Topic pack - International economics - introduction

Welcome to this Triple A Learning topic pack for International economics. The pack has a wide range of materials including notes, questions, activities and simulations.

A few words about Navigation

So that you can move to the next page in these notes more easily, each page has navigation tools in a bar at the top and the bottom. These tools are shown below.

![]() The right arrow at the top or bottom of the page will take you to the next page of content.

The right arrow at the top or bottom of the page will take you to the next page of content.

![]() The left arrow at the top or bottom of the page will take you to the previous page.

The left arrow at the top or bottom of the page will take you to the previous page.

![]() The home button will take you back to the table of contents for the pack.

The home button will take you back to the table of contents for the pack.

The pack is split into a series of sections and to access each section, the easiest way is to use the table of contents on the left-hand side of the page. To return to the full table of contents, please click on the 'home button' at any stage.

Higher level extension material

Some of the material in this pack relates to the higher level extension topics in the Economics guide. This material is marked by icons as follows:

This icon indicates the start of the higher level extension material.

This icon indicates either:

- The higher level extension material continues on the next page or

- The higher level extension material continues from the previous page

This icon indicates the end of the higher level extension material.

To start viewing the contents of the pack, please click on the right arrow at the top or bottom of the page.

Key terms - international trade

One of the key things you need to be sure to know are the definitions of all key international economics terms. In this section we give you explanations and definitions of terms relevant to international trade.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Key terms - exchange rate

One of the key things you need to be sure to know are the definitions of all key international economics terms. In this section we give you explanations and definitions of terms relevant to exchange rates.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Key terms - balance of payments

One of the key things you need to be sure to know are the definitions of all key international economics terms. In this section we give you explanations and definitions of terms relevant to the balance of payments.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Key terms - economic integration

One of the key things you need to be sure to know are the definitions of all key international economics terms. In this section we give you explanations and definitions of terms relevant to economic integration.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Key terms - terms of trade

One of the key things you need to be sure to know are the definitions of all key international economics terms. In this section we give you explanations and definitions of terms relevant to the terms of trade.

If you would prefer to view this interaction in a new web window, then please follow the link below:

International Organisations

In this section we take a look at international organisations that regulate, monitor and support world trade. We also look at organisations that support development in less developed countries.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Aims of the economics course

The aims of the economics course at HL and SL are to enable students to:

- develop an understanding of microeconomic and macroeconomic theories and concepts and their real-world application

- develop an appreciation of the impact on individuals and societies of economic interactions between nations

- develop an awareness of development issues facing nations as they undergo the process of change.

Assessment Objectives

Having followed the economics course at HL or SL, students will be expected to:

- AO1 Demonstrate knowledge and understanding of specified content

- Demonstrate knowledge and understanding of the common SL/HL syllabus

- Demonstrate knowledge and understanding of current economic issues and data

- At HL only: Demonstrate knowledge and understanding of the higher level extension topics

- AO2 Demonstrate application and analysis of knowledge and understanding

- Apply economic concepts and theories to real-world situations

- Identify and interpret economic data

- Demonstrate the extent to which economic information is used effectively in particular contexts

- At HL only: Demonstrate application and analysis of the extension topics

- AO3 Demonstrate synthesis and evaluation

- Examine economic concepts and theories

- Use economic concepts and examples to construct and present an argument

- Discuss and evaluate economic information and theories

- At HL only: Demonstrate economic synthesis and evaluation of the extension topics

- AO4 Select, use and apply a variety of appropriate skills and techniques

- Produce well-structured written material, using appropriate economic terminology, within specified time limits

- Use correctly labelled diagrams to help explain economic concepts and theories

- Select, interpret and analyse appropriate extracts from the news media

- Interpret appropriate data sets

- At HL only: Use quantitative techniques to identify, explain and analyse economic relationships

Section Three Structure

Unit three has four core sub-topics and one HL extension.

Section 3.1 International trade (notes)

In this section we will look at the benefits of trade, absolute and comparative advantage, the World Trade Organisation (WTO), types of trade protection and arguments for and against trade protection.

By the end of this section you should be able to:

- Explain that gains from trade include lower prices for consumers, greater choice for consumers, the ability of producers to benefit from economies of scale, the ability to acquire needed resources, a more efficient allocation of resources, increased competition, and a source of foreign exchange.

- Describe the objectives and functions of the WTO.

- Explain, using a tariff diagram, the effects of imposing a tariff on imported goods on different stakeholders, including domestic producers, foreign producers, consumers and the government.

- Explain, using a diagram, the effects of setting a quota on foreign producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.

- Explain, using a diagram, the effects of giving a subsidy to domestic producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.

- Describe administrative barriers that may be used as a means of protection.

- Evaluate the effect of different types of trade protection.

- Discuss the arguments in favour of trade protection, including the protection of domestic jobs, national security, protection of infant industries, the maintenance of health, safety and environmental standards, anti-dumping and unfair competition, a means of overcoming a balance of payments deficit and a source of government revenue.

- Discuss the arguments against trade protection, including a misallocation of resources, the danger of retaliation and "trade wars", the potential for corruption, increased costs of production due to lack of competition, higher prices for domestic consumers, increased costs of imported factors of production and reduced export competitiveness.

- Explain the theory of absolute advantage.

- Explain, using a diagram, the gains from trade arising from a country's absolute advantage in the production of a good.

- Explain the theory of comparative advantage.

- Describe the sources of comparative advantage, including the differences between countries in factor endowments and the levels of technology.

- Draw a diagram to show comparative advantage.

- Calculate opportunity costs from a set of data in order to identify comparative advantage.

- Draw a diagram to illustrate comparative advantage from a set of data.

- Discuss the real-world relevance and limitations of the theory of comparative advantage, considering factors including the assumptions on which it rests, and the costs and benefits of specialization.

- Calculate from diagrams the effects of imposing a tariff on imported goods on different stakeholders, including domestic producers, foreign producers, consumers and the government.

- Calculate from diagrams the effects of setting a quota on foreign producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.

- Calculate from diagrams the effects of giving a subsidy to domestic producers on different stakeholders, including domestic producers, foreign producers, consumers and the government.

Reasons for trade - introduction

Did you know that?

Did you know that?

- The total value of world trade in 2010 was $16 trillion; that's over $30 million a minute.

- World trade expanded an average 6 percent yearly between 1990 and 2008

On the following pages we consider the following topics in detail:

- Reasons for trade

- Theory of absolute and comparative advantage

- The World Trade Organisation

Benefits of trade

Why trade?

Why trade?

Countries trade for a number of reasons:

- Different factor endowments - some economies are rich in natural resources while others have relatively little. Trade enables economies to specialise in the export of some resources and earn revenue to pay for imports of other goods.

- Lower prices - one of the principal gains from trade is lower prices. The goods and services that consumers want are often available internationally cheaper than they would be domestically. The lower prices may arise as a result of the different factor endowments countries have. Comparative advantage (HL only topic) helps to explain these lower prices.

- Increased welfare - specialisation and trade allow countries to gain a higher level of consumption than they would do domestically, e.g. consume beyond their PPC.

- To gain economies of scale - with trade a country can get access to a larger market, and can therefore produce on a larger scale at a lower average cost. The process of specilisation within trade will often help countries to become increasingly skilled at production and therefore gain further economies of scale.

- Diversity of choice -through trade a country can provide a greater variety of goods and services therefore more choice to domestic consumers.

- Increased competition -global competition will encourage domestic firms to innovate, improve productivity and improve their products. This will benefit consumers through lower prices.

- Trade may be an 'engine for growth' - increased trade may encourage economic growth and drive further improvements in living standards, for instance improving the standards of living for millions of Chinese families.

- Availability of foreign exchange - by trading, countries can acquire foreign exchange. This is particularly important for countries like Ghana, North Korea and Cuba whose currencies are not convertible on international markets. The only way they can pay for imports is to export goods and be paid in foreigh exchange. This can then, in turn, be used to purchase imports.

Absolute advantage

Did you know?

Did you know?

- Trade allows a country to specialise in the production of those products that it can produce most efficiently. A country will benefit from international trade as long as it exports goods for which it forgoes less other goods than other countries, and imports goods in which it has a higher opportunity cost of production than other countries.

In this section we look at how the theories of absolute and comparative advantage help explain the benefits of trade to a country, and to the World.

International trade is based on specialisation at a national level.

According to economic theory a country could benefit from trade if it specialises in the production of goods in which it has an absolute or comparative advantage (see below).

Theory of Absolute advantage

According to Adam Smith (1723-1790), each country should concentrate on producing those goods in which it has an absolute advantage.

Absolute advantage

Absolute advantage exists when a country can produce more of a product per resource unit than another country. It is a possible basis for trade. A country with an absolute advantage is producing more efficiently (at a lower cost per unit) than another.

Benefits of specialisation and trade:

- Consumers in each country can buy a wider range of goods at lower prices leading to a better standard of living

- There is a more efficient allocation of resources. i.e. better use of scarce resources

- More goods are produced in the World and more goods are available for consumption.

Comparative advantage

According to David Ricardo (1772 - 1823) countries will benefit from trade, not only when they have an absolute advantage, but also if they have a comparative advantage. It would be always beneficial for two countries to trade if they have different relative costs (opportunity cost) of producing a good.

Comparative Advantage

A country has a comparative advantage in producing a good, if it is able to produce the good at a lower opportunity cost (by sacrificing less production of other goods) than other countries,

Comparative advantage theory

The theory of comparative advantage is based on the following assumptions:

- There are no trade restrictions

- There are no transport costs

- There are no exchange rates

Suppose there are two countries - Utopia and Happyland. These countries produce two products - hardware and software. According to the theory of comparative advantage each country should specialise in production of a good where it has a lower opportunity cost.

Pre trade situation and opportunity costs

The graph below shows production possibilities for Utopia and Happyland.

Figure 1 Production and consumption possibilities before trade

Assume that before trade each country uses a half of its resources to produce hardware and another half to produce software.

| Production and consumption | Hardware (units) | Software (units) |

|---|---|---|

| Utopia | 100 | 500 |

| Happyland | 50 | 750 |

| Total World | 150 | 1250 |

Utopia:

To produce 1 more Hardware Utopia has to give up 5 units of Software, e.g.

1 hardware = 5 Software

To produce software more Utopia has to give up 1/5 Hardware, e.g.

1 Software = 1/5 Hardware

Happyland:

To produce 1 more Hardware Happyland has to give up 15 units of Software, e.g.

1 hardware = 15 Software

To produce software more Happyland has to give up 1/15 Hardware, e.g.

1 Software = 1/15 Hardware

In conclusion, Utopia has a comparative advantage (lower opportunity cost) in production of Hardware and should specialise in production of Hardware.

Happyland has a comparative advantage (lower opportunity cost) in production of Software and should specialise in production of Software.

Specialisation

The table below shows specialisation based on comparative advantage.

| Hardware (units) | Software (units) | |

|---|---|---|

| Utopia (production) | 200 | 0 |

|

Happyland (production) |

0 | 1500 |

| Total production | 200 | 1500 |

Trade

As each country produces only one good, they will have to trade to be able to consume some of the other good. The terms of trade must settle somewhere between the two opportunity cost ratios to ensure that both countries benefit. As we saw earlier:

In Utopia 1 Hardware = 5 Software and in Happyland 1 Hardware = 15 Software, so the terms of trade (the world price) is 1 Hardware = 10 Software

If the countries agreed to trade 75 units of Hardware for 750 units of Software, then Utopia and Happyland will have the following amounts of Hardware and Software available for consumption:

| Hardware (units) | Software (units) | |

|---|---|---|

|

Utopia (consumption) |

125 | 750 |

|

Happyland (consumption) |

75 | 750 |

| Total production | 200 | 1500 |

Both countries are better off from specialisation and trade, because they can reach higher levels of consumption of both goods than was possible before specialisation. After trade they are both able to consume beyond their production possibility curves.

Limitations of comparative advantage theory

- Transport costs and tariffs and exchange rates may change the relative prices of goods and may distort comparative advantages.

- Imperfect competition may lead to prices being different to opportunity cost ratios.

- Comparative advantage theory is a static theory and does not take account of some of the more dynamic elements determining world trade. In particular, the factor of production capital is not a natural resource, and so may come outside the scope of the theory.

Absolute and comparative advantage (video)

Watch the video International trade: absolute and comparative advantage and then answer the questions below. You can watch this in the window below, or follow the previous link to open the video in a new web window.

- While watching the video, draw the production possibility frontiers associated with the examples they give. Use these diagrams to explain which country has a comparative advantage for each DVDs and which country for wheat production.

- Suggest reasons why:

- Japan may have a comparative advantage in DVD production.

- South Africa may have a comparative advantage in wheat production.

- Discuss the relevance of comparative advantage theory in explaining the pattern of trade between Japan and South Africa.

World Trade Organisation (WTO)

What is the WTO?

The WTO has evolved from the General Agreement on Tariffs and Trade (GATT), which was originally established in 1947. There have been nine rounds of negotiations e.g. the 'Uruguay Round' that took place between 1986 and 1994. These negotiations were aimed at reducing tariffs for the facilitation of global trade on goods.

The WTO replaced GATT as the world's global trading body in 1995. The purpose of the WTO is to ensure that global trade is conducted freely. The WTO creates the legal framework for global trade among member nations in order to make the world trade easier and fairer. The new round of trade liberalisation talks started in the year 2000 and is ongoing.

Opponents of the WTO argue that as the WTO functions as a global authority on trade national sovereignty of member countries could be compromised. A country may have to sacrifice its own interests to avoid violating WTO agreements.

Further reading

For an excellent introduction to the WTO and the work they do, have a look at the 'What is the WTO' section of their web site. There is a useful guide - The WTO in brief, and a section looking at the 10 benefits of the WTO trading system. There is also a slide show about 50 years of work on the multilateral trading system that is well worth a look. For an excellent summary from the BBC site on the role of the WTO, go to What is the World Trade Organisation?

Success and failure of the WTO viewed from different perspectives

For this section, look at the range of views at the role of the WTO by following the links below.

- 10 benefits of the WTO - from the WTO web site

- 20 excellent reasons why the WTO is bad newsN.B. Please be warned that the tone and language of this posting are quite strident.

Browse these two links and make a note of the most important points for each side of the debate.

New WTO members in the order in which they acceded:

| 1. Ecuador | 12. Croatia |

| 2. Bulgaria | 13. Lithuania |

| 3. Mongolia | 14. Moldova |

| 4. Panama | 15. China |

| 5. Kyrgyz Republic | 16. Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu (Chinese Taipei) |

| 6. Latvia | 17. Armenia |

| 7. Estonia | 18. Former Yugoslav Republic of Macedonia (FYROM) |

| 8. Jordan | 19. Nepal (LDC) |

| 9. Georgia | 20. Cambodia (LDC) |

| 10. Albania | 21. Saudi Arabia |

| 11. Oman | 22. Viet Nam |

| 23. Tonga |

Source: http://www.wto.org/english/thewto_e/acc_e/cbt_course_e/c1s1p1_e.htm

For a complete list of WTO member countries see: http://www.wto.com/about/member-countries/

The role of the WTO

If you would prefer to view this interaction in a new web window, then please follow the link below:

WTO background information

WTO members 2009

The following video gives some background information about the World Trade Organization and its predecessor, the General Agreement on Tariffs and Trade.

You might want to make some summary notes for revision purposes.

Trade protection - introduction

Did you know?

Did you know?

- The European Union spends around €55 billion on farm subsidies. In Zimbabwe, GDP per capita is $176 (http://en.wikipedia.org/ ).

On the following pages, we start to look at the different types of trade protection that are used and the arguments for and against protection. We consider the following topics in detail:

- Free trade

- Types of protectionism

- Arguments for protectionism

- Arguments against protectionism

Introduction to trade policies (video)

Watch the video International trade: introduction to trade policies and then answer the questions below. You can watch this in the window below, or follow the previous link to open the video in a new web window.

- Define the following terms:

- Trade policy

- Balance of payments

- Protectionism

- Tariff

- Explain how South Africa's trade policies have changed in the last 20 years.

- Analyse the impact of the move from subsidising the fruit industry to free trade on the South African fruit industry.

- Evaluate whether subsidies awarded to European farmers make them, as the video suggests, more competitive or more dependent.

- In the interview with Johann Baard of Cape Clothing Manufacturers he suggests that "South African clothing manufacturers can never, and never will, be competitive against clothing manufacturers in China." Discuss the extent to which this offers a justification for trade protection for South African clothing manufacturers.

- Explain the arguments offered in favour of tariffs.

Types of protectionism

Free trade

Free trade is trade that occurs between countries without any barriers or hindrances.

Protectionism has arisen in various forms. These include.

If you would prefer to view this interaction in a new web window, then please follow the link below:

If you would prefer to view this interaction in a new web window, then please follow the link below:

Tariffs - case study

Read the article US to Impose Tariff on Tires From China and watch the video Milton Friedman on the Dangers of Protectionism (Obama's recent tariff on Chinese imports). You can do this in the web windows below, or follow the previous links to open the article/video in a new web window.

The video below, while based around the decision to impose tyre tariffs, is based around an interview with Milton Friedman in 1980.

You may also like to read:

- China 'strongly opposes' Obama's tire import tariffs

- Americans will be punished by the punitive tariffs

- Explain the likely impact of the tariff on:

- US domestic tyre prices

- US tyre manufacturers

- Chinese tyre manufacturers

- Draw a diagram to illustrate these effects. Label it clearly to show:

- The change in revenue for US tyre manufacturers

- The tariff revenue

- The deadweight welfare loss as a result of the tariff

- Discuss the medium-term sustainability of using tariffs as a policy to protect jobs at US tyre manufacturers.

- Assess the extent to which Milton Friedman's arguments for free trade apply to this decision to impose tariffs on Chinese tyres.

Imposing a tariff - calculation

For higher level, you need to be able to understand how to calculate the impact of a tariff on a market. You will need to calculate this from linear demand and supply functions and to be able to calculate the change in consumer expenditure and the tariff revenue from the diagram. The presentation below goes through this. Click on the screenshot, or link below, to open the presentation. It will open in a new web window. You will need a headset or speakers to listen to the explanation.

Imposing a tariff

Setting a quota - calculation

For higher level, you need to be able to understand how to calculate the impact of a quota on a market. You will need to calculate this from linear demand and supply functions and to be able to calculate the change in consumer expenditure and the domestic and overseas firm's revenue from the diagram. The presentation below goes through this. Click on the screenshot, or link below, to open the presentation. It will open in a new web window. You will need a headset or speakers to listen to the explanation.

Impact of a quota

Giving a subsidy - calculation

For higher level, you need to be able to understand how to calculate the impact of a subsidy on a market. You will need to calculate this from linear demand and supply functions and to be able to calculate the change in consumer expenditure and the domestic and overseas firm's revenue from the diagram. The presentation below goes through this. Click on the screenshot, or link below, to open the presentation. It will open in a new web window. You will need a headset or speakers to listen to the explanation.

Giving a subsidy

Arguments for protectionism

Governments use the following arguments to justify protectionism:

Governments use the following arguments to justify protectionism:

- To safeguard domestic employment - protectionist policies reduce the level of imports and increase aggregate demand [AD = C + I + G + (X-M)], resulting in a higher level of national output and employment.

- To correct balance of payments disequilibrium - as imports are discouraged, and exports encouraged, the balance of payments improves.

- To prevent labour exploitation in developing economies - preventing import of goods produced by exploiting cheap labour in developing countries will prevent this labour exploitation. However, it might also reduce export income and job opportunities for some of the poorest economies in the world.

- To prevent dumping - which is where economies sell goods in overseas markets at a price below the cost of production. Domestic consumers pay more than those buying overseas. Such low prices are part of a policy to destroy rivals in export markets.

- To safeguard infant industries - The new industries need some protection from the power of already established competitors to be able to grow and achieve economies of scale.

- To enable a developing country to diversify - Many developing countries are heavily dependent on exports of primary commodities. This can leave them very exposed to changes in international commodity prices. If they want to diversify and develop new export revenue streams, they may need to protect these new industries from full exposure to international competition for a while.

- Source of government revenue - where protectionism takes the form of a tariff, this will also raise revenue for the government, like any other tax.

- To protect strategic industries - a particular product or industry might be of strategic importance to a country, e.g. agriculture or coal, and protectionism may be justified on the grounds that it is keeping alive an industry which plays a vital part in the economy.

Question 1

Discuss the effects of free trade on:

- US corporations

- US workers

- workers abroad in developing countries.

Question 2

Suggest what the cartoonist believes about the role of NAFTA and WTO.

For this unit it is vital to be aware of up to date examples and issues. A useful way to find these is to search the Biz/ed In the News archive. You can do this in the window below, or right-click on the link and choose 'Open in a new window'.

Try searching on terms like:

- Protection

- Protectionism

- Trade

- Tariff

- Quota

Arguments against protectionism

Various arguments are used against protectionism. These include:

Various arguments are used against protectionism. These include:

- Inefficiency of resource allocation in the long run - the imposition of tariffs, or other protectionist measures, in the long run results in losses of allocative efficiency. Protected producers are not exposed to international competition,do not have enough incentive to decrease costs or innovate and, in the long run, become less competitive and fall behind the rest of the world. In addition, tariffs increase prices in the domestic market and distort the price signals directing investments towards inefficient industries.

- Downward multiplier effects - if a country protects against imports, this will reduce the exports of other countries and their aggregate demand and national output. Consequently, they will import less as the level of imports is a function of national income level. This process could continue and result in a decrease in world production and income.

- Retaliation - protectionist measures tend to be met with some form of retaliation. This will mean that any success in protecting against imports is likely to result in a fall in exports.

- Loss of allocative efficiency (welfare loss) in the short run - a tariff leads to a reduction in imports and increases the price. There is a loss of consumer surplus (part of consumers' welfare shown as areas A, B, C and D in the diagram below). Some of the welfare loss is transferred to the government (tariff revenue shown as area C), and some to producers (shown as area A). There is also welfare cost to society (loss to consumers that is not transferred to anybody else) represented by areas B and D.

Figure 1 The impact of a tariff

- Bureaucracy - many protectionist measures are bureaucratic to enforce and result in extra cost to society.

However, completely free trade may also create additional costs to the economy and to society, for instance:

- Adjustment costs - changes in comparative advantage may require adjustments in the structure of industry, which may take some time and cause temporary increases in unemployment.

- Environmental costs - free trade may encourage firms to relocate to countries, where environmental and other regulations are more relaxed and compliance costs are lower. Although, this may increase producers' profits, it may lead to long-term environmental problems.

Section 3.1 International trade (questions)

In this section are a series of questions on the topic - international trade. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Numerical - calculation questions

- In the news - questions based around a topical economics news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Reasons for trade - short answer

Question 1

Explain two reasons why countries may engage in international trade.

Question 2

Discuss the view that the main reason to trade internationally is to benefit from lower prices.

Question 3

With the use of suitable examples, explain how the law of comparative advantage and the concept of opportunity cost are linked.

Vietnam joins the WTO

Read the article World trade body admits Vietnam and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain the role of the World Trade Organisation (WTO) in the governance of world trade. You may find the WTO web site helpful in considering this.

Question 2

Examine the impact that membership of the WTO is likely to have on the Vietnamese economy.

Question 3

Use a suitable Internet search tool (e.g. Google news) to analyse the impact that recent actions of the WTO have had on the world trading system.

Russia's WTO membership bid backed by European Union

Read the article Russia's WTO membership bid backed by European Union and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain the significance of Russia's bid to join the WTO.

Question 2

Explain why the EU supported Russia's bid to join the WTO.

Question 3

Discuss the benefits of Russia joining the WTO to:

- Russia

- other countries

Types of protectionism - short answer

Question 1

Define the terms:

(a) Tariff

(b) Quota

(c) Voluntary Export Restraint

Question 2

Explain the ways in which a tariff distorts comparative advantage and international trade.

Question 3

Examine how a government raises money from quotas.

Arguments for protectionism - short answer

Question 1

Examine why many countries protect their domestic producers.

Question 2

Analyse the advantages and disadvantages of a government using Voluntary Export Restraints as compared to tariffs on imports.

International bread basket

Read the article Bread basket that is left to grow weeds and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Identify and explain three different forms of protectionism.

Question 2

Explain why the land identified in the article has been left uncultivated.

Question 3

Analyse the arguments for and against the reduction of tariff barriers to increase the production of food.

New Zealand apple growers bite back - trade & protectionism

Read the article NZ wins WTO appeal on Australia apple ban and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain why the Australian government originally banned the import of New Zealand apples.

Question 2

Analyse the costs and benefits of the trade in apples resuming between New Zealand and Australia for:

(a) Australian apple growers

(b) New Zealand apple growers

(c) The Australian economy

(d) The New Zealand economy

Question 3

Assess the methods used to resolve this dispute.

Fowl Play?

Read the article Fowl Play? and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Define the following terms from the article:

(a) Tariff

(b) Import penetration

(c) Dumping

Question 2

Describe what the Chinese authorities accused the US government of doing in the case of the trade in chicken, and earlier, for other products like movies and books.

Question 3

Outline why, and how, the US government supported their producers, including the producers of chicken.

Question 4

Identify, and explain, the action the Chinese authorities have taken. Analyse the likely effectiveness of this action in reducing US chicken imports and protecting domestic Chinese producers.

Dumping shoes on the EU

Read the article EU adopts shoe dumping penalties and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain what is meant by 'free trade'.

Question 2

Explain what is meant by the term 'dumping'.

Question 3

Examine the reasons why the EU decided to impose duties on shoes imported from China and Vietnam.

Question 4

Analyse the advantages and disadvantges of increased free trade.

Further research

There are a number of excellent resources available, which provide more information on free trade issues. For example, read the following articles from the BBC website:

- The argument for free trade

- A century of free trade - an excellent summary of the changes that have taken place in World Trade in the last 100 years.

- Debate - globalisation - good or bad - looking at the wider area of globalisation and the impact this has had on the world.

Lobby Groups

There are numerous non-government organisations (NGOs), such as charities and lobby groups, which campaign on the issue of free and fair trade. Have a look at the following:

- The rigged rules of global trade http://www.oxfam.org/en/campaigns/trade/rigged_rules

- FREE TRADE OR PROTECTIONISM http://www.isil.org/resources/lit/free-trade-protectionism.html (Beware ISIL = International Society for Individual Liberty "The world's premier freedom networking organization")

Protectionism in Europe

Read the article Protectionist stakes rise in Europe and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

You may also like to read the articles:

Question 1

Identify and explain three different forms of protectionism.

Question 2

Explain, with examples, the form that rising protectionism takes in Europe.

Question 3

Analyse two possible policies that the EU could use to reduce protectionism.

Imposing a tariff - numerical

- If the demand function is Qd = 170-5P and the supply function is Qs = -30+15P, calculate the figures for quantity demanded and quantity supplied for prices from $1 to $20.

- Use these figures to plot the supply and demand curves. What is the equilibrium price and quantity?

- The world price is $6, plot this on your supply and demand diagram.

- The government imposes a tariff of $2. Illustrate the impact of this on your diagram.

- Calculate the following:

- Domestic firm's revenue before and after the tariff

- Overseas firm's export revenue before and after the tariff

- Consumer expenditure before and after the tariff

- The government's revenue from the tariff

- Evaluate the impact of the tariff on domestic firms and consumers.

Setting a quota - numerical

- If the demand function is Qd = 150-5P and the supply function is Qs = -15+10P, calculate the figures for quantity demanded and quantity supplied for prices from $1 to $20.

- Use these figures to plot the supply and demand curves. What is the equilibrium price and quantity?

- The world price is $8, plot this on your supply and demand diagram.

- The government sets a quota for foreign firms of 15 units. Use your supply and demand diagram to illustrate the impact of this quota.

- Calculate the following:

- Domestic firm's revenue before and after the quota

- Overseas firm's revenue before and after the quota

- Consumer expenditure before and after the quota

- Evaluate the impact of the quota on overseas firms and consumers.

Giving a subsidy - numerical

- If the demand function is Qd = 190-5P and the supply function is Qs = -50+15P, calculate the figures for quantity demanded and quantity supplied for prices from $1 to $20.

- Use these figures to plot the supply and demand curves. What is the equilibrium price and quantity?

- The world price is $6, plot this on your supply and demand diagram.

- The government provides a subsidy of $4 per unit for domestic producers. Use your supply and demand diagram to illustrate the impact of this subsidy.

- Calculate the following:

- Domestic firm's revenue before and after the subsidy

- Overseas firm's export revenue before and after the subsidy

- Consumer expenditure before and after the subsidy

- The level of government expenditure on the subsidy

- Using your diagram, show the deadweight welfare loss that results from the subsidy.

- Assess the extent to which the subsidy will benefit domestic firms and consumers.

- Analyse the likely impact on the competitiveness of domestic firms receiving the subsidy.

Section 3.1 International trade - simulations and activities

In this section are a series of simulations and activities on the topic - international trade. These simulations and activities might include:

- Interactive diagrams - diagrams where you can drag curves or sliders to see the impact of the changes on the diagram

- PlotIT - a chance to build diagrams from data

Click on the right arrow at the top or bottom of the page to move on to the next page.

DragIT - Comparative advantage theory

The following diagram shows a production possibility curve. To keep the analysis simple, we assume that the country produces just two goods, wheat and computers.

Initially assume that production and consumption are at point P: the country produces and consumes 40 million tonnes of wheat and 60 million computers per year.

Now assume that trade occurs and that 1 tonne of wheat is exchanged for 1 computer. Assume also, that production remains at point P. By trading internationally, the country can consume anywhere along the straight red line linking 100 millions of tonnes of wheat with 100 million computers.

Drag the bullet at point P to show some of the alternative combinations of the two goods that can be consumed.

Drag the bullet to the top of the red line.

1 |

Imports and exportsAssuming that the country consumes at the point you have dragged the curve to (i.e. 100 million tonnes or wheat per year and no computers), how much will be imported and exported? |

Now drag the bullet to a consumption point that represents 20 million tonnes of wheat being exported and 20 million computers being imported.

2 |

DragIT - Tariffs (1)

To see the impact of a tariff on the level of imports, domestic production, government tax revenue and welfare losses, drag the tariff line in the following diagram up and down.

1 |

Tariff - tax revenueIf the government impose a higher tariff what will be the impact on government tax revenue from tariffs? |

2 |

Welfare lossA higher tariff will lead to a greater welfare loss. |

DragIT - Tariffs (2)

Drag the sliders in the simulation below to see the impact of changes in the world price and tariff.

DragIT - Tariffs (3)

Drag the sliders in the simulation below to see the impact of changes in the demand function, supply function, world price and tariff.

Section 3.2 Exchange rates (notes)

In this section we will look at freely floating exchange rates and government intervention in the foreign exchange market.

By the end of this section you should be able to:

- Explain that the value of an exchange rate in a floating system is determined by the demand for, and supply of, a currency.

- Draw a diagram to show determination of exchange rates in a floating exchange rate system.

- Describe the factors that lead to changes in currency demand and supply, including foreign demand for a country's exports, domestic demand for imports, relative interest rates, relative inflation rates, investment from overseas in a country's firms (foreign direct investment and portfolio investment) and speculation.

- Distinguish between a depreciation of the currency and an appreciation of the currency.

- Draw diagrams to show changes in the demand for, and supply of, a currency.

- Evaluate the possible economic consequences of a change in the value of a currency, including the effects on a country's inflation rate, employment, economic growth and current account balance.

- Describe a fixed exchange rate system involving commitment to a single fixed rate.

- Distinguish between a devaluation of a currency and a revaluation of a currency.

- Explain, using a diagram, how a fixed exchange rate is maintained.

- Explain how a managed exchange rate operates, with reference to the fact that there is a periodic government intervention to influence the value of an exchange rate.

- Examine the possible consequences of overvalued and undervalued currencies.

- Compare and contrast a fixed exchange rate system with a floating exchange rate system, with reference to factors including the degree of certainty for stakeholders, ease of adjustment, the role of international reserves in the form of foreign currencies and flexibility offered to policy makers.

- Calculate the value of one currency in terms of another currency.

- Calculate the exchange rate for linear demand and supply functions.

- Plot demand and supply curves for a currency from linear functions and identify the equilibrium exchange rate.

- Using exchange rates, calculate the price of a good in different currencies.

- Calculate the changes in the value of a currency from a set of data.

Exchange rates - introduction

Did you know?

The eight most traded currencies in the world (in no specific order) are the U.S. dollar (USD), the Canadian dollar (CAD), the euro (EUR), the British pound (GBP), the Swiss franc (CHF), the New Zealand dollar (NZD), the Australian dollar (AUD) and the Japanese yen (JPY).

Source: http://www.investopedia.com/ask/answers/06/maincurrencypairs.asp

Exchange rate systems

Exchange rate

An exchange rate is the price of one currency expressed in terms of another, e.g. 1 U.S. dollar = 30.13 Thai baht.

An exchange rate system is the way in which the exchange rate is determined.

On the following pages, we consider the following topics in detail:

- Floating exchange rates

- Changes in the exchange rate

- Effects of exchange rate changes

- Fixed exchange rates

- Managed exchange rates

Floating exchange rates

If you would prefer to view this interaction in a new web window, then please follow the link below:

Demand and supply of dollars (video)

Watch the videos Exchange rate 01: Demand for dollars and Exchange rate 02: Supply of dollars and then answer the questions below. You can watch these in the windows below, or follow the previous link to open the video in a new web window.

- Outline the main determinants of:

- The demand for dollars

- The supply of dollars

- Explain the difference between:

- A shift and a move of the demand curve for dollars

- A shift and a move of the supply curve for dollars

- Suggest three factors that would:

- Increase the demand for dollars

- Decrease the supply of dollars

Exchange rate appreciation

If you would prefer to view this interaction in a new web window, then please follow the link below:

If you would prefer to view this interaction in a new web window, then please follow the link below:

Exchange rate depreciation

If you would prefer to view this interaction in a new web window, then please follow the link below:

If you would prefer to view this interaction in a new web window, then please follow the link below:

Demand and supply of dollars (video)

Watch the video Exchange rate 03: Determining the Rand Dollar exchange rate and then answer the questions below. You can watch this in the window below, or follow the previous link to open the video in a new web window.

- Explain two factors that may cause an appreciation of the dollar against the rand.

- Draw a diagram to illustrate each of these changes.

- Discuss the possible consequences of the dollar appreciating against the rand for US and South African firms.

Advantages and disadvantages of floating exchange rates

Governments can use exchange rates to affect economic performance. A rising exchange rate, which is often linked to an increase in base interest rates, leads to exports becoming more expensive, but imports falling in price. This reduces part of the inflationary pressure within an economy. A fall in the exchange rate will lead to the reverse and may help domestic businesses export more.

If you would prefer to view this interaction in a new web window, then please follow the link below:

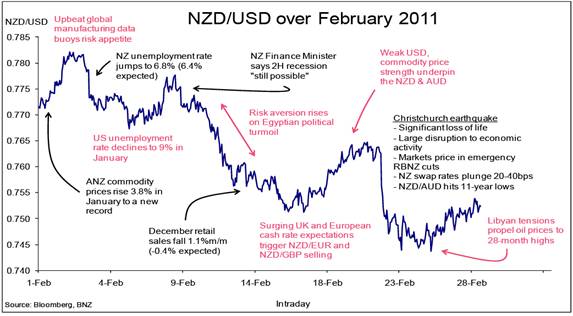

The New Zealand Dollar

Examples of some of the factors that can influence a floating currency, such as the New Zealand dollar (NZD) are indicated in the bullet points and the graph below.

The following exchange rate analysis came from BNZ Financial Markets Wrap, Feb 2011

- Early in the month an increase in risk appetite underpinned rises in global equity markets and bond yields.

- Later on risk aversion rose as political turmoil in the Middle-East once again took the stage.

- Global commodity prices continued to soar, underpinning strong returns from AUD, CAD and energy and materials sectors of world equity markets.

- The 22 February Christchurch earthquake resulted in markets immediately pricing RBNZ OCR cuts and a fall in the NZD.

Source: BNZ Financial Markets Wrap, Feb 2011

Question 1

Explain why the currency depreciated following the bad news.

Question 2

Suggest reasons why the NZD appreciated following the increase in commodity prices.

Question 3

Analyse the possible links between the higher risk aversion and the depreciation in the NZD.

Exchange rate determination - calculation

For higher level, you need to be able to understand how to calculate the equilibrium exchange rate in a market. You will need to calculate this from linear demand and supply functions and to be able to plot the demand and supply curves for foreign exchange. You will also need to be able to calculate exchange rates and the prices of goods in other currencies. The presentation below goes through this. Click on the screenshot, or link below, to open the presentation. It will open in a new web window. You will need a headset or speakers to listen to the explanation.

Calculating exchange rates

Causes of changes in exchange rate

As already shown, the exchange rate is affected by the state of the economy indicated by inflation, interest rates and balance on trade. We now consider these influences using the example of Australian economy.

Balance of trade

A surplus in the balance of trade (X>M) means that DAus$ > SAus$ , i.e. there is net increase in DAus$ . This causes an upward pressure on the exchange rate. The exchange rate will appreciate. This is illustrated in Figure 1 below:

Figure 1 Australian trade surplus - impact on exchange rate

Alternatively, a deficit in balance of trade will result in net increase is SAus $ and result in downward pressure on the exchange rate as shown in Figure 2 below. The exchange rate will depreciate.

Figure 2 Australian trade deficit - impact on exchange rate

Interest rates

Differences in interest rates between different countries affect the investment flows (capital flows) between these countries and will, in return, affect the exchange rate

Capital flows exert a greater influence on exchange rates than trade flows. This is because the fund managers of international financial organisations and multinational corporations, and rich individuals, move more money around the globe on a daily basis than is accounted for by trade flows. They do this to take advantage of differences in relative interest rates and changes in exchange rates, or they may be speculating on future movements in such variables.

If interest rates were to fall below those in other major economies, or international speculators were pessimistic about the future of the Australian economy, or predict a large depreciation in the Australian $, they might decide to sell their holdings of Aus $ and convert them into yen. This would increase the demand for yen, while increasing the supply of Aus $'s, which causes a depreciation of the currency. This can be seen in Figure 3 below:

Figure 3 Australian capital outflows - impact on exchange rate

An increase in Australian interest rates relative to others, or greater optimism about the future of the Australian economy will enable investors to earn higher returns Consequently, speculators / fund managers might decide to move funds currently being held in yen into Aus $'s. This will have the reverse effect As the Aus $ will appreciate as the demand for it increases (indicated by a rightward shift of the demand curve for Aus $'s).

Inflation

A higher rate of inflation in Australia, than in other countries, will make Australian exports less competitive and may lead to less exports being sold, depending on the price elasticity of demand for exports. If this causes a worsening of the current account, the exchange rate will depreciate. With less demand for exports and imports becoming relatively cheaper, the demand for Aus $'s will fall, while the supply will increase. This is shown in Figure 4 below:

Figure 4 Impact of higher inflation on the exchange rate

The opposite might be the case, i.e. an appreciation of the Aus $, if the rate of inflation in Australia fell below that in other countries.

Inflation may also be a factor which currency speculators take into account when making decisions about buying/selling currencies. If a very high, uncontrollable rate of inflation was expected (hyper-inflation), speculators may lose confidence in the currency and sell, causing it to depreciate in value.

Effects of exchange rate changes

The government may influence the exchange rate in order to influence the economy. The government may influence the exchange rate directly by buying or selling the domestic currency from the currency reserves in the foreign exchange market. Alternatively the government can affect the exchange rate indirectly, by affecting the level of aggregate demand, employment, inflation and the balance of payments.

The government may influence the exchange rate in order to influence the economy. The government may influence the exchange rate directly by buying or selling the domestic currency from the currency reserves in the foreign exchange market. Alternatively the government can affect the exchange rate indirectly, by affecting the level of aggregate demand, employment, inflation and the balance of payments.

The government can, for example, increase the value of the exchange rate (by raising short-term interest rates) in order to decrease the prices of imports and reduce the import price-led inflation within the economy. However, this may cause export volumes to fall, especially if they are price sensitive (elastic) as well as leading to a fall in employment.

The government may also decrease the exchange rate to achieve some of its macroeconomic goals, such as improving the balance of payments (imports less competitive and exports more competitive) or increasing employment. However, higher import prices could cause import price led inflation.

Changes in exports

As we have seen, a depreciation of a currency will reduce the overseas price of exports, which should lead to an increase in demand for exports. The higher the price elasticity of demand for exports, the bigger the increase in demand for exports will be.

Changes in imports

A depreciation of a currency will increase the price of imports. This will lead to a decrease in the demand for imports, with the scale of the decrease depending on the price elasticity of demand for imports. If demand is very inelastic, then imports will change very little. If, on the other hand, demand is very elastic, then imports will change considerably.

Fixed exchange rates

If you would prefer to view this interaction in a new web window, then please follow the link below:

If you would prefer to view this interaction in a new web window, then please follow the link below:

Advantages and disadvantages of fixed exchange rates

If you would prefer to view this interaction in a new web window, then please follow the link below:

Managed exchange rates

Under the managed exchange rate system, the exchange rate is predominantly determined in the foreign exchange market by supply of and demand for a currency. The government intervenes only occasionally to influence the exchange rate when it considers it to be necessary.

There has been a reduction in central bank intervention in the developed countries over the last decade. However, any central bank still has the discretion to intervene if it feels conditions warrant. The central banks in many parts of the developing world still engage in intervention.

A recent example of a central bank's intervention on the foreign exchange market is Bank of Japan selling the yen after it spiked dramatically in the aftermath of the 2011 earthquake and tsunami. Moreover, in a show of sympathy the G7 countries joined the Bank of Japan in selling the yen.

Exchange rates are best when they are:

- Predictable

- Consistent

- Not open to 'outside' interference by speculators

Remember that a change in the exchange rate will cause changes in the prices of imports and exports. An increase in the exchange rate will cause export prices to rise and import prices to fall, while a decrease in the exchange rate will cause export prices to fall, but import prices to rise.

Task (1)

Go to an exchange rate site (try Oanda.com) or statistics site and find exchange rates for the last couple of years for the country where you are, against one of the major worldwide currencies (e.g. the euro, dollar or sterling). Plot these figures and assess what impact the changes are likely to have had on the balance of payments on current account.

Then, find out the figures for the current account and see if your expectations were correct. Identify other factors that may have been responsible for the balance of payments changes.

Task (2)

Identity the type of exchange rate system operating in your country. If it is a fixed rate system, find out the level of the fixed rate and any revaluations and devaluations there may have been. If the exchange rate is a floating system find figures for the exchange rate against three major currencies for the last 10 years and plot the figures on a graph. Mark on the graph the years where there have been a depreciation in the rate, and the years where there have been an appreciation in the rate.

Section 3.2 Exchange rates - questions

In this section are a series of questions on the topic - exchange rates. The questions may include various types of questions. For example:

- Self-test questions - on-screen questions that give immediate marking and feedback

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Numerical - calculation questions

- In the news - questions based around a topical economics news article

Click on the right arrow at the top or bottom of the page to work through the questions.

Exchange rate movements - short answer

Question 1

Explain two factors which may cause an appreciation of a country's exchange rate under a floating exchange rate system.

Question 2

Explain how a government may try to influence the exchange rate.

Question 3

Compare and contrast a fixed and floating exchange rate system.

Question 4

Discuss whether a government should attempt to manage its currency's exchange rate.

Exchange rates - essay

Question 1

(a) Explain three factors, which may cause an appreciation of a country's exchange rate.

(b) Discuss the view that an exchange rate appreciation will always be beneficial for an economy.

Pound takes a dive

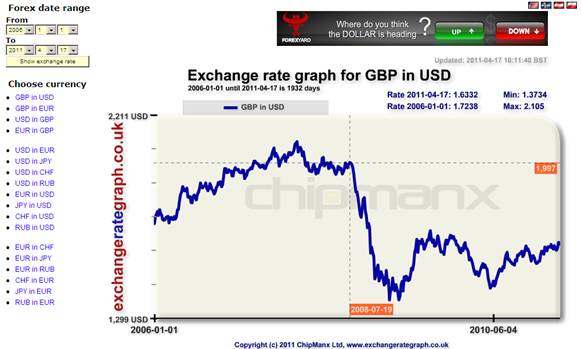

There are a number of excellent websites you can access to provide exchange rate graphs. The graph above shows the pound in US dollars from 2006 to 2011. With this particular site, you can set the currencies and dates required, and then move your cursor along the graph to read off the date and exchange rate.

Question 1

Referring to the graph above, describe the change in GBP / USD exchange rate in the months following July 2008.

Question 2

Analyse the likely impact of this change in value of the pound on the major UK economic targets.

Question 3

Select two policies the UK government can use to influence the value of sterling against the dollar and evaluate their likely success.

Destabilising currency flows

Read the article Asian heads stress currency risk and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Using diagrams as appropriate, show the impact of a rise in inward capital flows on the exchange rate of an Asian country.

Question 2

Analyse the likely economic impact of recent Thai restrictions on foreign ownership of Thai companies.

Question 3

"It is, and will surely be, the most difficult task for any monetary authorities to maintain the stability of foreign exchange rates, the free flow of capital, and the independence of monetary policy simultaneously...". Discuss the extent to which all these factors are interdependent.

The iPad index

Read the article Oz prices cheap says Commsec's iPad index and then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain what the iPad index shows and how it might be used.

Question 2

Suggest possible reasons for the differences in price of iPad in the UK and Australia.

Question 3

Discuss the relevance of indices like the Big Mac index and iPad index for economists and policy-makers.

Exchange rates - G20 considers wider role for China's yuan

Read the article G20 considers wider role for China's yuan then answer the questions below. You can either read the article in the window below or you can follow the previous link to read the article in a separate window.

Question 1

Explain how the G20 leaders propose giving the Chinese yuan more of a role in global finance.

Question 2

Identify the requirements for a currency to join the SDR basket.

Question 3

Describe the criticisms that developed nations had of China's exchange rate policy.

Question 4

Analyse the reasons why the Chinese have been reluctant to allow a sudden appreciation of its currency.

Section 3.2 Exchange rates - simulations and activities

In this section are a series of simulations and activities on the topic - exchange rates. These simulations and activities might include:

- Interactive diagrams - diagrams where you can drag curves or sliders to see the impact of the changes on the diagram

- PlotIT - a chance to build diagrams from data

Click on the right arrow at the top or bottom of the page to move on to the next page.

DragIT - exchange rate determination (1)

Drag the sliders in the simulation below to see the impact of changes in the demand function and supply function on the equilibrium exchange rate.

DragIT - Exchange rate determination (2)

In a free foreign exchange market, the rate of exchange is determined by demand and supply. This is illustrated in the following diagrams, which show the demand and supply of pounds against the US dollar.

In the first diagram, you can drag the supply curve to see the impact of changes in supply, while in the second you can drag the demand curve.

NB For the sake of example, we have used the demand for and supply of sterling - the UK currency.

1 |

Exchange rate changesMatch the following events to the relevant shifts in the curves. (N.B. Bear in mind that we are looking at changes to the UK currency - sterling) |

2 |

Exchange rate changesMatch the following events to the changes they will cause to the demand and supply of sterling. |

Section 3.3 Balance of payments - notes

In this section we will look at the structure of the balance of payments and current account deficits and surpluses.

By the end of this section you should be able to:

- Outline the role of the balance of payments.

- Distinguish between debit items and credit items in the balance of payments.

- Explain the four components of the current account, specifically the balance of trade in goods, the balance of trade in services, income and current transfers.

- Distinguish between a current account deficit and a current account surplus.

- Explain the two components of the capital account, specifically capital transfers and transaction in non-produced, non-financial assets.

- Explain the three main components of the financial account, specifically, direct investment, portfolio investment and reserve assets.

- Explain that the current account balance is equal to the sum of the capital account and financial account balances (see the appendix, "The balance of payments").

- Examine how the current account and the financial account are interdependent.

- Explain why a deficit in the current account of the balance of payments may result in downward pressure on the exchange rate of the currency.

- Explain why a surplus in the current account of the balance of payments may result in upward pressure on the exchange rate of the currency.

- Calculate elements of the balance of payments from a set of data.

- Discuss the implications of a persistent current account deficit, referring to factors including foreign ownership of domestic assets, exchange rates, interest rates, indebtedness, international credit ratings and demand management.

- Explain the methods that a government can use to correct a persistent current account deficit, including expenditure switching policies, expenditure reducing policies and supply-side policies, to increase competitiveness.

- Evaluate the effectiveness of the policies to correct a persistent current account deficit.

- State the Marshall-Lerner condition and apply it to explain the effects of depreciation/devaluation.

- Explain the J-curve effect, with reference to the Marshall-Lerner condition.

- Discuss the possible consequences of a rising current account surplus, including lower domestic consumption and investment, as well as the appreciation of the domestic currency and reduced export competitiveness.

BOPs - introduction

The balance of payments accounts record the financial flows between a country and the rest of the world. These flows result from trade, international investments, international borrowing and loan repayments.

The balance of payments accounts record the financial flows between a country and the rest of the world. These flows result from trade, international investments, international borrowing and loan repayments.

Overall, the balance of payments accounts will always balance, although there may be deficits or surpluses on the various sections within the overall accounts. If there is a deficit in the trade of goods and services recorded in the current account, this will then be paid for by an inflow of funds recorded in the financial account.

On the following pages, we consider the following topics in detail:

- Current account

- Capital account

- Financial account

Credits and debits

The balance of payments is a record of all financial flows between a country and the rest of the world. These flows are recorded as either credits or debits.

Credit

A credit item on the balance of payments is any financial flow that leads to money entering the country.

Debit

A debit item on the balance of payments is any financial flow that leads to money leaving the country.

Credit items will include any item where money enters the country. It is important to think of a credit as the money entering the country. For example, one of the principal credit items is exports. In the case of exports, the goods leave the country to be sold overseas, but the money enters the country. Exports are therefore a credit item. Credit items therefore include:

- Export receipts

- Current transfers into the country

- Capital transfers into the country

- Direct and portfolio investment into the country

In the same way, debit items will include:

- Imports payments

- Current transfers out of the country

- Capital transfers out of the country

- Direct and portfolio investment out of the country

Net

The term net in the balance of payments accounts is used to refer to the net of credits and debits. e.g. if credits are $5,000 and debits are $4,000 then the net figure is +$1,000.

Current account

The current account records money flows from imports and exports of goods (the 'balance of trade' or 'visible balance') and imports and exports of services (sometimes 'invisible trade'). It also records income flows (flows of interest, profits and dividends that may have arisen from investment flows) and transfers of money.

The current account records money flows from imports and exports of goods (the 'balance of trade' or 'visible balance') and imports and exports of services (sometimes 'invisible trade'). It also records income flows (flows of interest, profits and dividends that may have arisen from investment flows) and transfers of money.

The current account balance is the net balance of all of these items.

The major components of the current account are:

- The balance of goods account

-

The balance of services account

When combined,these two accounts are commonly known as trade in goods and services account. A difference in the monetary value of exports and imports, in the trade in goods and services account, is known as the balance of trade. -

The balance of income

Income flows consist of investment income such as interest, dividends, and payments of profits and reinvested earnings on direct investment. -

The balance of current transfers

Current transfers consist of receipts and payments, where there is no corresponding exchange such as foreign aid and contribution to international organisations such as the European Union. This account also includes international transfers of money by private individuals, such as workers' remittances.

The balance of goods is also known as visible or merchandise balance, whereas the other three balances are sometimes referred to as the invisible balance.

The sum of the balances of the four components of the current account is known as the current account balance. A current account balance is in surplus if overall credits exceed debits and in deficit if debits exceed credits.

Capital account

The capital account is a relatively small element of the balance of payments. It includes capital transfers, such as debt forgiveness and migrants' transfers. It also includes the acquisition and disposal of non-produced, non-financial assets, such as land purchases and sales associated with embassies and other extra-territorial bodies.

The capital account is a relatively small element of the balance of payments. It includes capital transfers, such as debt forgiveness and migrants' transfers. It also includes the acquisition and disposal of non-produced, non-financial assets, such as land purchases and sales associated with embassies and other extra-territorial bodies.

Financial account

The financial account records transactions associated with changes of ownership of a country's foreign assets and liabilities. The financial account is divided into four main sub-accounts: direct investment, portfolio investment, other investment and reserve assets, each showing inflows of money (credits) and outflows of money from a country (debits).

The financial account records transactions associated with changes of ownership of a country's foreign assets and liabilities. The financial account is divided into four main sub-accounts: direct investment, portfolio investment, other investment and reserve assets, each showing inflows of money (credits) and outflows of money from a country (debits).

(i) Direct investment is productive investment. It is investment in plant, equipment, machinery or factories, i.e. investment that will help with the process of wealth creation.

(ii) Portfolio investment, on the other hand, is investment in paper assets like shares and government bonds. The only purpose of portfolio investment is financial gain, so they do not involve foreigners' participation in the management of the domestic firms. There may be both inflows and outflows of portfolio investment.

(iii) Other financial flows - this heading can cover a range of short-term monetary flows like bank deposits from overseas residents, loans into a country from abroad and so on.

(iv) Flows to, and from, reserves - all countries hold reserves of foreign currency and this section measures any changes in these reserves. If the government influences the exchange rate, e.g. wants to appreciate the rate, then they may sell some of their foreign currency reserves and buy their own currency instead.

A deficit or surplus on the current account is offset with an equal and opposite surplus or deficit on the capital and financial account. In practice, however, as data for the current account and financial account come from different data sources, a balancing item called net errors and omissions is included in the balance of payments account. This ensures that there will be an exact balance in the overall balance of payments.

Relationship between accounts

The IB exams will use a standard structure for the balance of payments. This will be as follows:

| Credits (+), Debits (-) | $m (2011) | |

|---|---|---|

| Current account | ||

| 1 | Exports of goods | 555 |

| 2 | Imports of goods | -635 |

| 3 | Balance of trade in goods | -80 |

| 4 | Exports of services | 185 |

| 5 | Imports of services | -215 |

| 6 | Balance of trade in services | -30 |

| 7 | Income receipts (investment income) | 225 |

| 8 | Income payments (investment income) | -215 |

| 9 | Net income receipts (investment income) | 10 |

| 10 | Current transfers (net) | -35 |

| 11 | Net income flows | -25 |

| 12 | Current account balance | -135 |

| Capital account | ||

| 13 | Capital account transactions (net) | 25 |

| Financial account | ||

| 14 | Direct investment, net | 55 |

| 15 | Portfolio investment, net | -15 |

| 16 | Reserve assets funding | 45 |

| 17 | Errors and omissions | 25 |

| 18 | Capital and financial account balance | 135 |

The balance of payments should balance. All inflows of money into the country should be matched by an equivalent outflow (across all the accounts - current, capital and financial). In practice, this is simply not going to happen. There are so many transactions and they are so complex that it would be impossible to record them all accurately. As a result a figure is added in for errors and omissions to ensure that the balance of payments balances.

This means that the relationship between the accounts is as follows:

Current account = capital account + financial account + errors and omissions

Task - Balance of payments

Go to the national statistics for the country where you live (or another of your choice) and identify the balance of payments figures for recent years. To find the National Statistics sites for different countries, you could use the OFFSTATS site. Select the country you require under the 'Browse' link. This will give links usually to the National Statistics provider for each country. Consider the changes that have taken place and assess how these might have affected the economy. Reflect on the questions below:

- Has your chosen country been running a persistent current account deficit or surplus? Consider the likely impact on economic policy of this situation.

- Is the capital transfers figure a net credit or a net debit? Assess the extent to which this might be related to net immigration or emigration figures.

- Does your chosen country have a net credit or a net debit on the financial account? Are they a net investor overseas? Assess the extent to which this is related to the net income receipts or payments figures.

Balance of payments - calculation

The IB exams will use a standard structure for the balance of payments. This will be as follows:

| Credits (+), Debits (-) | $m (2011) | |

|---|---|---|

| Current account | ||

| 1 | Exports of goods | 555 |

| 2 | Imports of goods | -635 |

| 3 | Balance of trade in goods | -80 |

| 4 | Exports of services | 185 |

| 5 | Imports of services | -215 |

| 6 | Balance of trade in services | -30 |

| 7 | Income receipts (investment income) | 225 |

| 8 | Income payments (investment income) | -215 |