Monetary policy and short term demand management

Syllabus: Explain how changes in interest rates can influence the level of aggregate demand in an economy.Remember AD is made up of C+I+G+X-M.

Expansionary monetary policy

Governments may choose to use expansionary (loose or easy) monetary policy in times of recession or a general downturn in economic activity. This was in widespread use by many governments following the financial crisis on 2008.

In this situation, governments use monetary policy to stimulate the economy. They may do this by lowering interest rates or by increasing the money supply. Following the 2008 credit crunch, periods of Quantitative Easing (Q.E.) took place where governments increased the money supply by purchasing assets of longer maturity than only short-term government bonds with the objective of lowering longer-term interest rates.

Lowering interest rates encourage firms (I) and individuals (C) to borrow and spend more. Increasing the money supply into the national income will similarly increase spending. Either way, the level of demand in the economy (Shifting AD to the right) should rise and help encourage economic growth.

Reflationary monetary policies include:

- Lowering interest rates

- Increasing money supply

These policies should boost aggregate demand and, therefore, the equilibrium level of income. This can be seen in Figure 1 below.

Syllabus: Explain the mechanism through which easy (expansionary) monetary policy can help an economy close a deflationary (recessionary) gap.

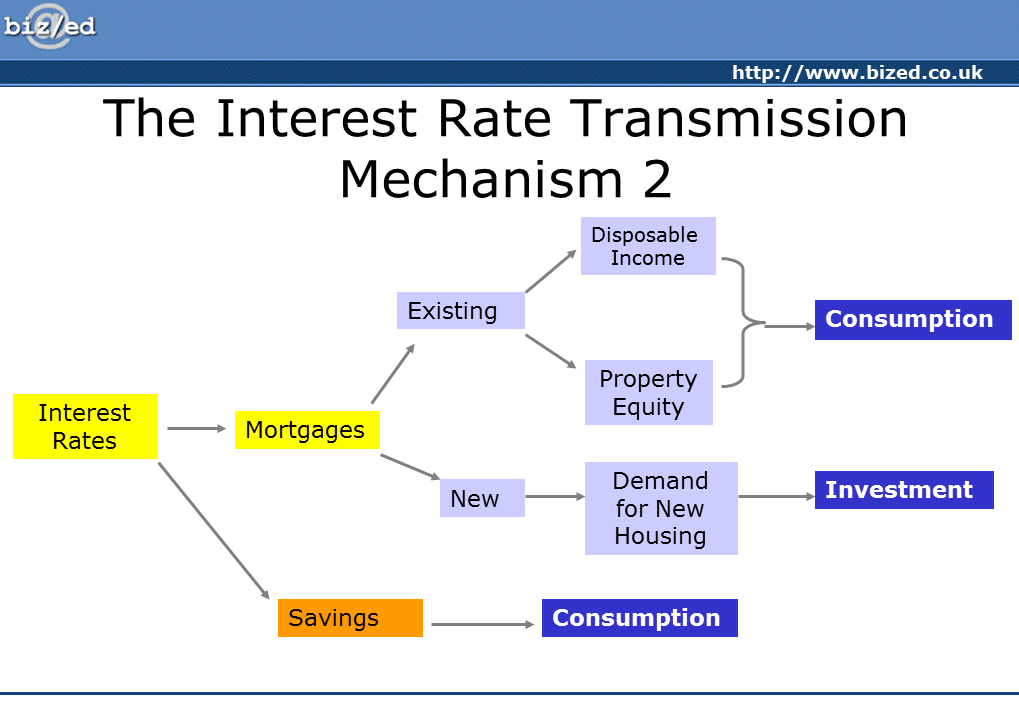

The way changes in interest rates feed through to increasing or decreasing equlibrium Real GDP is called the Transmission mechanism:

For Keynesians, any increase in AD on the horizontal section of the AS curve will not be inflationary. Prices will only increase when full employment is reached and the AS curve becomes vertical. Contrast this with the neoclassical view using a vertical LRAS (Figure 2) where in the long run expanding AD does not increase Real Output or lower unemployment.

However, this policy may cause demand-pull inflation. We can see from Figure 1, that the new equilibrium would involve a higher price level. Keynesians argue that reflationary monetary policy sometimes referred to as a loosening or easing of monetary policy, is appropriate where there is spare capacity, as they believe that the economy can settle at any equilibrium level of output.

Figure 1 Decreasing interest rates and increasing the money suppy increase C and I and shift AD to the right

Figure 2 Reflationary monetary policy - Neoclassical analysis

Contractionary monetary policy

Contractionary (tight) montary policy is likely to be most appropriate in times of economic boom.

Syllabus: Explain the mechanism through which tight (contractionary) monetary policy can help an economy close an inflationary gap.

Syllabus: Construct a

diagram to show the potential effects of tight (contractionary)

monetary policy, outlining the importance of the shape of the aggregate

supply curve.

If the economy is operating at full capacity, further increases in aggregate demand will result in inflation and potential balance of payments problems. In an attempt to slow economic growth and control inflation, the government could increase interest rates and/or reduce the money supply. Either, or both of these policies, will reduce the level of demand in the economy and the level of economic growth.

Yu need to refer to arguments above but reverse the reasoning including the diagrams (ie AD2 to AD1)

Contractionary (tight) monetary policies include:

- Increasing interest rates

- Reducing the money supply

The effect of these policies will be to shift the aggregate demand curve to the left

Both neoclassicals and Keynesians maintain that raising interest rates or reducing the supply of money will lower aggregate demand and close an inflationary gap. Keynesians would argue that such actions may overshoot and cause a deflationary situation, with rising unemployment. They have traditionally argued that reducing the money supply may not always be effective. Indeed, any attempt to control the money supply may only speed up the velocity of circulation, to fund spending. In other words, the existing stock of money will simply be used more frequently and changes hands at a quickening rate.