Intangible assets

Recording tangible assets in the balance sheet is relatively straightforward, but the treatment of intangible assets is more problematic.

Intangible assets

Assets are things of value. The value should be a matter of fact or, at least, a commonly accepted valuation. The value should be objective. Tangible assets, such as land and buildings are real and touchable and have a market value that can be generally agreed.

Intangible assets are non-physical assets. However, they have value, and indeed may be the most valuable asset a firm possesses. Brand names are the prime example. The Coca Cola brand name is virtually priceless. It is one of the best known symbols in the entire world. Putting an exact value on an intangible asset can be extremely difficult and cannot normally be established until it is sold. However, intangible assets are rarely sold (they are not normally intended to be sold) and in some cases the asset cannot be sold.

Intangible assets appear in the balance sheet in the Fixed Asset section. They include:

- Goodwill. Goodwill represents the good name and reputation of the business, its public image and customer base and its existing products. Goodwill can only arise when a business is sold because it is the difference between what was paid for the business by the acquiring firm and the book value of the assets.

Example: A bar is purchased for $500,000 as a 'going concern'. The price includes:

Buildings and land - $250,000. This value is established by reference to a Land Agent.

Stock and fitting - $50,000. A value established and accepted by an external surveyor.

Goodwill - $200,000. An extra charge decided by the seller to reflect the value of the reputation, future profits and existing customer base.

The value of goodwill is what the buyer is prepared to pay, over and above the value of the assets. Goodwill is not guaranteed into the future; customer loyalty for instance can be lost almost overnight and reputation only exists if the firm remains a going concern. The value of the goodwill simply represents an estimation of a range of intangible factors... and consequently accountants, who are prudent people, really do not like it and want to remove from the balance sheet as soon as possible! Often shareholders will question the amount paid for goodwill.

Note however, that the firm is generally not allowed to include the value of its own goodwill on the balance sheet, except when it has been recently acquired by another business. There is a problem with this as it may severely undervalue the business and so does not provide a 'true and fair view' of the net worth of the business.

- Patents and copyrights. Firms want to protect their intellectual property rights to allow them to profit from their ideas and inventions. Patents are legal documents designed to protect an invention against copying by other businesses for up to 20 years. Copyrights are similar to patents, except that protect the ideas of authors, artists and composers. Fees can be charged if other companies or individuals wish to use these ideas. Alternatively, patents and copyrights can be sold completely. The value of patents and copyrights can be significant and the argument is, therefore, that these valuable assets should be recorded on the balance sheet.

Singer-songwriter, Crystal Cartier, sued Michael Jackson and others for an alleged infringement of her song "Dangerous" copyrighted July 18, 1991. However, in this case, the jury returned a verdict in favour of the defendants, stating that there were significant differences in the works.

- Trademarks and brand names. Trademarks are a visible representation of the firm and may be in several forms such as symbols, images and logos. These are instantly recognisable and provide a shorthand identity for what a firm stands for. Examples include the three stripes of Adidas or the 'Golden Arches' of McDonalds. They generate significant sales and therefore firms will protect trademarks through registering them. Trademarks can be sold. Brand names have as similar value and function and will also be protected.

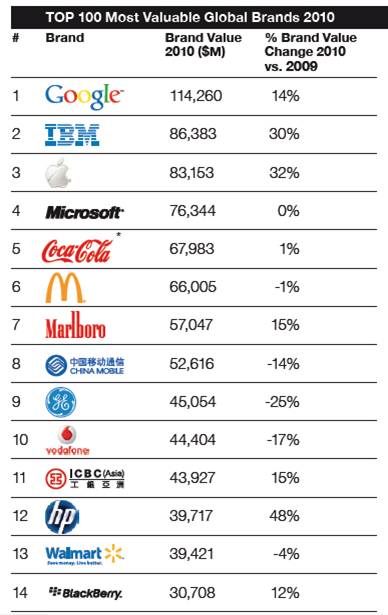

In conjunction with The Financial Times, Bloomberg and Datamonitor, Millward Brown Optimor developed the BrandZ Top 100 providing a guide to the value the 100 Most Powerful Brands and showing changes in values over a number of years. The Top 100 total $2.04 trillion in brand value, which means that in the past five years, since the ranking was first published in 2006, the brand value of the Top 100 has grown by a more than 40%.

A summary of the top 14 brands by value is given below. Google and IBM are the top 2 brands by value in 2010. Google's brand is estimated to be worth $bn114.26 and the IBM brand $bn 86.38.

If you wish to download a pdf of the 2010 report showing all of the top 100 brands, please click on this link.

Intangible assets - example

Goodwill - if you buy a shop, hotel or pub you will be asked to pay for the assets, and more. This extra is called goodwill, and is essentially the price paid to buy the future profits of the firm. This cannot be valued or even guaranteed; you have to judge if it is worthwhile. Having paid it, is it an asset that should go into the balance sheet? It can be misleading to do this as it inflates the net worth of the business. As a consequence, many firms write goodwill off as a loss.

Look at the following example. Both firms start from the same point and buy an asset, a restaurant, and pay $500,000 for it, including $200,000 goodwill. Firm A includes the transaction using intangible assets; the other has the product policy of writing off such payments in the year that they occur. The two balance sheets are as follows:

| Balance sheet - A and B Company year ended 1st April 2011 ($k) |

|---|

| Start | Firm A | Firm B | |

|---|---|---|---|

| Fixed assets - tangible | 12,000 | 12,300 | 12,300 |

| Fixed assets - intangible | 0 | 200 | 0 |

| Current assets - cash | 2,000 | 1,500 | 1,500 |

| Current assets - others | 3,000 | 3,000 | 3,000 |

| Current liabilities | 2,000 | 2,000 | 2,000 |

| Long-term liabilities | 3,000 | 3,000 | 3,000 |

| Net capital employed | 12,000 | 12,000 | 11,800 |

The difference is the goodwill, considered by B as a loss.

| Financed by: | |||

|---|---|---|---|

| Shares | 6,000 | 6,000 | 6,000 |

| Retained profits | 6,000 | 6,000 | 5,800 |

| Total | 12,000 | 12,000 | 11,800 |

Company B will have to make profits in the future and retain them to get the goodwill back. It is being wise and prudent. Company A, on the other hand, is 'counting its chickens'; it is assuming profits in advance. Not wise, and is contrary to accounting standards in many countries.