The Keynesian multiplier (Higher Level Only)

The Multiplier

The Multiplier

The multiplier refers to a change in an injection into the Circular Flow of Income (either investment (I), government expenditure (G) or exports (X)), will lead to a proportionately larger change (or multiplied change) in the level of national income i.e. the eventual change in national income will be greater than the initial injection of spending.

Syllabus: Explain, with reference to the concepts of leakages (withdrawals) and injections, the nature and importance of the Keynesian multiplier.

You

need to be aware that changes in any Expenditure component (C,I,G,X,M)

will have a larger effect on GDP than just the value of the initial

change. This is known as the multiplier effect.

You

need to be aware that changes in any Expenditure component (C,I,G,X,M)

will have a larger effect on GDP than just the value of the initial

change. This is known as the multiplier effect.

Notice that changes in C are a little more complicated as it

is not (strictly) a recognised injection into the Circular Flow.

However, autonomous (or non-induced) changes

in consumption have the same effect as a decrease in saving and

therefore act as an injection: Decreasing withdrawals has the same

effect as increasing injections.

If there was an injection of extra spending (and therefore income as one personīs spending MUST be another personīs income, remember) into government-provided health care in an economy some of the money will go to doctors and nurses in the form of a salary increase or to employ new doctors and nurses: New building and equipment will could also be bought and this will boost sales revenue (income) of those making such items. This 'first round effect' is the initial increase in income brought about through the increased spending within the economy.

However, doctors and nurses eat, drink and consume stuff just like the rest of us, and they will choose to spend some of their additional salary and save the rest. Do you recognise these concepts? Refer to Page 19 and marginal propensity to consume (MPC) and marginal propensity to save (MPS).

The MPC is defined as the proportion of extra income received that is used for spending.

The MPS is defined as the proportion of extra income received that is used for saving.

NB. MPC+MPS must equal 1 since income can only be spent or saved.

So, if a doctor was awarded an

extra $100 in salary and chose to spend $80 of this, his or her MPC

would be 0.8 and his or her MPS would be 0.2.

The producers (sellers) of the goods and services that the doctors

and nurses and equipment producers now buy may take on more labour to

cope with the extra demand and these new

employees will also spend part of their additional income and so it

goes on.

The amount that is passed on will diminish (because of withdrawls reducing the extra spending) in each successive

round of spending but the overall effect on the economy will be

greater than the initial injection.

The Importance of the Multiplier

If Governments decide to use keynesian demand management policies they must take into account both the size of the multiplier and the time lag it involves while the multiplier process works its way through the economy. Too much initial injection will lead to inflation but too little will not remove unemployment.

Barrack Obama`s famous stimulus

policy (begun 2008) to reduce unemployment was criticised for some

years as not working, yet the effects were beginning to be seen in

(2014) and unemployment has decrease significantly in 2015.

Calculating the Multiplier

Syllabus: Calculate the multiplier using either of the following

formulae.

1

(1− MPC )

OR

1

(MPS + MPT + MPM)

Another way to remember this is it is 1 over the withdrawals.

Also note that 1-MPC is exactly the same as the withdrawals since they

both sum to 1.

The size of the multiplier can be worked out by dividing the increase in national income (Y) that eventually occurs by the increase in injections that caused it.

![]()

So, for example, if an increase in government spending of $10m caused GDP to rise by $50m, this would be a multiplier of 5 (There are no units it is a multiplier). This would be found by dividing $50m (the change in GDP) by $5m (the initial change in injection of expenditure).

The key determinants of the value of the multiplier are:

-

The size of the savings ratio - the more people save of any

increase in income (MPS), the less the increase in spending at each

stage of the process, the smaller the multiplier.

- The amount spent on imports - if a lot of the extra spending created goes on imported goods and services, then this money will be lost out of the country and not passed on within the economy (the marginal propensity to import or MPM).

- The level of taxation - any increase in income will also mean higher tax revenue. However, if the government use this extra revenue to spend on public sector investment and employment, then this may help the process continue.

Overall, the value of the multiplier therefore depends on the amount of any increase in income that is spent by the people receiving it. The higher the MPC, the higher the value of the multiplier will be.

Marginal propensity to consume (MPC)

Marginal propensity to consume (MPC)

The marginal propensity to consume is the proportion of each extra dollar of income spent by households. For example, if a person earns $1 more and consumes 70c of it, then the MPC is 0.7.

Syllabus: Use the multiplier to calculate the effect on GDP of a change in an injection in investment, government spending or exports (I,G,X)

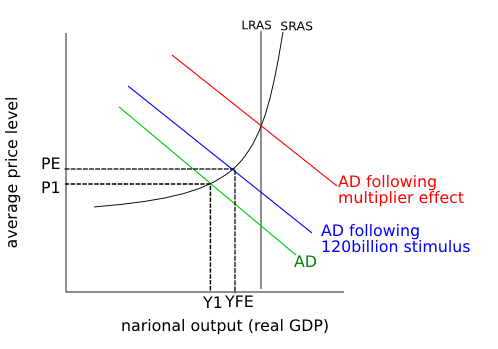

Syllabus: Draw a Keynesian AD/AS diagram to show the impact of the multiplier.

Figure 1 Diagram to show Multiplier effect

Figure 1 Diagram to show Multiplier effect

Figure

1 AD shifts due to the initial injection and then has a greater shift

due to multiplier effect - I donīt know why it says narional income but

I think we can assume it means national income. Anyway, the point is to

show 2 shifts with the second shift of the greater magnitude.

But, how exactly is the multiplier determined? (For the more mathematically inclined)

Past Paper Essay

Nov 2011

2. (a) Explain what the multiplier is and, using a numerical example, demonstrate how it can be calculated. [10 marks]

(b) Evaluate whether real Gross Domestic Product (GDP) can be increased by the

use of demand-side policies.

[15 marks]