Budgeting

A budget

A budget is an agreed plan setting out an organisation's expected future income and expenditure over a defined period usually one year.

A budget is a forward financial plan. It provides a prediction of expected flows of money in and out of the firm in the immediate future. A budget is a yardstick by which a manager's success or failure can be measures and potentially rewarded. Normally, a budget will be prepared in advance of a period of time, usually a year but it could be on a monthly or quarterly basis.

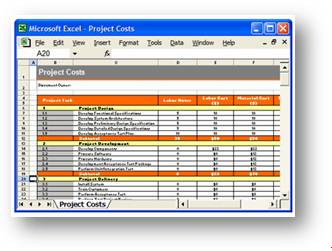

What is called the firm's budget is actually a whole series of sub-budgets covering all of the functional areas such as production, marketing, finance and administration. From the start of the process the firm identifies the primary constraint on its operations during the coming year. Normally this is sales, so all other budgets must reflect this primary budget, after all a business should not spend more than it is earning. The master budget is a summary of company's plans that sets specific targets for sales, production, distribution and financing activities. It consists of a number of separate but interdependent budgets, which usually culminates in a cash budget, a budgeted profit and loss statement, and a budgeted balance sheet. In short, the master budget represents a comprehensive expression of management's plans for future and how these plans are to be accomplished. It is quite clearly a confidential document!

What is called the firm's budget is actually a whole series of sub-budgets covering all of the functional areas such as production, marketing, finance and administration. From the start of the process the firm identifies the primary constraint on its operations during the coming year. Normally this is sales, so all other budgets must reflect this primary budget, after all a business should not spend more than it is earning. The master budget is a summary of company's plans that sets specific targets for sales, production, distribution and financing activities. It consists of a number of separate but interdependent budgets, which usually culminates in a cash budget, a budgeted profit and loss statement, and a budgeted balance sheet. In short, the master budget represents a comprehensive expression of management's plans for future and how these plans are to be accomplished. It is quite clearly a confidential document!

Budgets are drawn up for a number of reasons within a firm. Often the process of producing a budget will take a significant amount of time. Producing budgets on a regular basis for a large part of the activities of the business will help in the following ways.