The Boston Consulting Group (BCG) matrix

If you would prefer to view this interaction in a new web window, then please follow the link below:

The ideal product portfolio is likely to be balanced with a mixture of problem children, stars and cash cows, but not dogs (unless they have a purpose in completing the firm's offer). Firms need new products in the pipeline, but also require cash cows to generate funds for researching and developing new products and for turning question marks into stars. Too many question marks and stars may lead to cash flow problems for a firm and so it must be selective in developing products.

There is an assumption in BCG analysis that fast growing markets and high market share are always preferable as these generate higher profit levels. Certainly the higher the market share, the more cash will be generated, and as a result of the economies of scale the greater the potential profits.

However, it is possible for firms to be very profitable by:

- developing niche products in a large market segment

- introducing innovative technologies or design which change the nature of the market. A perfect example of this is Dyson's entry into the vacuum cleaner market.

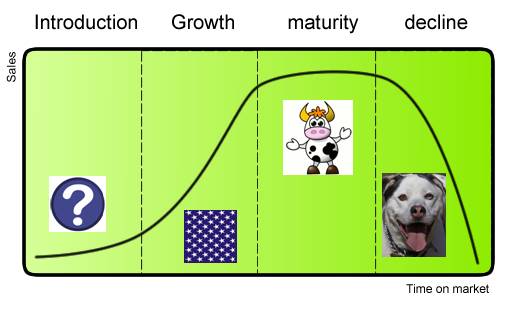

There are links between the BCG and the Product Life Cycle:

However, it is best to be careful as to how this is used. It is possible that a Question Mark is not early on in its life cycle - it might just have a low market share in a large market. In general, however, the connection is appropriate and the strategies employed when a product is in its infancy will be suited to Question Marks as will products in the growth (Stars), maturity (Cash Cows) and decline (Dogs) stages.