Advantages and disadvantages of floating exchange rates

Governments can use exchange rates to affect economic performance. A rising exchange rate, which is often linked to an increase in base interest rates, leads to exports becoming more expensive, but imports falling in price. This reduces part of the inflationary pressure within an economy. A fall in the exchange rate will lead to the reverse and may help domestic businesses export more.

If you would prefer to view this interaction in a new web window, then please follow the link below:

The New Zealand Dollar

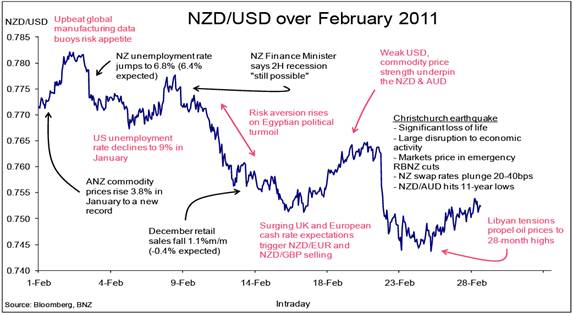

Examples of some of the factors that can influence a floating currency, such as the New Zealand dollar (NZD) are indicated in the bullet points and the graph below.

The following exchange rate analysis came from BNZ Financial Markets Wrap, Feb 2011

- Early in the month an increase in risk appetite underpinned rises in global equity markets and bond yields.

- Later on risk aversion rose as political turmoil in the Middle-East once again took the stage.

- Global commodity prices continued to soar, underpinning strong returns from AUD, CAD and energy and materials sectors of world equity markets.

- The 22 February Christchurch earthquake resulted in markets immediately pricing RBNZ OCR cuts and a fall in the NZD.

Source: BNZ Financial Markets Wrap, Feb 2011

Question 1

Explain why the currency depreciated following the bad news.

Question 2

Suggest reasons why the NZD appreciated following the increase in commodity prices.

Question 3

Analyse the possible links between the higher risk aversion and the depreciation in the NZD.