Topic pack - Accounts and finance - introduction

Welcome to this Triple A Learning topic pack for Accounts and finance. The pack has a wide range of materials including notes, questions, activities and simulations.

A few words about Navigation

So that you can move to the next page in these notes more easily, each page has navigation tools in a bar at the top and the bottom. These tools are shown below.

![]() The right arrow at the top or bottom of the page will take you to the next page of content.

The right arrow at the top or bottom of the page will take you to the next page of content.

![]() The left arrow at the top or bottom of the page will take you to the previous page.

The left arrow at the top or bottom of the page will take you to the previous page.

![]() The home button will take you back to the table of contents for the pack.

The home button will take you back to the table of contents for the pack.

The pack is split into a series of sections and to access each section, the easiest way is to use the table of contents on the left-hand side of the page. To return to the full table of contents, please click on the 'home button' at any stage.

Higher level extension material

Some of the material in this pack relates to the higher level extension topics in the Business and Management guide. This material is marked by icons as follows:

This icon indicates the start of the higher level extension material.

This icon indicates either:

- The higher level extension material continues on the next page or

- The higher level extension material continues from the previous page

This icon indicates the end of the higher level extension material.

To start viewing the contents of the pack, please click on the right arrow at the top or bottom of the page.

Terms and definitions

One of the key things you need to be sure to know are the definitions of all key business terms. In this section we give you explanations and definitions as well as some flash cards, crosswords and word searches to help you practise them.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Click on the right arrow at the top or bottom of the page to start looking at the definitions.

Aims of the business and management course

The aims of the business and management course at HL and SL are to:

- promote the importance of exploring business issues from different cultural perspectives

- encourage a holistic view of the world of business

- enable the student to develop the capacity to think critically about individual and organisational behaviour

- enhance the student's ability to make informed business decisions

- enable the student to appreciate the nature and significance of change in a local, regional and global context

- promote awareness of social, cultural and ethical factors in the actions of organisations and individuals in those organisations

- appreciate the social and ethical responsibilities associated with businesses operating in international markets.

Assessment Objectives

Having followed the business and management course at HL or SL, students will be expected to:

- demonstrate knowledge and understanding of business terminology, concepts, principles and theories

- make business decisions by identifying the issue(s), selecting and interpreting data, applying appropriate tools and techniques, and recommending suitable solutions

- analyse and evaluate business decisions using a variety of sources

- evaluate business strategies and/or practices showing evidence of critical thinking

- apply skills and knowledge learned in the subject to hypothetical and real business situations

- communicate business ideas and information effectively and accurately using appropriate formats and tools.

In addition to the above, students at HL will be expected to:

- synthesize knowledge in order to develop a framework for business decision-making.

Topic Three Structure

Topic two has five core sub-topics and one HL extension sub-topic.

3.1 Sources of finance - notes

Introduction

By the end of this section you should be able to:

- Evaluate the advantages and disadvantages of each type of finance

- Evaluate the appropriateness of a source of finance for a given situation

Sources of finance

Firms need money. They need money to pay wages, to buy raw materials, to pay for promotional activities, to fund research and development and to enable them to invest in new machinery and equipment. All these different activities require different sources of finance. Some will be internal (from within the firm), and some external (from outside the firm).

Firms need money. They need money to pay wages, to buy raw materials, to pay for promotional activities, to fund research and development and to enable them to invest in new machinery and equipment. All these different activities require different sources of finance. Some will be internal (from within the firm), and some external (from outside the firm).

Selecting the source

Choosing an appropriate source of finance is vital. Considerations when selecting a source of finance include:

- Cost: Business obviously prefer sources that are cheaper - administration or interest charges add to the cost e.g. share issue carry high administration charges but no interest.

- Use of funds: Revenue expenditure tends to be financed by short term finance, e.g. raw material purchases are financed by trade credit or overdraft. However, the purchase of property should be financed with long term sources such as share capital or a mortgage.

- Status and size: Small firms may be limited in their sources as they lack sufficient security. Large firms have access to many sources including a flotation on a stock market.

- Financial situation: Firms suffering from liquidity problems, or firms that already have significant loans, may face reluctance from lenders to provide funds. If lenders do agree to the loan, it is likely to be at higher interest rates.

- The external environment: Firms will need to aware of market trends and forecasts and research available sources of finance.

- Organisational goals: Is the business wishing to grow, and if so how? For example, expansion overseas may require substantial funds.

- Existing financial structure: Additional loans may have a negative effect on the balance sheet and financial ratios.

- Risk: The riskier the use of the funds the harder it will be to find a lender.

- Availability of security: Small firms may find it difficult to borrow large sums for long periods as they do not have sufficient assets of value to offer as security.

When answering an examination question about finance, the most important question when choosing a source is:

Does the source of finance match the need e.g. term?

If the need is long-term e.g. buying a property, then the source should be long-term e.g. a mortgage .... Not short term like an overdraft.

Do not mix up short-term needs with long-term sources or vice-versa

The need for finance

The source of finance needs to be related to its purpose. There are two types of expenditure:

Capital Expenditure

Capital expenditure

Capital expenditure is spending to acquire or upgrade physical assets such as buildings and machinery and not for operating expenses; also called capital spending or capital expense.

Revenue expenditure

Revenue expenditure is spending related to the day-to-day running of the business, e.g. administrative and selling expenses including raw materials, wages and salaries.

Capital expenditure is incurred when a business spends money either to buy fixed assets or to add to the value of an existing fixed asset.

Fixed assets are assets not intended for resale. They represent the productive capacity of the business and determine the scale of the business operations and provide the opportunity for the business to make profits or losses. Purchases of fixed assets are shown on the balance sheet and increase the value of the business.

Included in capital expenditures is spending on:

- acquiring fixed assets such as equipment, buildings, machinery and vehicles

- improving existing assets

- preparing an asset to be used in business

- restoring property or adapting it to a new or different use

- starting a new business

As fixed assets tend to be expensive, the finance used will be of a medium- to long-term nature. Capital spending is not usually charged to just one year's accounts, but is spread out of the life of the asset in the form of a depreciation charge to the profit and loss account.

Revenue expenditure refers to an operating expense incurred from the daily running of the organisation, such as staff wages, purchase of trading stock, rent of business premises, advertising and so on. It does not add to the value to the business. The expenditure needs to be matched against revenue in the same period as the revenue is earned. Revenue and expenditure are matched in the profit and loss account, but because it is short-term it will only affect one accounting period.

There are three categories of revenue expenditure:

- Single use consumables such as stationery, petrol for vehicles

- Purchase of items that will be used up within the current financial year e.g. raw materials

- Items that are used before they are paid for, e.g. marketing expenditure

Revenue expenditure is sometimes described as circulating capital. This description reflects the fact that the capital in question leaves the owner's possession to produce profit or loss. The capital may be considered as being 'turned over'. In the process of turning over, profit or loss ensues.

Forms of finance

Finance can be classified by the:

- type: equity (share capital) or debt (loans and mortgages)

- source: external or internal

- duration: permanent, short-, medium- or long-term

Type: equity or debt

There are two basic types of finance available to any business:

- Equity is share capital risked by the shareholders. As long as the business is a going concern, this capital is not repayable, so it is considered as permanent capital. If the business makes profit, the shareholders will receive a proportion of this in the form of a dividend. Dividend, however, is optional as it is decided by the board of directors, so in a bad year a nil dividend may be announced. Equity also includes profits that have retained in the business for the purpose of re-investment.

- Debt includes all forms of borrowing from sources external to the firm. These funds need to be repaid and lenders will expect a reward in the form of interest. Interest is a legal charge and must be paid before any profit is distributed. In a bad year, interest must still be paid.

The relationship between the value of loans and the value of equity is the firm's gearing ratio. If a higher proportion of finance comes from loans than equity the business is said to be highly geared.

Source of funds

Source of funds: Internal sources of finance

If you would prefer to view this interaction in a new web window, then please follow the link below:

An evaluation of internal sources of finance

Internal finance has no direct cost to the business and is relatively convenient. It does not normally increase the liabilities of the business. However, in the case of sale and leaseback, there will be leasing charges. Internal sources are limited and relying on these to finance growth would severely limit the pace and scale of expansion, because the finance would be restricted by the extent of the profits generated.

Source of funds: External sources of finance

If you would prefer to view this interaction in a new web window, then please follow the link below:

3.1 Sources of finance - questions

In this section are a series of questions on the topic - Sources of finance. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Case study - a case study with associated questions

- In the news - questions based around a topical business news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Forms of finance - case study

Read the case material that follows, and then answer the questions.

Sherston Antiques

This company was founded five years ago by four partners. As an unincorporated business, it has grown slowly and steadily, and has developed a good reputation for the selling of old books. It is based just in one country and has 3 shops.

It is now at a major crossroads, and some major business decisions need to be taken soon by the partners, one of whom is approaching retirement age.

They have the opportunity of taking over a major competitor in the same area as they are in, but it will be expensive. They would need to raise $1 million. They have few loans at present, and could raise considerably more. It has been suggested, though, that this is the time for the firm to 'go public' and raise the money that way.

They have just been approached by the '3h' company, a venture capital organisation, with an offer to finance their expansion.

What should they do?

Questions

1. Explain the meaning of the terms:

- Unincorporated business

- Going public.

2. Discuss the additional sources of finance that would be available to Sherston Antiques if they went public.

3. Explain why the firm should aim for a balanced portfolio of finance sources rather than just one.

4. Discuss the advantages and disadvantages of using a venture capitalist to finance such an expansion.

Forms of finance - overdraft report

Write a report outlining whether or not you would consider a bank overdraft to be the most suitable form of short-term finance for a sole trader.

Forms of finance - sole trader report

David Merchant operates as a sole trader and is considering turning his business into a private limited company. He asks you to produce a report outlining the merits of such a move as well as the case for remaining as a sole trader, with your personal recommendation.

Forms of finance - short answer questions

Question 1

Explain the concept of sale and leaseback.

Question 2

Outline the reasons for a company raising capital from a variety of sources.

Question 3

Explain the difference between an ordinary share and a debenture.

Question 4

Explain why venture capital may be a deceptively dangerous source of finance.

Question 5

The capital that a firm needs may be raised from within the company (internally) or from outside of the firm (externally).

Look at the following list of possible sources of funds and decide if they are an internal (I) or external (E) sources. Be careful, some are not sources at all, but are uses of funds (U). Mark these as well.

| 1. Profits | [I] or [E] or [U] |

|---|---|

| 2. Overdrafts | [I] or [E] or [U] |

| 3. Bank loans | [I] or [E] or [U] |

| 4. Trade creditors | [I] or [E] or [U] |

| 5. Selling of unwanted assets | [I] or [E] or [U] |

| 6. Hire purchase | [I] or [E] or [U] |

| 7. Credit sales | [I] or [E] or [U] |

| 8. Taxation | [I] or [E] or [U] |

| 9. Debt factoring | [I] or [E] or [U] |

| 10. Sale of more shares to existing shareholders | [I] or [E] or [U] |

| 11. Dividends | [I] or [E] or [U] |

Tesco: sale and leaseback

Read the article Tesco funds more expansion abroad with $570m sale and leaseback deal and then have a go at the questions below. You can either read the article in the window below, or follow the previous link to open the article in a new window.

Tesco has a long history of using sale and leaseback as a source of finance to fund its global expansion programme. Read more from the articles below to help answer the questions.

Question 1

Define the terms 'sale and leaseback' and 'joint venture'.

Question 2

Explain why Tesco has chosen to enter a joint venture to sell and leaseback a number of their stores.

Question 3

Examine three other sources of finance that Tesco could have used instead of sale and leaseback to fund their international expansion plans.

Question 4

Discuss the advantages and disadvantages of using sale and leaseback to fund further international expansion for Tesco.

Extension activity:

With reference to the Ansoff's Matrix, analyse the strategic growth options that Tesco have chosen to pursue.

SouFun: Flotation IPO

Read the article SouFun sets eyes on $300 million flotation IPO and then have a go at the questions below. You can either read the article in the window below, or follow the previous link to open the article in a new window.

Read more about Global IPOs in the following article:

To support your answers, you may wish to review the Wikipedia article on an IPO

Question 1

Define the term Initial Public Offering.

Question 2

Explain how the funds raised from an IPO will be used by the SouFun.

Question 3

Explain the role of merchant banks, such as JP Morgan Chase, in an IPO.

Question 4

Analyse the advantages and disadvantages of a flotation.

Extension activity:

You may wish to investigate the following statement:

"The $30.5 billion that new issues raised globally in July was the most since November 2007".

See if you can find some other examples of recent IPOs and examine why there is a link between the popularity of IPOs and the business cycle.

3.2 Investment appraisal - notes

Introduction

In the previous section we looked at sources of finance and their suitability. We now move on to look at investment appraisal.

By the end of this section you should be able to:

- Calculate the payback period and ARR for an investment

- Analyse the results of the calculations

- Calculate the NPV for an investment

- Analyse the results of the calculations

Investment appraisal

Investment

Investment means postponing present consumption to increase future returns. In a business sense this will involve the purchase of capital equipment such as plant and machinery with the objective of increasing future output, sales revenue and profit.

In the next section we will be looking at investment appraisal. In essence, we will be looking at the question 'is it worth investing in that project?'

Just like individuals, the finance available to firms is limited and so they must choose how to spend this finance in a way that offers the best return on their investment. This is not always an easy assessment because it is dependent upon the time period involved and the level of risk the firm is prepared to take.

Just like individuals, the finance available to firms is limited and so they must choose how to spend this finance in a way that offers the best return on their investment. This is not always an easy assessment because it is dependent upon the time period involved and the level of risk the firm is prepared to take.

A business may have a variety of investment decisions. They may have to choose between:

- Launching one product or another

- Between different locations for parts or whole of their business

- Buying one piece of equipment or another

Investment appraisal is a quantitative technique used to avoid relying on 'hunch' decision making. However, like all such business tools it must be remembered that the reliability of the outcome is only as good as the data used in the appraisal. As is often said, 'Garbage In, Garbage Out' (GIGO).

Investment appraisal requires two main pieces of information

- The capital cost of the project

- The value of the project (what cash will it bring in for the cost?)

Investment appraisal is a forward-looking process. It considers what might happen, and makes forecasts of financial returns. However, these forecasts will always contain elements of inaccuracy, uncertainty and risk and we will examine how different investment appraisal methods account for these elements.

Investment appraisal will not only be used to choose between one project and another, but also to rank the investments in terms of financial returns. Just like other tools in the business and management toolbox, it is likely that investment appraisal will be used in combination with other tools to provide a broader analysis. Non-financial information may be just as important in the decision making as financial outcomes. It may be the best financial decision to locate in a remote area of the world, but how will employees and customers react?

Investment appraisal

Investment appraisal is built around estimates of future cash flows - cash flow into and out of the company as a result of a particular investment project.

These are almost certainly not entirely accurate. The capital cost will not really be known until it is actually done. Plus or minus 5% would be a good level of accuracy from a good, experienced project team. Cash inflows are also notoriously hard to predict with any accuracy.

Cash outflow

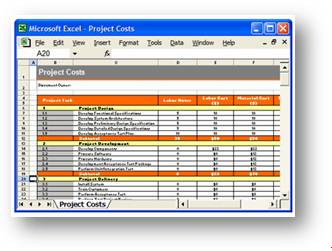

This is all the costs of the project. It will be built up by the 'Projects Department', often using a series of sub-estimates that are aggregated to get the overall cost.

Follow the link below to see an example of a possible project cost pro-forma.

Project cost pro-forma

Every effort is made to cover all items that may be required. Note the inclusion in the above proforma of the words 'Contingencies'. What are they, and why are they needed?

Cash inflow

This is the estimate of the value of the project. It is expressed in terms of net cash inflow.

Net cash inflow

Net cash flow is the additional cash a project will generate (sales revenue or cost savings) less annual costs incurred in processes such as the manufacture and sale of a product.

The heart of the forecast of net cash inflow is the sales forecast produced by the marketing department. This may possibly be inaccurate as it is a forecast. This inaccuracy may be magnified if there are also problems with the cost side of net cash inflow.

Follow the link below to see an example of a possible net cash flow pro-forma.

Net cash flow pro-forma

Notice that it is a cash flow forecast, not a profit forecast. We are concerned with real money here.

Cash inflows often tend to be overestimated. Brand managers who have committed themselves to their new product are rarely pessimistic about sales or they may do themselves out of a job! Marketing people tend to be optimists - the product will sell well - so the sales forecast will probably be an overestimate of the real situation.

Reasons for this inaccuracy are:

- Firms do not work in a vacuum. They cannot predict accurately the actions of the competition, the development of the market, changes in consumer taste, and changes in the economy and government regulation.

- Firms cannot always accurately predict the prices of materials or the cost of labour in advance. These prices may fluctuate daily.

- The weather may be very unseasonable and cause sales to be different to the forecast.

- Some other items, such as agricultural products are difficult to predict in advance.

August 2010

A severe drought destroyed one-fifth of the wheat crop in Russia, one of the world's largest exporters. The majority of the damage to Russia's wheat crop has been caused by the drought, one of the worst in decades as much of the country suffers through the hottest summer since record-keeping began 130 years ago. But in recent days, wildfires raging through much of western Russia have spread and there are fears that more fields will be lost.

Expectations that Russia will slash exports by at least 30 percent have sent wheat prices soaring. "Russia has become the price-maker on the market," said Dmitry Rylko, director general of the Institute for Agricultural Market Studies, who says he expects minimal exports.

Wheat prices on the Chicago Board of Trade surged in July by 42 percent, the biggest monthly gain in more than a half century, and are now the highest they have been in nearly two years. With no immediate end in sight for the drought in Russia, analysts expect prices to continue to rally.

Thus there is a considerable element of risk when cost figures are used; which is another reason to ensure a contingency is included in the budget. The results of investment appraisal need to be considered in the light of uncertainty in the market, the reliability of the source and the quality of the data involved. An allowance should be made for the risk element.

Investment appraisal issues

The basis of investment appraisal is the cost and cash flow estimates. We will now see how we can use them to come to a judgement about an investment project.

The basic requirements of investment appraisal are:

- An estimate of what the project will cost. This is the capital investment.

- An estimate of what the project will earn the firm. This is called the forecast of net cash inflow.

These are both estimates, and may well be inaccurate. As we have discussed, the cost estimate may to be too low (forecast is fraught with problems), so costs may well only become apparent during the project. The net cash inflow, which is based on a sales forecast for the product, will possibly be too high (marketing people are optimists and are not known for producing under-estimates). As a result, any estimate of the value of a project is likely to be too high.

Investment appraisal techniques

Investment appraisal methods divide into two groups:

- Simple, easy to calculate methods. They are not very accurate or sensitive, but are good for screening out poor projects from a long list. All projects should be subjected to these tests. These screening tests are

- Payback period

- Average rate of return (ARR)

- Detailed and more accurate tests. If a project passes through the initial screening, then in larger businesses, which can afford the cost, the project may be it is subjected to more complex tests are based on discounted cash flow methods. They are:

- Discounted cash flow (DCF)

- Net present value (NPV)

We will look at all these tests in turn using a single example.

Investment appraisal example

Student Computers plc is trying to decide between two expansion projects. It has the following data available from the projects department. All units are $000's.

Project A has a capital cost (in year 0) of $400k

Project B has a capital cost (in year 0) of $700k

| Net cash inflow ($000) | ||

|---|---|---|

| Project A | Project B | |

| 50 | Year 1 | 100 |

| 100 | Year 2 | 300 |

| 150 | Year 3 | 500 |

| 200 | Year 4 | 300 |

| 100 | Year 5 | 200 |

Which project is best, or should Student Computers decide to do neither?

Payback period

Payback period

Payback period is a method of investment appraisal that estimates the time period taken to recover the initial cash outlay on an investment. Although simplistic it is the most popular method of investment decision making.

This technique is not a measure of profitability, but more a measure of short-term risk. Long payback periods indicate a high risk, short ones a low risk.

Cumulative cash flow method of payback

Cumulative cash flow

Cumulative data is generated by adding up consecutive numbers within a series. So with project A the annual returns are:

| Project A ($000) |

|---|

| 50 |

| 100 |

| 150 |

| 200 |

| 100 |

So the cumulative returns at the end of each year are:

| Year | Cumulative ($000) |

| 1 | 50 |

| 2 | 150 (50 + 100) |

| 3 | 300 (50 + 100 + 150) |

| 4 | 500 (50 + 100 + 150 + 200) |

| 5 | 600 (50 + 100 + 150 + 200 + 100) |

Payback period method - convert the net cash flow data to cumulative net cash flow and to find the time when cumulative net cash flow is the same as the capital cost. In other words when the project repays the capital cost.

| Project A | Project B | |||

|---|---|---|---|---|

| Cost: 400 | Payback reached? | Capital cost ($000) | Cost: 700 | Payback reached? |

| Cumulative net cash inflow ($000) | ||||

| 50 | No | Year 1 | 100 | No |

| 150 | No | Year 2 | 400 | No |

| 300 | No | Year 3 | 900 | Yes |

| 500 | Yes | Year 4 | 1200 | |

| 600 | Year 5 | 1400 |

The cost of project A has been covered by the end of year 4, and the Project B covered by the end of year 3. But this is not as accurate as we require. We need to know when the payback occurs within the year.

Project A pays back between 3 and 4 years. At the end of the third year Student Computers need an additional $100 000 to payback their investment. A total of $200 000 in cash inflows are expected in the fourth year, so:

Payback period = 3 + 100/200 = 3.5 years (i.e. 3 years and 6 months)

Project B pays back between years 2 and 3. At the end of the second year, Student computers need an additional $300 000 to payback their investment. A total of $500 000 in cash inflows are expected in the third year, so:

Payback period = 2 + 300/500 = 2.6 years (i.e. 2 years and 7.2 months)

Firms will often set a criterion level or screening test in advance for undertaking a project. For instance Student Computers may state that only projects paying back within 3 years will be undertaken. In this case only Project B would be acceptable. However, they may set a payback period as 5 years, in which case both projects fulfil the investment criterion. Then it is a choice between the two.

Clearly on a financial basis, Project B is preferable as it pays back the quickest. However, other factors may now be considered, such as non-financial issues or liquidity issues. It may be that the firm's cash flow is poor, so it is important to select the project that pays back the quickest even if other factors suggest it is not the best in the long-run.

Benefits of payback method

- Easy to calculate and understand

- Includes the cost of the investment

- Focuses on short-term cash flow and is appropriate for equipment with a relatively short life

Limitations of payback period

- Not a measure of profit.

- Ignores all cash flows after the payback point.

- Ignores the pattern of cash flow.

- Ignores the 'time value' of money.

- Encourages a short-term view of investment

Follow the link below to see a numerical example of these problems.

Payback period - problems

The payback period can also be calculated without using the cumulative method by the following formula:

![]()

Initial investment = 3000

monthly contribution = 300

Payback 9000/300 = 30 months or 2 years 6 months

This method is not normally used in IB examinations and would only work if the net cash inflow was constant.

Average rate of return (ARR)

The average rate of return (ARR), or accounting rate of return, method of investment appraisal measures the annual income of a project as a percentage of the total investment cost, which is something that simple payback does not do. This is a measure of average profit, and is expressed in a familiar percentage form. It is also a relatively straightforward method and the result can be compared with returns from alternative uses of funds and with the base bank interest rate.

As with payback, it is likely that the firm will establish an investment criterion. For example, the firm may decide that any project with an ARR of less than 5% will not be considered.

ARR - The three main steps

The ARR measures the net return each year as a percentage of the initial cost of the investment.

![]()

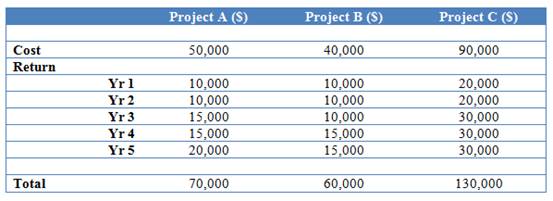

EXAMPLE: Three projects have the following costs and expected income:

STEP 1. Calculate the total net profit from each project by subtracting the total return of the project from its cost.

![]()

STEP 2. Calculate the net profit per annum by dividing the total net profit by the number of years the project runs for.

![]()

STEP 3. Calculate the ARR using the following formula:

![]()

Calculate the ARR for the projects B and C.

Follow the link below if you need to look again at the example figures.

Student Computers - investment appraisal example

| Project | A | B |

|---|---|---|

| Total gain (sum of each years cash inflow) | 600 | 1400 |

| Less: capital cost | (400) | (700) |

| Total net gain | 200 | 700 |

| Years | 5 | 5 |

| Average net gain | 200/5 = 40 | 700/5 = 140 |

| ARR (as % of initial investment) | 40/400 = 10% | 140/700 = 20% |

This is a measure of profit, and project B seems to be preferable here as well.

Benefits of ARR

- Measures profitability

- Uses all the cash flows

- Easy to understand

- Easy to compare percentage returns with other investment opportunities

Limitations of ARR

- Ignores the pattern of cash flow - when they occur

- Later cash flows are unlikely to be accurate as they are longer term forecasts

- The length of the project or the life span of a machine maybe an estimate

- Ignores the timing of cash flows

- Ignores the 'time value' of money

- Ignores the risk factors associated with a long payback period on liquidity

Follow the link below to see a numerical example of these problems.

ARR - problems

So, with all of the problems associated with these methods of analysis, what are they used for? They are simple and quick to prepare, and are used as screens or sieves to weed out poor, or useless, projects. Firms have to set themselves 'action standards' for payback and ARR, say 3 years maximum and 15% minimum, and only if these are met and/or exceeded will a project 'pass' to be examined by the more complex discounted cash flow method. Action standards are selected by the firm concerned to reflect their view of the future and individual requirements. You will be given them in an exam if they are appropriate.

So in our example (Student Computers) project A has failed; project B has passed. Project B now has to be evaluated allowing for the 'time value' of money.

Click on the right arrow at the top or bottom of the page to move on to the next page.

Discounted cash flow (DCF) & Net present value (NPV)

Discounted cash flow (DCF)

Discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset using the concepts of the time value of money. DCF is used to calculate the value of future cash flows in terms of an equivalent value today. All future cash flows are estimated and discounted to give their present values (PVs).

What is the time value of money?

What is the time value of money?

When you were younger, you probably looked at compound interest in mathematics and were asked some simple questions such as,

If you had $100 and put it in the bank at 10% interest how much would you have at the end of:

Year 1?

Year 2?

Year 3? and so on...

The answers are:

Year 1 $110 ($100 + $100 x 10 per cent) or ($100 x 1.1).

Year 2 $121 ($110 + $110 x 10 per cent) or ($110 x 1.1).

Year 3 $133.1 ($121 + $121 x 10 per cent) or ($121 x 1.1).

N.B. Multiplying by 1.1 is the same as working out 110%.

Why is it called compound interest? The reason is that you will get 10% interest on your original $100 deposit (the principal) plus you also get 10% interest on any previous interest. So in the case of year 2 to year 3, you will receive 10% on your original $100 (which is $10) plus an additional 10% on your $21 interest (which is $2.1). So in total you receive $12.1 interest. Add that to your $121 and you get $133.1.

Compound interest

Compound interest is interest which is calculated not only on the initial principal, but also the accumulated interest of prior periods. Compound interest differs from simple interest in that simple interest is calculated solely as a percentage of the principal sum.

Therefore, it can be asked what $110 earned in one year's time is worth today (the Present Value or PV) if the interest rate is 10%. One way of thinking of this is reverse compound interest. The answer is obviously $100 as this could have been invested a year ago at 10 per cent to earn $10 in interest giving $110. Therefore $100 is worth the same as $110 received in a year's time or $121 received in two years' time. This indicates the time value of money

Discounted Cash Flow (DCF) deals with the two problems of interest rates and time. The return on an investment project is always in the future, usually over a period of several years. Money earned or paid in the future is worth less today, because of the concept of reversecompound interest:

We have already seen that, $100 is worth the same as $110 received in a year's time or $121 received in two years' time. This indicates the time value of money. So the Present Value or PV of $110 received in a year's time is $100 as this could have been invested today at 10 per cent to earn $10 in interest giving $110 at the end of the year. $100 today is therefore exactly the same in financial terms as $110 received at the end of the year. By now you should be getting the point!

Therefore, if a business wishes to compare two possible investments, which deliver different returns in the future, it is impossible to compare the relative merits unless the business can compare 'like with like'. To achieve this, all future returns must be converted into present values (PV). This can be achieved by discounting future returns.

To evaluate the worth of an investment we will then need to calculate the Net Present Value:

Net Present Value

The Net Present Value (NPV) of a project is the return on the investment (the sum of the discounted cash flows) less the cost of the investment.

If the NPV is larger than the initial cost (positive NPV), then the firm will see a return on its money. If it is less than the initial cost (negative NPV) then the project is not worth pursuing.

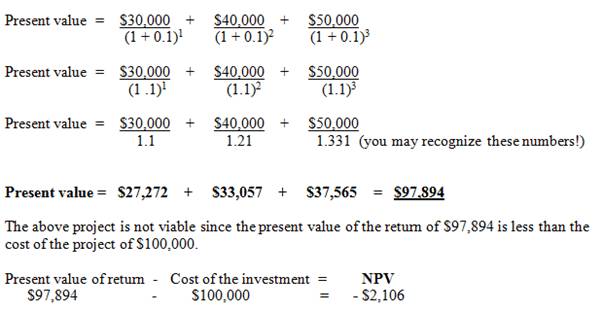

An investment project costing $100,000 yields an expected stream of income over a three year period of:

Year 1 - $30,000

Year 2 - $40,000

Year 3 - $50,000

If the interest rate is 10%, the discount values (present values) can be calculated using the technique below:

The firm will be losing money on the investment (a negative NPV), so should not undertake it.

Fortunately, it is not necessary to carry out these discount factor calculations as tables of discounted values at different interest rates can be used and should be included with the examination paper (unless the examination board forgets to do so, which can happen!). The example above shows you how the discount factors are worked out.

The extract of a table below shows the present value of $1 receivable for a 6 year period at an interest rate of 5% per cent (rounded to two decimal places).

Present value of $1 receivable at the end of 6 years at 5 per cent

| After | 1 yr | 2 yrs | 3yrs | 4 yrs | 5 yrs | 6 yrs |

|---|---|---|---|---|---|---|

| Present value of $1 | $0.95 | $0.90 | $0.86 | $0.82 | $0.78 | $0.75 |

| Discount factor | 0.95* | 0.90 | 0.86 | 0.82 | 0.78 | 0.75 |

Therefore, it is possible to calculate the present values of the yields from previously used example using the correct discount factor from the table:

| Present value of income in year 1 | = | $30,000 | x | 0.95* | = | $28,500 |

|---|---|---|---|---|---|---|

| Present value of income in year 2 | = | $40,000 | x | 0.90 | = | $36,000 |

| Present value of income in year 3 | = | $50,000 | x | 0.86 | = | $43,000 |

| Total present value of all income | = | $107,500 |

This investment is now viable as the Total Present Value ($107,500) is greater than the cost ($100,000). The NPV, therefore, is $7,500.

Worked Example: Net present value (NPV)

Our company - Student Computers - wants a minimum return on its investment of 15%, after allowing for the time value of money. We can work out what Project B is worth in terms of today's money using the discount factors below.

| Discount rate 15% |

|---|

| Year in future | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Discount factor (f) | 0.870 | 0.756 | 0.658 | 0.572 | 0.497 |

The project has a capital cost of $700k and the net cash inflow for each year will be:

Cash inflow for year x discount factor (for year)

| Year | Cash inflow | Discount factor | Net cash inflow |

|---|---|---|---|

| 1 | 100,000 | 0.870 | 87,000 |

| 2 | 300,000 | 0.756 | 226,800 |

| 3 | 500,000 | 0.658 | 329,000 |

| 4 | 300,000 | 0.572 | 171,600 |

| 5 | 200,000 | 0.497 | 99,400 |

| Total cash inflow | $ 913,800 |

The project is worth $913.8k in today's money, but costs only $700k. This means that it has a net present value (NPV) of +$213.8k.

i.e. $913.8 - $700k = + $ 213.8k

This means that the project should bring in more money than simply investing the $700k in the bank at a rate of 15%.

Note how NPV is written as + or - , $ , number. You must give the sign (+/-) and the money unit as well as the number itself. Do not forget the thousands if they are there.

Interpretation of NPV

- NPV is positive: The project earns more than the discount rate. The project has 'passed' this test, and may be considered further.

- NPV is zero: The project earns exactly the discount rate. It may or may not be rejected.

- NPV is negative: The project earns less than the discount rate. The project will be rejected.

Benefits of Discounting/NPV

- Considers all cash flows

- Accounts for the time value of money and therefore considers the opportunity cost

- It is more scientific than the other methods

Limitations of NPV

- Complex to calculate

- Only as good as the original data. If the estimates of cost or net cash inflows are wrong, so will be the NPV

- The selection of the discount factor is crucial, but it is mostly guesswork as this rate is constantly changing

- NPV's look deceptively accurate

- Ignores all and any non-financial factors.

1 |

Average rate of returnThe average rate of return for a project gives you: |

2 |

Discounted cash flowDiscounted cash flow methods of investment appraisal |

The time value of money

1. The dollar and time

Look at the following data:

| Year | 1963 | 2009 |

|---|---|---|

| New honours graduate salary | $800 per year | $50,000 per year |

| 3 bedroom house | $2,825 | $400,000 |

| Small car | $400 | $10,000 |

All monies are in dollars, but they clearly do not have the same value. The $ in 1963 was worth more than the one today. So a $ today is worth more than a $ tomorrow; a demonstration of the time value of money.

This approach is general, not specific or numerate. That is where discount tables come in.

2. Discount tables

Imagine that you invest $100 at 10% per annum, compounded annually. Your deposit would grow.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Value | 100 | 110 | 121 | 133 | 146 | 160 | 176 |

This is the future value of a $ today at 10%. We can turn this round and look at the present value of a $ earned in the future. It is the reciprocal of the numbers above.

Present value of $1 earned in the future.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Present value | 1.000 | 0.909 | 0.826 | 0.75 | 0.684 | 0.625 | 0.568 |

This tells us that a $ received in 3 years time is worth the same as 75 cents today at 10% rate of interest.

Do the same thing for an interest rate of 20% and we get:

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Future value | 100 | 120 | 144 | 173 | 207 | 249 | 299 |

| Present value | 1.000 | 0.833 | 0.694 | 0.578 | 0.483 | 0.401 | 0.334 |

The higher the interest rate, the less money is worth received in the future.

For interest rate, read discount rate and you have the discount tables.

Residual values

The residual value of any investment is the scrap value of any plant etc. at the end of its life. This does not reduce the cost of a project, it simply gives another cash inflow in the year when the item is sold.

The residual value of any investment is the scrap value of any plant etc. at the end of its life. This does not reduce the cost of a project, it simply gives another cash inflow in the year when the item is sold.

What effect does a residual value have on our tests?

- Payback period - none at all, since the money comes after the payback point.

- Average rate of return - will increase the 'gain' and hence the 'net gain'. The return will increase if the number of years is not adjusted.

- NPV - little change, unless the residual value is very high. Discount factor will be low since the money only comes in after the project is over.

Investment appraisal - qualitative factors

We have examined the numerical methods of performing investment appraisal. It is vital, however, that you appreciate that this is an aid to decision-making, not a decision maker in itself. People make decisions and have to take into consideration a wide range of non-financial factors. By definition, non-financial factors cannot be taken into account when doing payback periods, average rates of return and net present values.

What are these non-financial factors?

They can be summarised under the headings of:

- Personnel

- Objectives

- Image

- Risk

Let's examine each of these in more detail.

- Personnel factors - numerical measures cannot account for the availability of skills, effect of redundancy and concerns about relocation. It cannot account either, for the personal preferences of Directors and Managers.

- Objectives - firms have to set action standards. These should reflect likely external changes such as interest rate trends, inflation trend and the change in the economy. People who have individual objectives also set them. Whether the firm wants high or low returns, if it after short-term or long-term gains is a matter of personal decision, not numerical fact. A good project may be turned down for short-term, non-financial reasons. Corporate objectives may overtake financial figures and information.

- Image - decisions are taken often so as to maintain or improve the image of the company in the eyes of some or all of the stakeholders.

- Risk - risk management is important, but difficult to enumerate. Degrees of risk are hard to decide, and may be more a matter of opinion than fact. Allowance for risk may lead to high action standards being set.

3.2 Investment appraisal - questions

In this section are a series of questions on the topic - Investment appraisal. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Case study - a case study with associated questions

- In the news - questions based around a topical business news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Payback & ARR - self-test questions

Why not have a go at the following examples to see how well you have understood the calculation of payback and ARR?

A firm has to choose between two possible projects and the details of each project are as follows:

| Capital cost | $000 |

|---|---|

| Project A | 300 |

| Project B | 500 |

| Project C | 450 |

| Net cash inflow ($000) | |||

|---|---|---|---|

| Project A | Project B | Project C | |

| Year 1 | 75 | 100 | 50 |

| Year 2 | 125 | 200 | 75 |

| Year 3 | 125 | 300 | 250 |

| Year 4 | 100 | 300 | 300 |

| Year 5 | 75 | 150 | 200 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Discounted cash flow - self-test questions

Why not have a go at the following examples to see how well you have understood the calculation of discounted cash flow and net present value?

A firm has to choose between three possible projects and the details of each project are as follows:

| Capital cost | $000 |

|---|---|

| Project A | 300 |

| Project B | 500 |

| Project C | 450 |

| Net cash inflow ($000) | |||

|---|---|---|---|

| Project A | Project B | Project C | |

| Year 1 | 75 | 100 | 50 |

| Year 2 | 125 | 200 | 75 |

| Year 3 | 125 | 300 | 250 |

| Year 4 | 100 | 300 | 300 |

| Year 5 | 75 | 150 | 200 |

Assume a discount rate of 8%. The discount factors for this are given in the table below.

| Discount factors 8% | |

|---|---|

| Year 1 | 0.926 |

| Year 2 | 0.857 |

| Year 3 | 0.794 |

| Year 4 | 0.735 |

| Year 5 | 0.681 |

1 |

2 |

3 |

Inv. appraisal techniques - short answer questions

Question 1

Define the term 'screening test' (or 'criterion level').

Question 2

Explain the term 'time value of money'.

Question 3

Explain what a net present value (NPV) of +$256 at a 20% discount factor tells you about a project.

Question 4

Outline how a residual value affects the average rate of return.

Question 5

Explain the meaning of the payback period for an investment and why this might be considered a measure of risk rather than profitability.

Quantitative factors - numerical questions (1)

Question 1

A company is faced with the choice between two projects X and Y. The cost information for the two projects is summarised below.

| X | Project | Y |

|---|---|---|

| 600 | Capital cost ($000) | 900 |

| Net cash inflow ($000) | ||

| 50 | Year 1 | 150 |

| 100 | Year 2 | 300 |

| 300 | Year 3 | 500 |

| 300 | Year 4 | 300 |

| 200 | Year 5 | 250 |

| 50 | Year 6 | 100 |

N.B. There are no residual values

(i) For each project determine the payback period and the average rate of return.

The firm has a screening tests of a maximum of 3.0 years for payback period and 12 % as the minimum rate for the average rate of return.

(ii) Explain the meaning of the term 'screening test'.

The firm has a company screening test of 10% for all projects after adjustment for the time value of money.

(iii) Explain the term 'time value of money.

(iv) Calculate the net present value for the best project found in i). Does this meet the firm's screening test?

Use the following discount factors (10% discount rate):

Year 1 0.909

Year 2 0.826

Year 3 0.751

Year 4 0.683

Year 5 0.621

Year 6 0.564

Question 2

Hertford Chemicals plc

Hertford Chemicals plc is considering investing in a new chemical processing plant, but has the choice of manufacturing one of two products on it. The firm requires a minimum return of 20% on any capital expenditure. Details of the two proposals are summarised below:

| Project A | Initial capital cost | Project B |

|---|---|---|

| $200,000 | $250,000 | |

| Net cash inflows | ||

| $50,000 | Year 1 | $20,000 |

| $100,000 | Year 2 | $150,000 |

| $200,000 | Year 3 | $250,000 |

| $200,000 | Year 4 | $100,000 |

| $100,000 | Year 5 | $150,000 |

(a) Calculate the payback period, average rate of return and the net present value for the two projects.

Use the following discount factors (20% discount rate):

Year 1 0.833

Year 2 0.694

Year 3 0.579

Year 4 0.482

Year 5 0.402

(b) On the basis of these measures only, which project would you recommend?

(c) What other factors, other than quantitative/financial factors, should you take into consideration when deciding between projects?

Quantitative factors - numerical questions (2)

Question 1

The manager of O'Neill Biochemical Ltd is considering relocation of the processing facilities. He has narrowed down the choices to two options. Data relevant for this decision is as follows:

Location A

This location is in Michigan and, although a cheaper option, there would be higher operating costs due to the higher wages that would need to be offered to recruit suitable workers. The capital cost of plant A is $5 million.

Location B

This location is in Houston would be very near transport links, which would save the firm money, but the site is relatively expensive. The capital cost of plant B is $10 million.

Forecast information for each of the plants was produced as follows:

| Location A | Location A | Location B | Location B | |

|---|---|---|---|---|

| Revenue receipts | Operating payments | Revenue receipts | Operating payments | |

| $ million | $ million | $ million | $ million | |

| Year 1 | 7.3 | 4.0 | 7.3 | 2.7 |

| Year 2 | 7.5 | 5.2 | 7.5 | 3.3 |

| Year 3 | 9.1 | 5.3 | 9.1 | 4.6 |

| Year 4 | 9.8 | 6.5 | 9.8 | 5.5 |

| Year 5 | 11.2 | 8.1 | 11.2 | 6.4 |

Additional information:

- A modification to the plant at location B to treat the pollution would need an extra capital cost of $2 million. In addition, operating payments would increase in each year by $400,000.

- The company's cost of capital is 10% per annum.

- The following extract is from the present value table for $1 at 10% per annum.

| Year 1 | 0.909 |

|---|---|

| Year 2 | 0.826 |

| Year 3 | 0.751 |

| Year 4 | 0.683 |

| Year 5 | 0.621 |

Required

Produce net present value calculations for the locations A and B. For Location B provide figures both for the plant in its basic form and also with the modifications to treat pollution.

Question 2

Flanders Ltd is trying to decide which project should be taken up, out of three possible investments. The initial investment would amount to $40,000. Scrap value at the end of use would be nil.

The cost of capital is 9%, for which discount factors are as follows:

| Year | Present value of $1 |

|---|---|

| 1 | 0.917 |

| 2 | 0.842 |

| 3 | 0.772 |

| 4 | 0.708 |

| 5 | 0.650 |

The net cash inflows from the three projects under consideration are:

| XC1 | VB93 | IPR2 | |

|---|---|---|---|

| $ | $ | $ | |

| Year 1 | 5,000 | 14,000 | 11,000 |

| Year 2 | 8,000 | 16,000 | 12,000 |

| Year 3 | 6,000 | 21,000 | 13,000 |

| Year 4 | 12,000 | - | 14,000 |

| Year 5 | 18,000 | - | - |

Required

For each possible project you are required to calculate:

(i) Payback

(ii) Net present value

Investment appraisal - quantitative factors - numerical questions 2

Question 1

Wells Ltd is considering extending its operations into the production and sale of components used in the making of lawnmowers. The components cost $7 to manufacture and would be sold on to the lawnmower manufacturer for $12. A new machine will be needed costing $10,000 which is payable on 1 January in Year 1.

The expected sales of these are as follows:

| Units | |

|---|---|

| Year 1 | 600 |

| Year 2 | 650 |

| Year 3 | 720 |

| Year 4 | 800 |

| Year 5 | 850 |

The cost of capital is 10%.

The following is an extract from the present value table for a cost of capital of 10%:

| 10% | |

|---|---|

| Year 1 | 0.909 |

| Year 2 | 0.826 |

| Year 3 | 0.751 |

| Year 4 | 0.683 |

| Year 5 | 0.621 |

It is assumed that revenues are received and costs are paid off at the end of each year.

It is assumed that everything produced is sold

(a) Calculate the annual net cash flows for each year, which are expected to result from the purchase of the machine.

(b) Using the expected annual net cash flows, calculate the net present value for the machine.

Question 2

The assembly machine of Tahoulan Ltd could be replaced. The replacement machine will cost $400,000, which is payable on 1 January in Year 1. The new machine will be able to assemble 24,000 units a year. However, this is expected to rise by 25% from the start of year 4.

The cost of capital is 10%.

- The following is an extract from the present value table for a cost of capital of 10%:

| 10% | |

|---|---|

| Year 1 | 0.909 |

| Year 2 | 0.826 |

| Year 3 | 0.751 |

| Year 4 | 0.683 |

| Year 5 | 0.621 |

- It is assumed that revenues are received and costs are paid off at the end of each year.

- It is assumed that everything produced is sold

- Each unit of production costs $25 to manufacture, but will rise to $32 in year 3 and $35 in year 4 onwards.

- Each unit is expected to sell for $35 in years 1 and 2 rising by 10% (compound) in years 3 and 4, thereafter remaining constant.

Should the assembly machine be replaced?

3.3 Working capital - notes

In the previous section we looked at sources of finance and their suitability and used different methods of investment appraisal. We now move on to look at working capital and the preparation of cash flow forecasts.

By the end of this section you should be able to:

- Define working capital and explain the working capital cycle

- Prepare a cash-flow forecast from given information

- Evaluate strategies for dealing with liquidity problems

Working capital

Working capital

Working capital is the day-to-day finance for running a business and is used to measure a firm's ability to meet current obligations, such as the payment of wages, electricity and rent. A high level of working capital indicates significant liquidity. It is also called net current assets or net working capital.

Every business needs money, cash, to keep it operating. Money is the lifeblood of business to meet day-to-day expenses and to pay bills, as and when they come due. If key bills, such as those for rent and energy are left unpaid, the firm may be declared insolvent. Indeed, a lack of cash, rather than insufficient profit, is the main reason for business failure.

Working capital is calculated by using the formula:

![]()

Current Assets are assets that are intended to be turned into cash within the present financial year. Typically current assets comprise stock, debtors and cash.

- Stock is the least liquid of current assets. It comprises of stocks of raw materials (components), semi-processed goods (work in progress) and finished goods. In some countries stock is called inventory.

- Debtors are people or organisations that owe money to the business as the result of buying goods or services on credit. It is an asset, because the firm should eventually receive payment.

- Cash is the most liquid asset. It is held in the organisation or in the bank (cash-in-hand or cash-at-the-bank). All other assets are measured against it to define liquidity.

Current Liabilities are anything owed by the organisation, which is likely to be paid within the present financial year. Typically current liabilities comprise an overdraft, creditors, dividends and unpaid tax.

- An overdraft is a facility given to an organisation that allows it to raise short term finance by having a negative balance on its accounts up to an agreed limit. In essence it is a short term bank loan.

- Creditors are suppliers to whom the organisation owes money because it has bought goods and services on credit.

- Dividends are a share of the profits due to shareholders as a reward for purchasing shares, but have not yet been paid.

- Tax may be owed to the government for a variety of reasons, such as a percentage of profits.

Having too much working capital can be considered a problem, because there is an opportunity cost associated with surplus working capital tied up in stocks, debtors and cash. Current assets, such as cash, could have earned returns elsewhere in the business. For instance, cash could be invested in new fixed assets which would generate future sales. So there is a balance to be made between too many, and too few, liquid assets.

Do you know the difference between bankruptcy and voluntary liquidation? This money for the day-to-day operation of a business, and its survival, is known as working capital. Working capital control is vital to the survival of businesses.

Working capital cycle

The accounting definition of working capital is:

Working capital = Current assets - current liabilities

Stock + debtors + cash

minus

Creditors + overdrafts + short-term loans

There is, in most businesses, a significant delay between paying out for the raw materials and labour required to produce the goods or services and the receipt of cash from the sale of the goods. This means that for most businesses their working capital (their net current assets) needs to be very carefully managed.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Cash flow forecasts

We will look at this section in two parts. By way of introduction to the notion of cash and cash flow we will first look at the difference between profit and cash. People always tend to assume that they are the same, but they are far from it. Both are vital to a business, but for different reasons. Then we will look at how businesses can use cash flow forecasts to help them plan for the future and ensure they have enough cash to meet their obligations.

Profit and cash

Profit is the positive difference between a firm's sale's revenue and its total costs of production. The fact that a company is profitable does not guarantee it will be solvent. A profitable company may run out of cash. Why?

It is often assumed that at the end of the year, a sum equal to the firm's profit, is in the bank account able to be used to pay bills or fund expansion. In reality, it is more likely that profits will be tied up in some other area of the firm and will be in some other form of asset rather than cash.

It is possible for a firm to be profitable, but also be short of cash because:

- Many sales are on credit. They will be counted in the firm's profits, but the cash may not appear for months.

- The firm may have invested heavily in capital items. The cost of these assets may impact heavily on the firm's cash position.

- The firm may have invested in stocks. The cash outflow occurs when they are bought.

- Some items are paid for in advance, but do not appear as a cost until much later.

In the 1980s, Body Shop was expanding rapidly through the use of franchising. Every new franchise required training, new equipment, marketing and supplying. Body Shop was very profitable, but suffered a cash flow/liquidity problem as much of its cash became tied up in new franchises.

Bowater Scott, a paper manufacturer was making heavy losses. It decided to sell some of its loss-making divisions. The sale resulted in Bowater Scott having a large pile of cash, despite its losses.

Cash is not the same as profit. A firm may be making losses, but is 'cash rich' or alternatively may be very profitable, but suffering from liquidity problems.

Cash flow forecasts

Firms usually exist to make a profit. However, it is also important for firms to monitor their cash flow position, otherwise they may not be able to pay their bills, supplier costs or wages. If they do not pay these they may be faced with closure.

It is vital, therefore for managers to track their cash flow position.

A cash flow forecast

A cash flow forecast is an estimate of the timing and amounts of cash inflows and outflows into an organisation over a specific period, usually one year.

A cash forecast contains three main elements:

- Cash inflows may arise from cash sales, debtors paying what they owe, interest received, bank loans, rent payments and disposal of assets.

- Cash outflows occur when the organisation pays its creditors, makes cash purchases, buys assets, pays taxes, wages and rent and any other cash outgoing for business expenses. Not all of these pass through the profit and loss account.

- Net cash flow is the difference between cash inflows and cash outflows. Ideally this should be positive, although organisations can survive negative cash flows if it can find cash from other sources, such as an additional bank overdraft.

A positive cash flow is not profit and a negative cash flow is not a loss. Do not use these terms interchangeably.

A profitable business may run out of cash - this is called insolvency. This could be the result of selling output with too long a credit period or tying up funds in new assets. According to the UK Department of Trade and Industry more business failures result from lack of cash than any other reason. This is particularly true for new businesses. Too little cash can result in the following problems:

- Non payment of suppliers

- Discounts lost for late payment of bills

- Wages and salaries may not be paid on time, causing poor motivation, high labour turnover, absenteeism and industrial unrest

- New capital assets cannot be afforded

- Tax cannot be paid.

Managing cash flow.

To manage cash, a firm will need to assess:

- The size and timing of cash flows into the business

- The size and timings of cash flows out of the business

- Whether there are other sources of finance to cover short term need for cash

Cash-flow forecast.

A cash-flow forecast is an attempt by management to plan ahead and prevent future liquidity problems. Each month a firm estimates the amount of cash entering and leaving the business and whether this will result in a cash deficit (overdraft) or surplus. If an overdraft is predicted, the managers will have to consider potential solutions. These could include:

A cash-flow forecast is an attempt by management to plan ahead and prevent future liquidity problems. Each month a firm estimates the amount of cash entering and leaving the business and whether this will result in a cash deficit (overdraft) or surplus. If an overdraft is predicted, the managers will have to consider potential solutions. These could include:

- Arranging an overdraft with a bank

- Arranging a longer term loan

- Rescheduling payments or considering alternative purchase solutions, e.g. hire purchase, or possible leasing arrangements

- Selling assets or postponing purchases

- Finding cheaper suppliers

- Reducing credit terms for customers or lengthening credit terms with suppliers

Some businesses are highly seasonal, e.g. farming, tourism. It is likely that firms in these industries will experience some cash-flow problems. If they make arrangements with banks to cover these periods then problems of insolvency may not arise

Alternatively, a firm may have too much cash during the year. This may result in the loss of interest as longer-term investments carry higher interest rates. Firms could also purchase more productive assets.

Example 1 - cash-flow forecast

A typical cash-flow is shown below:

New Horizon Holidays

Cash flow forecast year ($000s)

| Month | Jan. | Feb. | Mar. | Apr. | May | June | July |

|---|---|---|---|---|---|---|---|

| Receipts/inflows | |||||||

| Cash sales | 100 | 120 | 240 | 280 | 430 | 500 | 540 |

| Payments from debtors | 50 | 100 | 100 | 140 | 200 | 340 | 450 |

| Other (loan received) | 80 | ||||||

| Total cash inflows | 150 | 220 | 340 | 420 | 710 | 840 | 990 |

| Payments/outflows | |||||||

| Labour | 20 | 40 | 50 | 60 | 100 | 180 | 200 |

| Flights | 40 | 75 | 90 | 100 | 180 | 190 | 210 |

| Hotel bookings | 30 | 80 | 120 | 140 | 250 | 260 | 300 |

| Interest | 20 | 20 | |||||

| Advertising | 5 | 30 | 30 | ||||

| Electricity | 15 | 15 | 15 | ||||

| Rent | 50 | 50 | 50 | ||||

| Salaries | 50 | 50 | 50 | 50 | 50 | 50 | 50 |

| Purchase of fixed assets | 60 | ||||||

| Total cash payments | 210 | 295 | 340 | 475 | 600 | 680 | 825 |

| Net cash flow | (60) | (75) | (0) | (55) | 110 | 160 | 165 |

| Opening cash balance | 70* | 10 | (65) | (65) | (120) | (10) | 150 |

| Closing cash balance | 10 | (65) | (65) | (120) | (10) | 150 | 315 |

* January's opening balance of $70,000 is the closing cash balance from December

Similarly, January's closing balance of $10,000 becomes the opening balance of February.

Figures in brackets are negative, i.e. negative cash flow - an overdraft.

Examiners like to add complications to cash flows. The most common are:

- Delayed payments or receipts. It is common practice for firms to buy and sell products on credit. The examination question may give a table of sales or purchases but then say that the credit term is one month. It is important that you make the cash flow or inflow one month later. Remember this is cash forecast, not a record of other assets. In the following example the goods received in January are not paid for until February:

| Jan | Feb | March | April | May | June | July | |

| Good received ($000) | 20 | 30 | 30 | 25 | 40 | 50 | |

| Payment - cash outflow | 20 | 30 | 30 | 25 | 40 | 50 |

- Asset purchases made in instalments

- Payment such as electricity may be payable every quarter

The important thing is to make sure that the timings of the cash inflows and outflows are accurate.

Example 2 - Interactive cash flow forecast

Follow the link below to open up an interactive spreadsheet of a cash flow forecast. In this spreadsheet, you can change the values of the various receipts and payments and see the impact on the firms cash balance. Once you have experimented a bit with changing values, reset the spreadsheet (using the 'reset' button) and try the following questions.

Interactive cash flow forecast

1 |

2 |

Perils of cash flow forecasting

A firm prepares a forecast, no more. It makes assumptions when preparing the forecast and there is no guarantee that all expectations or assumptions will be met. This means that cash flow forecasting has to be a continuous or ongoing process. The firm needs constantly to check on the cash position and identify problems before they happen, otherwise the firm may find itself in a liquidity crisis.

A liquidity crisis may be caused by a number of factors including:

- Overstocking happens if the firm does not match its production or purchasing with final demand patterns and holds too much stock, which ties up liquid funds.

- Overborrowing creates significant interest payments. If interest rates rise, these payments may be unsustainable.

- Unexpected changes in the external environment may occur, such as seasonal variations and sudden changes in demand patterns.

- Poor credit control can cause liquidity issues if the firm allows too much credit some of which may go 'bad' in recessionary times.

- Overtrading occurs when a firm expands without securing the necessary long-term finance, which results in the reduction of working capital. If a firm accepts new orders, these may be profitable when sold. However, production ties up liquid funds in assets such as work-in-progress and the storage of stock as well as paying production expenses. The firm will not recover its liquidity until payment is made for the goods, which may not be for a long period, especially if the purchaser takes advantage of a credit period.

An overtrading scenario

The timing of inflows and outflows

A car company assembles vehicles in Europe. It receives an enquiry about supplying an additional 500 cars for a US dealership. It does its calculations and estimates, that even with additional transport costs it will make a 12% profit on every car sold because it has surplus capacity. It accepts the order and waits for the extra profits to roll in. However, they have not examined the cash flow situation.

Just like the majority of manufacturing firms the car assembler makes the cars and pays for all production costs well before they see any inflow of money from sales. The US dealership insists on delivery of all 500 cars before being invoiced. This will take 2 months.

Assume the car manufacturer:

- pays labour at the end of each week

- pays energy bills monthly

- orders the parts two weeks in advance and pays for them 3 months after receipt

- pays additional miscellaneous expenses throughout the production period

The US dealership receives all 500 cars after 2 months, but then uses the full 3 month credit period before paying the total order value.

So despite the each car making a profit, the manufacturer has cash outflows for up to 5 months, before receiving any cash inflows. The question is whether the firm has sufficient liquid assets to fund this production for the entire period. The negative cash flow could destroy the business. If they cannot pay their bills, their factory may be closed before they finish the order. The greater the rate of expansion of sales, the greater the adverse difference between inflows and outflows and the greater the potential cash flow problem. Success can be very expensive!

Management of working capital

If cash flow is poor, how can it be improved?

Working capital management involves monitoring four important components of the working capital cycle:

- debtors

- creditors

- stock

- cash

If you would prefer to view this interaction in a new web window, then please follow the link below:

'What if' analysis - contingency planning

As with all business tools the output is only as good as the quality of the input. Cash flow forecasts are exactly what they say - forecasts of future events. It is good planning to consider 'what if' scenarios which might affect cash flow. For instance:

- Sales revenue is lower than expected as fashions change

- Customers do not pay on time or there are larger bad debts than usual

- Raw materials, components and energy costs increase rapidly

- New competitors enter the market and existing competitors cut prices

- Interest rates increase

- Market research is inaccurate

- Motivation falls leading to lower output and higher production costs

The firm can work out the worst case scenario and look at the effect on its cash flow. Would this be sustainable? It can then put procedures and contingencies in place to deal with emergencies. For instance it may build contingencies into its budgets and/or negotiate overdrafts on good terms before they are required. Computer software makes it easier to complete 'what if' analysis using spreadsheets with variable timings and amounts.

3.3 Working capital - questions

In this section are a series of questions on the topic - Working capital. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Case study - a case study with associated questions

- In the news - questions based around a topical business news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Working capital - short exercises

Exercises

- Explain the concept of working capital.

- Draw a diagram to show the 'working capital cycle' and explain its components.

Cash flow forecasts - case study - cash flow management

Wholesale Phones Ltd

Three shareholders, Sandra, Sumira and Ranjit, have just set up a small company that buys mobile phones from Asia and the sells them to wholesalers in Europe. Marketing and selling is done using the Internet. When they started trading, Ranjit the Accountant, arranged an overdraft with the Bank for $100,000. They had also deposited $36,000 in cash in return for the initial share issue.

The early weeks were very hard, but the market was growing. Sales were very good, and all the owners' efforts were put into buying and selling. Credit control was ignored, and Ranjit let the work on the cash flow forecast slip.

The owners are in the boardroom when the receptionist interrupts them.

'Ranjit, phone the Bank Manager at once. Unless you talk to her, she will call our overdraft in.'

'What is she on about', said Sandra, 'does that mean I will have to cancel the order for my BMW?'

Ranjit went to his office. He had not really checked the cash position for two months.

He was a little worried. His records showed the following.

Opening bank balance - $12,468 credit

Overheads

Rent: Office $3,000 per month. Both months paid.

Furniture: $1,000 per month. One month paid.

Cars: $1,000 per month. One month paid.

Rates, Insurance etc: $1,000 per month. Both months paid.

Tax: $500 per month. None paid.

Services: $250 per month. Both months paid.

Salaries and expenses: $9,500 per month. Both months paid.

Sundries: $1,000 per month. One month paid.

Sales

Period 1: $15,000 All paid for.

Period 2: $24,000 All paid for.

Period 3: $30,000 Half paid for.

Period 4: $40,000 No payments received.

Period 5: $86,000 No payments received.

Purchases

Period 1: $8,000 Paid.

Period 2: $15,000 Paid.

Period 3: $15,000 Paid.

Period 4: $55,000 Paid.

Period 5: $45,000 Paid.