Variance analysis

A budget variance is the difference between the actual amount incurred or realised, and the corresponding budgeted or planned figure.

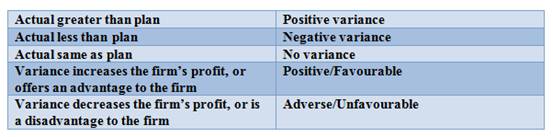

Variances can be adverse/unfavourable or favourable. They can also be positive or negative.

Be very careful with these terms. A positive or a negative variance may be favourable or adverse/unfavourable.

Adverse variances

Adverse variances are those variances that are unfavourable to the firm. Examples would be sales below plan; costs above budget, cash receipts lower than expected, and overtime payment more than forecast.

Favourable variances

Favourable variances are those variances that are beneficial to the business. Examples would be sales ahead of plan, costs below budget, and wages below forecast.

Positive variance

A positive variance occurs where 'actual' exceeds 'planned' or 'budgeted' value. Examples might be actual sales are ahead of the budget.

Negative variance

A negative variance occurs where 'actual' is less then 'planned' or 'budgeted' value. Examples would be when the raw materials cost less than expected, sales were less than predicted, and labour costs were below the budgeted figure.

As you can see in the table below, the variance may be adverse or favourable according to the budget being scrutinised.

| Actual greater than budget | Actual lower than budget | |

|---|---|---|

| Sales/turnover/income | Favourable | Adverse |

| Costs/expenses | Adverse | Favourable |

Which of these are favourable and which adverse?

- The raw materials cost less than expected. The company saves money so increases profit. Favourable, therefore, in spite of the variance being negative. Negative, favourable.

- Sales were less than predicted. Revenue will fall. Profit is lost, so the variance in adverse, but is negative. Negative, unfavourable.

- Profits were above the budgeted figure. The company gains from increased profit. Favourable, therefore, and positive. Positive, favourable.

- Sales tax charges were more than forecast. The company suffers, so it is an unfavourable variance, in spite of being positive. Positive, unfavourable

The tests for variance

If you follow these rules you should have no difficulties with variances.

In examinations, you will not be expected to analyse budgets in detail, but you may be asked to identify whether a variance is favourable or adverse, if it is positive or negative.

Management by exception

The concentration of management on abnormal performance is called 'management by exception'. There is no point in management wasting their valuable time monitoring and examining systems that are working normally and according to plan. Any variances, positive or negative should trigger an investigation. A positive variance may not be beneficial to a firm. It may, for instance, result from a manager under-spending on training or marketing, which may have negative impacts on performance and profitability. An improvement in sales revenue may be the result of increased prices, which may make the business less attractive in the longer term.

Causes of variances

Interpreting variances is like detective work. You probe deeper and deeper, and find out more and more. The process of monitoring, identifying and explaining variances is a significant element in finding solutions to improve performance.

Let's look at the example of Specialty Foods, which appears later in the questions with this module.

The report was as follows:

Specialty Foods Ltd. - profit report - June (Units - $000)

| Plan | Actual | Variance | |

|---|---|---|---|

| Profit | 10,000 | 9,000 | (1,000) |

| Sales | 110,000 | 120,000 | 10,000 |

| Costs | 100,000 | 111,000 | 11,000 |

If you were the Managing Director you might ask some questions.

Question 1

Where has the increase in sales revenue come from?

Sales revenue = number sold x price per unit.

Deeper in the pile of reports will be one covering this. It might look as follows:

Specialty Foods Ltd. - variance report - sales

| Plan | Actual | Variance | |

|---|---|---|---|

| Sales revenue ($000) | 110,000 | 120,000 | 10,000 |

| Sales units | 11,000 | 11,000 | 0 |

| Sales price ($ each) | 10 | 10.91 | 0.91 |

The increase in revenue has come from putting the price up. This may raise a whole set of new questions, and more detective work will be done. The firm will become more efficient over time.

Question 2

Where has the increase in costs come from?

You can dig in the same way. Cost of an item will be made up of price and usage. If the cost per unit had fallen but the usage increased you can again ask why.

- Is there something wrong with the cheaper material?

- Has the plant become old and worn out?

- Have the workers or management become slack?

Having answered the questions you can do something about it.

Budgeting is an interesting area of work in a real business. Budgets and the subsequent variance analysis is a very important part of management accounting and company management.