% |

| Net profit after interest and tax | 20 | 50 | 20 | 40 |

| Interest | 10 | 5 | 20 | 30 |

| Tax | 20 | 15 | 60 | 130 |

| Profit after interest and tax/sales | 10% | 17% | 5% | 8% |

Analysis

Analysis

- Which have been good years?

- What else do you need to know before you can come to any valid conclusions?

Gross profit performance - sales have increased by $100,000 each year. Gross profit is 50% of sales value except for year 2011. Why is this? We do not know, so can only guess (perhaps we should do some deeper research!) Has Compare put its prices up at the expense of sales or have the costs fallen? If it is the latter, is this a result of good buying by Compare, or is it part of a general trend? The main question is - is the improvement in profitability a reflection on compare, or is it really fortunate circumstances? Gross profit is, therefore a measure of the buying efficiency of a firm, or of improving general conditions, or a combination of both. This cannot be used a good basis for judging the performance of a firm as a whole, but it does point towards the effectiveness of the buying and selling process. We still have two more profit figures in the account though.

Profit before tax and interest performance - the first three years show a gradual improvement, but the fourth shows a big increase. This appears to have been a very good year. As this profit has taken account of all revenues and costs, it is a very good measure of the efficiency of the firm.

Profit after interest and tax performance - this shows the effect of interest and tax on a company's profit. It says little about the company, but more about government tax and economic policy. The pattern is very different to that of the 'before profit' data. Look at the tax figures and you see that the tax was increased significantly for the last two years. The firm's performance did not decrease; it was the government imposing higher taxes which made the difference. Therefore, this is not a good measure of efficiency.

So which profit is the most important? It all depends who you are and what information you are seeking. The important thing is that if comparisons are made, they must always use the same profit figure as the base. As we have said, the net profit before interest and tax is the best basis for examining operational efficiency, where the net profit after interest and tax is the measure of greatest interest for the shareholder as determines the sum available for the payment of dividends.

By examining the profit and loss account we have already done some ratio analysis. We will return to more ratio analysis later in the section.