Topic pack - Development economics - introduction

Welcome to this Triple A Learning topic pack for Development economics. The pack has a wide range of materials including notes, questions, activities and simulations.

A few words about Navigation

So that you can move to the next page in these notes more easily, each page has navigation tools in a bar at the top and the bottom. These tools are shown below.

![]() The right arrow at the top or bottom of the page will take you to the next page of content.

The right arrow at the top or bottom of the page will take you to the next page of content.

![]() The left arrow at the top or bottom of the page will take you to the previous page.

The left arrow at the top or bottom of the page will take you to the previous page.

![]() The home button will take you back to the table of contents for the pack.

The home button will take you back to the table of contents for the pack.

The pack is split into a series of sections and to access each section, the easiest way is to use the table of contents on the left-hand side of the page. To return to the full table of contents, please click on the 'home button' at any stage.

Higher level extension material

Some of the material in this pack relates to the higher level extension topics in the Economics guide. This material is marked by icons as follows:

This icon indicates the start of the higher level extension material.

This icon indicates either:

- The higher level extension material continues on the next page or

- The higher level extension material continues from the previous page

This icon indicates the end of the higher level extension material.

To start viewing the contents of the pack, please click on the right arrow at the top or bottom of the page.

Terms and definitions

One of the key things you need to be sure to know are the definitions of all key development terms. In this section we give you explanations and definitionsof these terms.

If you would prefer, you can open the key terms in a new web window by following the link below:

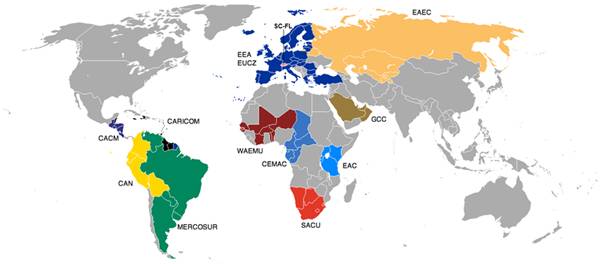

International Organisations

In this section we take a look at the various different international organisations that regulate, monitor and support world trade. We also look at organisations that support development in less developed countries.

If you would prefer to view this interaction in a new web window, then please follow the link below:

Aims of the economics course

The aims of the economics course at HL and SL are to enable students to:

- develop an understanding of microeconomic and macroeconomic theories and concepts and their real-world application

- develop an appreciation of the impact on individuals and societies of economic interactions between nations

- develop an awareness of development issues facing nations as they undergo the process of change.

Assessment Objectives

Having followed the economics course at HL or SL, students will be expected to:

- AO1 Demonstrate knowledge and understanding of specified content

- Demonstrate knowledge and understanding of the common SL/HL syllabus

- Demonstrate knowledge and understanding of current economic issues and data

- At HL only: Demonstrate knowledge and understanding of the higher level extension topics

- AO2 Demonstrate application and analysis of knowledge and understanding

- Apply economic concepts and theories to real-world situations

- Identify and interpret economic data

- Demonstrate the extent to which economic information is used effectively in particular contexts

- At HL only: Demonstrate application and analysis of the extension topics

- AO3 Demonstrate synthesis and evaluation

- Examine economic concepts and theories

- Use economic concepts and examples to construct and present an argument

- Discuss and evaluate economic information and theories

- At HL only: Demonstrate economic synthesis and evaluation of the extension topics

- AO4 Select, use and apply a variety of appropriate skills and techniques

- Produce well-structured written material, using appropriate economic terminology, within specified time limits

- Use correctly labelled diagrams to help explain economic concepts and theories

- Select, interpret and analyse appropriate extracts from the news media

- Interpret appropriate data sets

- At HL only: Use quantitative techniques to identify, explain and analyse economic relationships

Unit Four Structure

Unit four has 8 core sub-topics.

4.1 Economic development (notes)

In this section we will look at the nature of economic growth and economic development.

By the end of this section you should be able to:

- Distinguish between economic growth and economic development.

- Explain the multidimensional nature of economic development in terms of reducing widespread poverty, raising living standards, reducing income inequalities and increasing employment opportunities.

- Explain that the most important sources of economic growth in economically less developed countries include increases in quantities of physical capital and human capital, the development and use of new technologies that are appropriate to the conditions of the economically less developed countries, and institutional changes.

- Explain the relationship between economic growth and economic development, noting that some limited economic development is possible in the absence of economic growth, but that over the long term economic growth is usually necessary for economic development (however, it should be understood that under certain circumstances economic growth may not lead to economic development).

- Explain the relationship between economic growth and economic development, noting that some limited economic development is possible in the absence of economic growth, but that over the long term economic growth is usually necessary for economic development (however, it should be understood that under certain circumstances economic growth may not lead to economic development).

- Explain, using examples, that economically less developed countries differ enormously from each other in terms of a variety of factors, including resource endowments, climate, history (colonial or otherwise), political systems and degree of political stability.

- Outline the current status of international development goals, including the Millennium Development Goals.

Economic development - introduction

Introduction

In this section we consider the following sub-topics in detail

In this section we consider the following sub-topics in detail

- The nature of economic growth and development

- Common characteristics of economically less developed countries

- Diversity among economically less developed nations

- International development goals

Economic growth is covered in detail in the Triple A Learning BACCpack on Macroeconomics. Economic growth is vital to delivering improvements in standards of living and many of the policies pursued by national governments and international groupings are concerned with driving this growth. So how does economic growth differ from concept of the development of an economy? Well, development is a much broader concept than economic growth and may mean different things to different people. For some, development literally means access to shelter, health care and some form of employment. At the macro level, development tends to concentrate on promoting growth, increasing access to education and other essentials of life that for most in developed economies are taken for granted.

It is also important to distinguish between economic growth and economic development, because a rapidly growing economy does not necessarily lead to rapid economic development. We will examine this in greater detail as we move through this pack.

Development - pause for thought

Brazil is a South American country that has experienced high levels of economic growth over the last ten years. Look at the photograph below of Sao Paulo in Brazil.

- Identify three pieces of evidence suggesting that Brazil is a developed economy and three pieces of evidence that also shows a lack of economic development.

- Examine the strength of evidence in both cases.

Economic growth and economic development

Economic growth

This occurs where there is an increase in the productive potential of the economy and is best measured by the increase in a country's real level of output over a period of time, i.e. the increase in real Gross Domestic Product (real means adjusted for inflation).

Economic development

Economic development, on the other hand, is a process where there is improvement in the lives of all people in the country. This involves not only living standards, such as greater availability of goods and services (and also the ability to purchase them) but also the promotion of attributes such as self-esteem, dignity and respect, and the enlarging of people's freedom to choose and to take control of their own lives. While a country may grow richer therefore, through the growth of its real output, it does not necessarily mean that it will develop.

For a long period of time economic development was seen to be a factor of economic growth. It was believed that economic development occurred when there was a high level of industrialisation and economic growth; social factors, such as poverty and unemployment were of lesser importance. It was also believed that the material benefits of growth would trickle down from the better off to the rest of the population, causing development. However, many developing nations have managed to achieve high rates of economic growth, yet failed to experience any positive change in standards of living for the majority of their people. It was realised, therefore, that the definition of economic development had to be changed. As Dudley Seers says: "if one or two of the central problems (poverty, unemployment or equality) have been growing worse, especially if all three have, it would be strange to call the result 'development' even if per capita income doubled"(from D.Seers, 'The meaning of economic development').

According to Professor Michael Todaro, development should involve the following objectives:

- "To increase the availability and widen the distribution of basic life-sustaining goods such as food, shelter, health and protection.

- To raise levels of living including, in addition to higher incomes, the provision of more jobs, better education, and greater attention to cultural and humanistic values, all of which will serve not only to enhance material well-being but also to generate greater individual and national self-esteem.

- To expand the range of economic and social choices available to individuals and nations by freeing them from servitude and dependence not only in relation to other people and nation-states but also to the forces of ignorance and human misery."

(from M.P.Todaro 'Economic development')

There are several measures that are used to measure economic development such as GNP/GDP per capita, population growth and structure, health, education, technology, employment, rural/urban migration, rights of women and distribution of poverty and income. Statistically, GDP per capita is generally acknowledged as the best single indicator but composite indicators of development are also used. One such index is the Human Development Index (HDI) which includes GDP per capita, life expectancy and literacy rates.

Sustainability

Sustainability

Sustainability is the ability of the environment to survive its use for economic activity.

For economic growth to be sustainable, it must have a neutral effect on resources. Any resources used must be renewable and there must be no lasting impact on the environment. It is important that development is sustainable to ensure that it can endure in the long-term and is not built on the exploitation of natural resources that may run out in the future.

For economic growth to be sustainable, it must have a neutral effect on resources. Any resources used must be renewable and there must be no lasting impact on the environment. It is important that development is sustainable to ensure that it can endure in the long-term and is not built on the exploitation of natural resources that may run out in the future.

Some doubt if this is really possible, but to achieve it means investing more in such ventures as:

- Recycling

- Using alternative methods and resources to generate power

- Watching our biodiversity

- Admitting to both social costs and benefits and accepting that someone has to pay the true cost of resource allocation.

Achieving this may mean developing ways of:

- Extending property rights - this means extending ownership of resources to allow people to protect the environment and other resources more effectively.

- Taxing the polluter - if a tax is imposed that is equal to the external cost of an activity, this should ensure that resources are allocated in the interests of society.

- Issuing permits to pollute (tradable permits) - these allow firms to pollute a certain amount, but if they exceed their limit, they have to buy more permits. Firms which under-use their permits can sell them. This effectively taxes poorly performing organisations and subsidies firms using best practice.

- Introducing congestion charges and other road pricing policies to combat traffic congestion.

- Using direct controls and regulations on certain types of economic activity.

The sources of economic growth and economic development

The sources of growth in a less developed economy are no different from those in the advanced industrialised countries. There are four basic requirements, which are:

The sources of growth in a less developed economy are no different from those in the advanced industrialised countries. There are four basic requirements, which are:

- Natural resources - land, minerals, fuels, climate; their quantity and quality.

- Human resources - the supply of labour and the quality of labour.

- Physical capital and technological factors - machines, factories, roads; their quantity and quality.

- Institutional factors - which may include the banking system, the legal system and important factors like a good health care system. We look at this in more detail in Section 4.3.

Economic growth is caused by improvements in the quantity and quality of the factors of production that a country has available, i.e. land, labour, capital and enterprise. Conversely, economic decline may occur if the quantity and quality of any of the factors of production falls. In this section we look at approaches that developing countries could take to improve the quantity and quality of factors of production. We consider the following topics in detail:

- Natural factors

- Human factors

- Physical capital and technological factors

- Institutional factors

Natural factors

Improving the quantity and quality of land resources

Increases in the quantity of land available for agriculture will increase economic growth. However, the extent to which this happens is limited by the extent to which bush land can be converted to agricultural land (this process may have negative effects on soil erosion and quality, and contribute to deforestation globally). All economic resources are scarce and have an opportunity cost. As bush land is increasingly used for agricultural purposes, it is no longer a habitat for wildlife.

Increases in the quantity of land available for agriculture will increase economic growth. However, the extent to which this happens is limited by the extent to which bush land can be converted to agricultural land (this process may have negative effects on soil erosion and quality, and contribute to deforestation globally). All economic resources are scarce and have an opportunity cost. As bush land is increasingly used for agricultural purposes, it is no longer a habitat for wildlife.

The relative scarcity of land in the face of a growing population means that the law of diminishing returns might also become relevant. This law predicts that, if an increasing amount of labour is applied to a fixed quantity of land, the marginal productivity of the labour will fall. This was the basis of the argument put forward by the Reverend Thomas Malthus. To prevent this loss in productivity, the quality of the land must be improved. This can be done through the application of better technology through improved irrigation, fertilisers and pest control.

Pause for thought

The concept of opportunity cost is an important one in economics. Production inevitably involves making sacrifices. Consider the ethical issues involved in the arguments about whether land should be used for agriculture and food production for humans or for wildlife habitats.

Importance of agriculture

For many developing economies, agriculture is the largest single sector in the economy. For the 70% of the world's poor who live in rural areas, agriculture is the main source of income and employment. However, depletion and degradation of land and water pose serious challenges to producing enough food and other agricultural products to sustain livelihoods in rural areas and to meet the needs of urban populations.

Click on the this World Bank link to access data on agriculture and rural development with measures of agricultural inputs, outputs, and productivity compiled by the UN's Food and Agriculture Organization.

An excellent source of interactive economic data is the Gapminder site which allows you to explore economic trends through visualisations, showing changes through time and options to examine both global and national data. It also allows comparisons between countries.

This visualisation demonstrates the decline over time in the agriculture sector as a percentage of national GDP in most countries. You can look at the agricultural sector visualisation in the window below or click on the previous link to open it in a new web window:

You can select particular countries to highlight from the bar on the right hand side of the page. You can also select different axes for your visualisation by clicking on the arrow on either or both of these axes.

N.B. If the visualisation does not come up with Agriculture (% of GDP) on the vertical axis and Income per person (GDP/capita, PPP$ inflation-adjusted) on the horizontal axis, then simply select these by clicking on the arrows.

- Run the visualisation for ALL countries

- Select Tanzania and India in the box on the right of the visualisation and rerun the visualisation

- Comment on what the visualisation shows for India and Tanzania

- Search the internet for background to these trends and write a short summary explaining the differences between the two countries

You could start your research by looking at the following:

- CIA factbook

- TANZANIA: 50 YEARS OF INDEPENDENCE Economic development mismatches population rise

- Economy of India

- India May Overtake China in GDP Growth by 2012

So why are natural resources such an important issue in developing countries and what can be done to improve the situation? Summarise what we have considered above and then follow the natural resources link below to see the major issues

Gapminder also has an excellent presentational tool, called Gapminder desktop which allows you to download visualisation sets onto your computer for use in presentations, even when there is no internet access. The following video provides useful instructions and hints on how to incorporate visualisations into your presentations.

Using Gapminder desktop

Externalities

This section links with the discussion of externalities in theTriple A Learning microeconomics BACCpack, Section 1.4 (reasons for market failure). It would be useful if you thoroughly revised this part of the course before proceeding with this section. Can you, for example, accurately define the term 'negative externality' and distinguish negative externalities from social cost?

All of us have recently become aware of the real cost of resource usage. We now need to be conscious of externalities. How will the developing world control air pollution, or the risk of deforestation? Will they simply become the dumping ground for rich nations' waste?

Another negative externality from growth might be soil erosion and degradation. There are also the issues of water scarcity, pollution and waste disposal. All of these challenges face countries in the developed world but those experiencing the challenges of economic development have to 'balance' their desire to grow against the possible problems that might arise. The reduction in their biodiversity might also need to be addressed, as will atmospheric changes. Do the developing countries:

- Ban certain activities or impose strict rules and controls?

- Extend property rights and force private enterprise to pay more for the problems they cause?

- Impose taxes on pollution and other externalities?

- Subsidise non-pollution methods of production?

- Award permits to pollute?

Pause for thought

All developed countries have achieved rapid growth at some point in their history and in doing so have incurred significant external costs to society.

- Should less developed countries also not be entitled to grow in such a manner until they are in a better position to invest in technologies that reduce these external costs and are more sustainable?

- To what extent are the rich countries applying double standards when arguing that LDC should restrict production that involves negative externalities?

To achieve their goals, the developing countries will also need to address problems of:

- Land ownership and reform

- Involving local communities in their own development

- Engaging the poor and making them feel that opportunities will come their way

- Pricing in ways that include the real costs of development

So externalities need to be taken into account when considering development, but for many developing countries there will be a significant opportunity cost if they try to grow economically while minimising externalities, because this requires investment and perhaps reform - both of which are expensive.

Case study - farming in Kenya

The video clips highlight the problems experienced by a Kenyan farmer and look at some of the practices that he has introduced that enables him to overcome them.

Part 1

Part 2

You may want reflect upon the following questions whilst you are watching the video and to make some brief outline notes during and after the video for revision purposes.

- To what extent does the farm differ from those in your own country?

- Identify and explain the problems that farmers face in Kenya.

- Describe how this farmer attempted to overcome these problems?

- To what extent to you think the farmer is practicing sustainable agriculture?

You might want to review the section on sustainable development to help you draw your conclusion.

Human factors

Improving the quantity and quality of human resources

The quantity of labour is important. Increases in the population can increase the number of young people entering the labour force and these increases in the supply of labour can increase economic growth. Increases in the population can also lead to an increase in market demand thus stimulating production. However, if the population grows at a faster rate than the level of GDP, the GDP per capita will fall. This can be seen from the two charts below.

Chart 1 Average GDP growth 2006-9

There is also a static version of this chart available.

Chart 2 Average GDP growth per capita 2006-9

There is also a static version of this chart available.

Note the difference between these last two graphs. The first shows average GDP growth over the last two decades and the second shows the same figure, but adjusted to show how much GDP per capita (per person) has changed. This effectively adjusts for changes in the population. Where there is little or no change in population the difference is small (e.g. the UK), but where population is growing fast (e.g. Tanzania) the difference is greater.

However, it is not simply the amount of labour that will lead to economic growth. It is also the quality of that labour. This will depend on the educational provision in countries. Improving the skills of the work force is seen as being a key factor in promoting economic growth. Many LDCs have made enormous efforts to provide universal primary education. As more and more capital is used, labour has to be better trained in the skills to use the capital, such as servicing tractors and water pumps, running hotels and installing electricity. It should always be remembered that education spending involves an opportunity cost in terms of current consumption and thus it is often referred to as investment spending on human capital.

So what we can be done to improve the quality of labour and boost economic growth? Think through some ideas and then follow the link below to see how your answers compare.

Human resources

The enrolment in education and illiteracy levels in selected countries can be seen in charts 3 and 4 below.

Chart 3 Primary and secondary enrolment in education (% age group)

There is also a static version of this chart available.

Chart 4 Illiteracy (illiterate % age 15 and above)

There is also a static version of this chart available.

The quantity of labour is affected by the labour supply and, as we have seen in the previous section, this will depend on changes in the population. In this section we look at some background to population and the factors that will affect it.

Population

Population will be an important part of the development of many of the economies we are looking at.

Chart 1 Total population

There is also a static version of this chart available.

Chart 2 Population growth

There is also a static version of this chart available.

For further information on population and world population data, population pyramids and a world population clock, it may be worth looking at the World Population Information site provided by the US Census Bureau.

To see the trend in population growth watch this visualisation on the Gapminder site. You can select the specific countries that interest you on the right hand bar.

The net population increase figure (births - deaths + migration) will be an important factor as it is this that determines the growth rate of the population - the quantity of labour as a resource. In some developing economies, population growth is still around 4% per annum. In the short run, this will put pressure on education and employment but eventually social provision for the elderly will have to be financed. Population growth also impacts on the:

- Supply of food - although little starvation exists in the developing world, malnutrition (see chart 3 below) is a major problem in many countries. It adds to the size of infant mortality.

- Environment - food pressure puts pressure on land and takes valuable resources away from other sectors. Intensive methods require inputs that might damage the environment. GM crops are thought by some to be a major reducer of poverty whilst for others they threaten our very survival.

Chart 3 Child malnutrition - weight for age (% of under 5)

There is also a static version of this chart available.

Age is also an important consideration when looking at the population and its structure. We need to consider the dependency ratio - the proportion of those of working age to those who are dependent. The dependent population will include those of school age and those over the age of retirement. The dependent population will, by definition, need to be supported by those who are actively working but, in the longer term, economic development will be crucially determined by the quality of education and training received by the younger element of the dependent population. Often, however, in developing countries, children do not receive an appropriate education on account of the following:

(a) Inadequate education systems

(b) The need to keep children away from school to work on the land

(c) A lack of adequate jobs for those who have received a more formal education. The lack of jobs may lead to crime and increasing drug abuse, and an unwillingness to attend school in the first place.

For many young women, the only way to guarantee some form of security is to accept early marriage and child bearing.

Government and the birth rate - development implies better health, education etc. and a fast growing population makes this more difficult. So, should government try to influence the size of families? China tried this with its one child policy. Some of the problems associated with this form of population manipulation are not attractive.

Whatever the government decides to do, one fact is agreed upon by most, namely, that as an economy develops, so the number of conceptions per female declines. It therefore follows that policies designed to raise the living standards of the poor, e.g. redistributive fiscal policy, are likely to be the most effective way to reduce the rate of population increase - certainly more effective than just handing out contraceptives!

Chart 4 Fertility rate (births per woman)

There is also a static version of this chart available.

Chart 5 Contraception (% aged 15-49 using contraception)

There is also a static version of this chart available.

Education - health care and family planning can feature in government-sponsored programmes. As mentioned earlier fiscal (tax) incentives can be used to encourage families to have fewer children.

The role of women in society - if women can earn some money - say by a female only micro loan and then save this in a women-only bank, then they can gain some financial independence. This seems to be a successful way of reducing family sizes.

Migration - the pull of cities continues to cause large numbers to move to urban areas. Some argue that agricultural workers have low productivity and that they should be encouraged to move to cities and to take the higher productivity jobs to be found there. However, they create little, if anything, if all they drift into is unemployment, underemployment, poverty, crime and often prostitution.

Many of those who migrate to the cities do so on the expectation that eventually they will earn more than in the rural areas. Perhaps it might be best if some government funding went to the rural areas, so making life in those regions more closely resemble what the rural dwellers perceive urban life to be? This would take both money and time, as schools, hospitals, roads etc would be needed to offer a similar lifestyle to that which the urban dweller supposedly has access to.

The question of land ownership is also likely to be a crucial factor in preventing rural-urban migration, and policies which redistribute land from absentee landlords to landless peasants, although politically controversial, are likely to be a key factor in reducing the 'push' off the land and the 'pull' of the city.

Chart 6 Urban population as a % of total population

There is also a static version of this chart available.

Physical capital and technological factors

Improving the quantity and quality of capital resources

When looking at capital resources (machinery, equipment and so on), it is important to distinguish between:

When looking at capital resources (machinery, equipment and so on), it is important to distinguish between:

- Directly productive capital - plant and equipment, e.g. factories

- Indirectly productive capital - infrastructure or facilitating capital, e.g. roads and railways.

The process of acquiring capital is called investment. However, like many economic decisions, there is an opportunity cost involved in any investment decision. The opportunity cost of capital investment is the current consumption foregone. This makes it tempting not to invest, but the level of investment and the quality of investment will directly affect the level of economic growth - particularly in the long term. The efficiency of the labour force and the other factors of production will depend upon the amount and quality of capital they have. In LDCs, some investment comes from abroad in the form of foreign direct investment (FDI). This is usually through multinational enterprises locating in a country. There has been criticism of some investment in LDCs as to whether it is appropriate, but this is an issue we will look at later. If production moves from being labour intensive to capital intensive, unemployment and poverty may increase, so there may be a difficult transition process for an economy aiming to develop through investment which is not geared towards the needs of the population.

The need to invest in improved infrastructure becomes clear when we look at the provision of basic roads, telecommunications systems and other vital infrastructure requirements in developing countries.

For more detail on capital formation and the issues associated with raising money for this investment follow the link below.

Capital formation

Technology and its use is another important aspect of development and countries have to try to keep up with technological change, wherever possible. Have a careful think about the issues that are associated with this technological change and then follow the link below to compare the issues that you have identified with ours.

Technological change and innovations

Institutional factors

As we saw in the introduction to this section, it is no good just improving the factors of production. A country also needs a good quality infrastructure to support them. This means having a suitable financial, legal and social institutional framework. Important institutional factors are therefore:

As we saw in the introduction to this section, it is no good just improving the factors of production. A country also needs a good quality infrastructure to support them. This means having a suitable financial, legal and social institutional framework. Important institutional factors are therefore:

- The banking system - a good banking system provides the financial infrastructure that enables businesses to flourish and grow. This makes it an important driver of economic growth. Often such a system is lacking in developing countries.

- The educational system - this could also be included under the human resources heading above. Growth requires a high quality, well educated workforce. This in turn needs a good educational system to provide for as many people as possible.

- Health care - a healthy workforce and population is just as important as a well educated one. This means a good health care system.

- Infrastructure - economic activity needs an infrastructure to support it. Roads, ports, telecommunications networks - all these are vital elements to support economic development.

- Political stability - without political stability there will not be certainty and businesses require certainty to enable them to plan for the future. A stable political environment is likely to be a key factor in determining whether or not businesses are prepared to undertake major investment projects.

However, in some developing countries the infrastructure, governance and financial and social institutions present are poor and present significant barriers to growth and development. The next section highlights some of the barriers to growth and development associated with poor governance and institutions. Many of the issues raised will be discussed in more detail later in the pack.

As we have seen many developing countries have a poor institutional framework. They may face a range of barriers to growth. These may include:

- Ineffective taxation structure - in many developing economies, governments face enormous problems in collecting tax. These may be physical problems (actually accessing the communities in rural areas) or simply data information problems - poor records of the population. This makes it very difficult to collect tax revenue and low tax revenue makes it difficult to develop the required institutions.

- Lack of property rights - many developed economies lack a well-developed system of property rights. Property is allocated on traditional or tribal grounds or ownership is perhaps even unknown. This can prevent economic development as growth is stimulated by the trading of the factors of production.

- Political instability - if there is political instability then it is very difficult for economic activity to develop and grow. If businesses are to grow, then they need stability and a reasonably consistent or predictable political structure. Without this, development becomes a lot more difficult as there will be an unwillingness to engage in capital investment.

- Corruption - this almost speaks for itself. Corruption makes development difficult and can certainly act as a barrier for overseas firms investing in an economy.

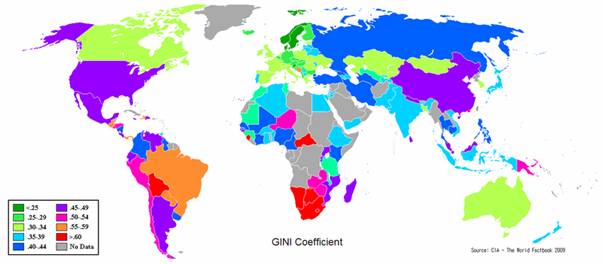

- Unequal distribution of income -income distribution will tend to widen as economies grow. This can act as a barrier to growth. Those on the lowest income levels will often have the highest marginal propensity to consume and therefore if they get an increase in their incomes, they are likely to spend it. This will help drive demand growth. However, if growth simply means that the rich get richer (and perhaps even move their money overseas) this will act as a constraint on development.

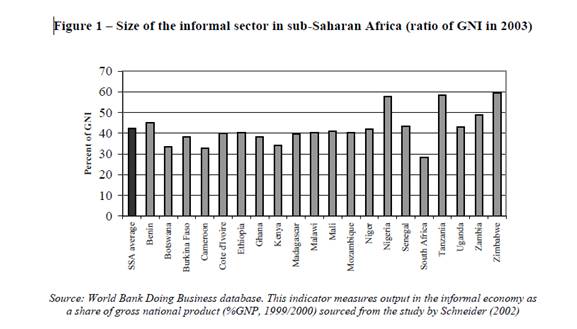

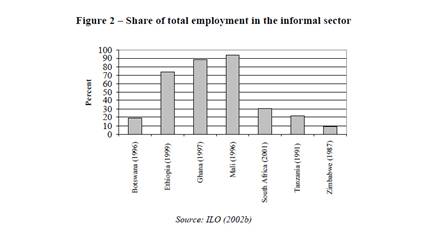

- Formal and informal markets - in the developed world most activity takes place in formal markets - that is organized markets where money is exchanged. However, in the developing world much of the economic activity takes place in informal markets. No money is exchanged and economic activity goes unrecorded.

- Lack of infrastructure - a good quality social infrastructure is vital for economic development, but in the developing world the infrastructure is often very poor. This is a significant barrier to growth and development and we look at this in more detail below.

Building a development Database (Part 1)

Often data speaks louder than words. We can see use data to see the differences in the infrastructure between developing and developed countries. In the rich world infrastructure quality and reliability is taken for granted. The lack of social infrastructure significantly impedes the level of economic growth and development in LDCs. For example:

- LDCs lack human capital in sufficient supply to be able to develop their resources and add value to them.

- High population places enormous strain on facilities and in many LDCs standards of living are actually getting worse. The 'dependency rates' are becoming larger as those in work become responsible for more who are not directly contributing to the economy.

- High population growth also places enormous burdens on the health facilities and infant deaths remain very high in many LDCs.

- With so many people living in LDCS, finding a job can be difficult. This leads to both high unemployment and underemployment (when people have a job, say selling single cigarettes, but which does not constitute a formal full-time form of employment).

- Go to the World Bank data site http://data.worldbank.org/ and find figures for a selection of the following variables:

- Agriculture irrigated land (% of total agricultural land)

- Improved sanitation facilities

- Electric power consumption (kWh per capita)

- Fixed broadband internet subscribers

- Improved water source, rural (% of rural population with access)

- Improved water source, urban (% of rural population with access)

- Motor vehicles (per 1,000 people)

- Roads, paved (% of total roads)

for the following countries:

- Australia

- China

- Romania

- Ecuador

- Italy

- Thailand

- Uganda

- USA

- Enter the data into a spreadsheet.

- Analyse the differences in infrastructure revealed by the data.

The consequences of growth for Development

'Growth is good'. This is the standard view of economic growth, and it tends to be treated as the 'Holy Grail' of economic policy for both developed and developing countries. It may be possible for some limited economic development to take place in economies that are not experiencing economic growth. Nevertheless, over the longer term economic growth is probably necessary for development to take place. However, the impact of growth on development may not always be good. Possible costs of growth include:

'Growth is good'. This is the standard view of economic growth, and it tends to be treated as the 'Holy Grail' of economic policy for both developed and developing countries. It may be possible for some limited economic development to take place in economies that are not experiencing economic growth. Nevertheless, over the longer term economic growth is probably necessary for development to take place. However, the impact of growth on development may not always be good. Possible costs of growth include:

- Inequality of income - growth rarely delivers its benefits evenly. It often rewards the strong, but gives little to the economically weak. This will widen the income distribution in the economy. In developing economies, income distribution is frequently unequal and many of the benefits of growth may go to the better-off in society and flow overseas in the form of increased profit for multinational corporations.

- Pollution (and other negative externalities) - the drive for increased output tends to put more and more pressure on the environment and the result will often be increased pollution and resource degradation. This may be water or air pollution, but growth also creates significantly increased noise pollution. Deforestation and environmental degradation are likely to result from growth. This is particularly true in developing countries as they tend to have little legal protection of the environment.

- Loss of non-renewable resources - the more we want to produce, the more resources we need to do that. The faster we use these resources, the less time they will last.

- Loss of land - increased output puts further pressure on the available land. This may gradually erode the available countryside. In many developing economies there will also be additional problems resulting from the movement of people from country to urban areas.

- Lifestyle changes - the push for growth has in many areas put a great deal of pressure on individuals. This may have costs in terms of family and community life in many economies.

UN opens conference on unlocking economic potential of world's poorest countries

Common characteristics of economically less developed countries

In the previous section we have reviewed the factors that drive economic growth and development and the costs associated with economic growth on a country's economic development. There is often a tendency for people to make sweeping generalizations about the nature of less developed countries, the level of development that is taking place and how people lead their day to day lives. In reality, it is simply impossible to identify common characteristics that are typically found in every less developed economy. Indeed, we must be careful to recognise the considerable diversity between less developed countries in terms of their economies and the economic problems they face. Nevertheless, there are some common features that appear to be shared by many LDCs

- Low GDP per capita

- High levels of poverty

- Dependence of agriculture and the export of primary products

- Higher rates of population growth

- Low levels of productivity

- High levels of unemployment and underemployment

Pause for thought

It is very easy to lump all less develop countries together and assume that they all exhibit the same characteristics. For example, how many times do you hear people refer to Africa as a country rather a continent made up of over 50 different countries? Similarly it is often assumed that the way of life of inhabitants of these countries also tends to conform to certain stereotypical ideas. What preconceived ideas do we have about the way people in less developed countries live? Why not try to ask your friends about what they think the similarities and differences might be for young people living in less developed countries. When you have put together a list of similarities and differences you might then try to find some evidence to support or reject such assertions.

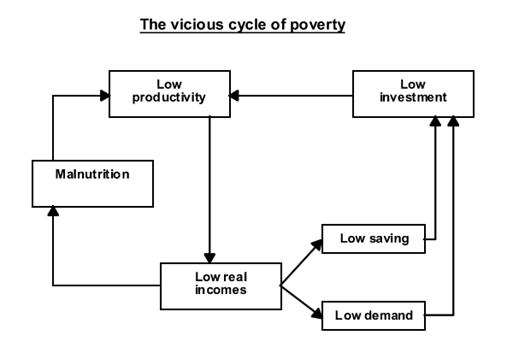

Many of these common characteristics contribute to what is known as the vicious cycle of poverty or the poverty cycle. Before we look at the cycle in more depth it may be worthwhile pausing to consider what we mean by poverty. When we talk of poverty we usually distinguish between absolute poverty and relative poverty.

Absolute poverty

Absolute poverty refers to being unable to afford basic human needs, such as clean and fresh water, nutrition, health care, education, clothing and shelter. About 1.7 billion people are estimated to live in absolute poverty today.

Relative poverty

Relative poverty refers to the lacking a usual or socially acceptable level of resources or income as compared with others within a society or country. What is considered 'acceptable' inevitably various from country to country and is significantly higher in developed countries than in developing countries.

The common international poverty line has in the past been roughly $1 a day. However in 2008, the World Bank revised this figure to $1.25 at 2005 purchasing-power parity (PPP).

Poverty cycle

Earlier we noted that poverty and inequality are major factors holding back the development of many of the poorest countries on earth. Poverty is a grinding fact of life. Often, people receive little education, hope or access to any of the normal features of life. What value can be added to these people? They may be intelligent and gifted individuals but they will receive little, if any education. Health care will be non-existent. The inequalities apparent within their economy will breed resentment. This can lead to hatred, ethnic violence, corruption and the undermining of the democratic process. Those thinking of investing in such an economy will probably decide not to. If you earn little, say just a few dollars a day, what chance do you have of saving any money, or owning a bank account? The acquiring of capital is impossible and that precludes you from passing wealth to your direct descendants.

Earlier we noted that poverty and inequality are major factors holding back the development of many of the poorest countries on earth. Poverty is a grinding fact of life. Often, people receive little education, hope or access to any of the normal features of life. What value can be added to these people? They may be intelligent and gifted individuals but they will receive little, if any education. Health care will be non-existent. The inequalities apparent within their economy will breed resentment. This can lead to hatred, ethnic violence, corruption and the undermining of the democratic process. Those thinking of investing in such an economy will probably decide not to. If you earn little, say just a few dollars a day, what chance do you have of saving any money, or owning a bank account? The acquiring of capital is impossible and that precludes you from passing wealth to your direct descendants.

Poverty cycle

Poverty can be very difficult to reduce as many economies struggle to develop and find themselves in what is known as the 'poverty cycle'. This can be seen as a spiral of deprivation. To develop economically, countries need to invest in new and improved capital. However, investment needs funding and this requires savings. Countries with low income and low savings levels have a lack of funds for investment, which in turn leads to lower incomes. This is, in essence, a downward spiral of cumulative causation. Low incomes lead to low investment levels, which mean even lower incomes. Less developed countries need to break the cycle to develop, but how can this be achieved? This poverty cycle is shown in diagrammatic form in Figure 1 below.

Figure 1 The vicious cycle of poverty

The poverty cycle is an example of a vicious cycle. However, it can be turned on its head and the process viewed from a positive perspective; a so called virtuous cycle. In a virtuous cycle, higher incomes will lead to higher savings and demand, enabling and encouraging more investment, raising productivity and thus increasing income. When it comes to strategies and policies to encourage economic development, it is consider how the vicious cycle of poverty can be halted and a virtuous cycle put in its place.

This poverty is clearly shown in link below to Human Poverty Index (HPI) data. The HPI is a composite index measuring deprivations in the three basic dimensions captured in the human development index-a long and healthy life, knowledge and a decent standard of living.

The 2010 Human Development Index (HDI) Report introduced three new indices to capture important aspects of the distribution of well-being for inequality, gender equity and poverty. This composite index includes:

- The Inequality-adjusted Human Development Index

- The Gender Inequality Index (GII)

- The Multidimensional Poverty Index (MPI)

Diversity among economically less developed nations

In this section, we highlight the considerable diversity between less developed countries. If we examine the four basic requirements for growth and development that we considered earlier in the section it is clear the availability and quality of each may vary enormously from one country to another. Some less developed countries such as Botswana are very well endowed as far as raw materials are concerned, some are not. The climates of some countries are conducive to high levels of agricultural productivity others constantly are have to battle again drought and irregular rain patterns. Some have large and ready supplies of labour whilst others do not. Some countries have a transport infrastructure than enables them to more readily engage in trade of goods whilst others have road and rail systems that are run down and lack sufficient capital investment. Understanding the context in which development is taking place is very important.

In this section, we highlight the considerable diversity between less developed countries. If we examine the four basic requirements for growth and development that we considered earlier in the section it is clear the availability and quality of each may vary enormously from one country to another. Some less developed countries such as Botswana are very well endowed as far as raw materials are concerned, some are not. The climates of some countries are conducive to high levels of agricultural productivity others constantly are have to battle again drought and irregular rain patterns. Some have large and ready supplies of labour whilst others do not. Some countries have a transport infrastructure than enables them to more readily engage in trade of goods whilst others have road and rail systems that are run down and lack sufficient capital investment. Understanding the context in which development is taking place is very important.

- Natural factors

- Human factors

- Physical capital and technological factors

- Institutional factors

Throughout the sections of the pack you will come across many case studies, data sets and examples taken from different developing countries. What should be becoming apparent is whilst there may be some common issues facing some of these countries, the problems they face and the solutions that may or may not be available will be very particular to a specific country.

Some economists would argue that enormous damage has been done to some countries (and their citizens) that have been pressurized to follow growth and development policies required by the multilateral agencies such as the World Bank and the IMF as conditions for loans. The variation in the natural, human, physical and technological and institutional factors affecting countries will mean that 'one size fits all' growth and development policies and approaches may make matters worse and paradoxically be anti-developmental.

International development goals

In 1970 the General Assembly of the United Nations made a commitment to the developing countries of the world that:

In 1970 the General Assembly of the United Nations made a commitment to the developing countries of the world that:

"Each economically advanced country will progressively increase its official development assistance to the developing countries and will exert its best efforts to reach a minimum net amount of 0.7 percent of its gross national product at market prices by the middle of the decade"

Over the past 40 years, since the original agreement, the members of the UN have repeatedly reiterated this commitment. However there has been disagreement from some of the richest countries such as the USA who argue that this is unfair and discriminates against the larger economies as 0.7% of a large GNP constitutes a much large sum of money that 0.7% of a small GNP.

There is still however a commitment amongst many of the richer countries to work towards achieving this goal.

Millennium Development Goals

At a Millennium Summit in 2000 the leaders of the richest countries present adopted the United Nations Millennium Declaration.

The Declaration asserts "that every individual has the right to dignity, freedom, equality, a basic standard of living that includes freedom from hunger and violence, and encourages tolerance and solidarity."

It had been realized by many including the multilateral agencies such as the UN, OECD, The World Bank and IMF that if these human rights were to be achieved a set of goals with measurable targets focusing on improving social and economic conditions in the world's poorest countries needed to be set.

Pause for thought

It has sometimes been stated that "what gets measured gets done". What is the basis for this argument and do you agree with it? If not, why not?

This realization led to the establishment of the Millennium Development Goals (MDGs) in 2001.

By setting targets and indicators for poverty reduction on a set fifteen-year timeline, ending in 2015, it was hoped that the human rights highlighted in the Declaration would be achieved. There are eight goals with 21 targets and a series of measurable indicators for each target.

Case Study - Millennium Development Goals

Read the article 'Uneven Progress of UN Millennium Development Goals' (you can do this in the window below or follow the previous link to read the article in a separate window) and then consider answers to the questions below.

You may also find the UN Millennium Development Goals and Millennium Development Goals monitor websites helpful in answering the questions below. For more details on the background to the Millennium Development Goals, see the UN Millennium Development Goals background site.

You can also find out how different countries are performing in terms of meeting the Millennium Development Goals by visiting the Aid Flows website (from the OECD and the World Bank). The site allows you to look at how the country's key development indicators change over time and arranges these according to the MDGs. It is a great resource.

- Outline the eight Millennium Development Goals.

- Why do you think the Goals have been broken down into specific measurable targets?

- Analyze the extent to which the Millennium Development Goals are currently being met.

4.1 Economic development (questions)

In this section are a series of questions on the topic - economic development. The questions may include various types of questions. For example:

- Short-answer questions - a series of short-answer questions to help you check your understanding of the topic

- Case studies - questions based around a variety of information

- Long answer - questions requiring an extended/essay type response

- Data response - responding to data or topical economics news articles

Click on the right arrow at the top or bottom of the page to work through the questions.

Short questions

Question 1

Explain the importance of human capital in contributing to economic development.

Question 2

Explain the difference between economic growth and economic development.

Question 3

Discuss the view that the achievement of higher economic growth rates should be the priority of developing economies.

Question 4

Explain what is meant by sustainable development.

Question 5

Explain how extending property rights and land ownership can help bring about more sustainable development.

Data response question (1)

As the 1970s evolved, so Nigeria was seen as one of the great hopes of the developing world. It had oil and a population that was being educated to international standards. As a consequence, bankers liked lending to such a prosperous nation. Then the oil price started to fall and lenders wanted their money back. Africa's largest country became riddled with debt, poverty and corruption. Now, despite being beset with many, there are at least some encouraging signs.

Key data - Nigeria

| Data type | 1997 | 2000 | 2001 | 2009 |

|---|---|---|---|---|

| Life expectancy (years) | 50.1 | 46.8 | 46.1 | 48 |

| Infant mortality rate (per 1,000 live births) | 111.2 | 110.0 | 110.0 | 86 |

| Under 5 mortality rate (per 1,000 children) | ... | 184.0 | 183.0 | 138 |

| GDP growth (annual %) | 2.7 | 3.8 | 3.9 | 6 |

| Exports of goods and services (% of GDP) | 45.0 | 52.3 | 48.3 | 36 |

| Imports of goods and services (% of GDP) | 37.8 | 41.1 | 49.0 | 27 |

| Total debt service (% of exports of goods and services) | 7.8 | 7.9 | 12.0 | 1 |

| Short-term debt outstanding (current US$) | 5.5 billion | 1.1 billion | 1.7 billion |

Oil prices Crude spot price US$

| 1980 | 36.86875 |

|---|---|

| 1985 | 27.18333 |

| 1990 | 22.87917 |

| 1995 | 17.18333 |

| 2000 | 28.22972 |

| 2005 | 53.39102 |

| 2010 | 79.04077 |

| 2011 | 104.7124 |

Question 1

Explain using supply and demand diagrams why in the last two decades of the 20th century the long term price of commodities such as oil fell.

Question 2

Explain how falling commodity prices can impede economic development.

Question 3

Using the data above, comment on the economic development process in Nigeria over the period 1997 to 2009.

Question 4

Examine the factors that might have caused the fall in the economic potential of a country as rich as Nigeria?

Question 5

From the early 2000s the price of oil has risen again. Using appropriate diagrams, evaluate the impact of an oil price increase on the economy of Nigeria.

Data response question (2)

Read the article Losing Thousands of Hectares of Forests Each Year and then answer the questions below.

The effect of clearing of forests to increase the amount of arable crops that can be grown is an example of a negative externality.

Question 1

Explain what is meant by a negative externality

Question 2

Using supply and demand diagrams, explain how negative externalities result in market failure.

Question 3

Examine why an increase in the level of poverty within Burkino Faso contributes to environmental degradation.

Question 4

Discuss strategies that the government of Burkina Faso could introduce to reduce the extent of forest degradation.

Data response question (3)

Read the article Small-Scale Farmers Bear the Brunt of Rapid Climate Change and then answer the questions below.

Question 1

Using supply and demand diagrams, explain what will happen to the price of tea and the revenue of tea farmers as a consequence of the drought.

Question 2

Explain the effect of farmers switching from subsistence agriculture (where they produce food for their own household consumption) to the production of cash crops for sale.

Question 3

Analyse the long term effects of recurrent droughts on small scale farming.

Question 4

Examine economic and social policies that the government of Kenya could introduce to support small scale tea farmers during periods of drought.

Long questions (1)

Question 1

Explain the concept of sustainable development and why it may be threatened by economic growth.

Question 2

Discuss the view that economic growth will inevitably conflict with sustainable development.

Long questions (2)

Question 1

(a) Using diagrams and examples where appropriate, explain what is meant by the poverty cycle.

(b) Evaluate alternative ways in which the poverty cycle can be broken.

Question 2

With reference to examples from specific countries, explain why the savings gap is considered to be an important concept when analysing development.

4.2 Measuring Economic Development (notes)

In the previous section, we looked at the nature of economic growth and economic development. In this section we will examine methods of measuring development.

By the end of this section you should be able to:

- Distinguish between GDP per capita figures and GNI per capita figures.

- Compare and contrast the GDP per capita figures and the GNI per capita figures for economically more developed countries and economically less developed countries.

- Distinguish between GDP per capita figures and GDP per capita figures at purchasing power parity (PPP) exchange rates.

- Compare and contrast GDP per capita figures and GDP per capita figures at purchasing power parity (PPP) exchange rates for economically more developed countries and economically less developed countries.

- Compare and contrast two health indicators for economically more developed countries and economically less developed countries.

- Compare and contrast two education indicators for economically more developed countries and economically less developed countries.

- Explain that composite indicators include more than one measure and so are considered to be better indicators of economic development.

- Explain the measures that make up the Human Development Index (HDI).

- Compare and contrast the HDI figures for economically more developed countries and economically less developed countries.

- Explain why a country's GDP/GNI per capita global ranking may be lower, or higher, than its HDI global ranking.

Measuring Economic Development - introduction

In this section we consider the following sub-topics in detail

In this section we consider the following sub-topics in detail

- Single indicators

- Composite indicators

Single indicators

As we saw in Section 4.1, there are various measures of national income and economic growth. GDP and GNP are two of these single indicators. GDP considers all output that has been domestically produced, whereas GNP, now often referred to as GNI (or Gross National Income) takes into account net property income from abroad or paid abroad.

Few less developed countries (LDC's) have national companies operating in overseas markets, but there is a good chance that they will have foreign multinational companies (MNCs) operating in their country. Developing economies often offer a good low cost base for production for MNCs, which attracts them to locate there. However, MNCs tend to return profits overseas to where the parent company is located, rather than reinvesting in the local economies where they are located and operate. This can mean large net outflows of profit from developing economies making GNP lower than GDP. In addition, the large overseas debts of many LDC's results in further large outflows in the form of interest repayments. So, if we want a measure of national income to focus on domestic development, it may be better to look at GDP figures, rather than GNP. However, for many reasons this measure may not be adequate.

This section is going to require you to build a database of key development indicators for a number of countries. Having done this, you will be asked to analyse the data you have gathered and draw some conclusions. The questions you will be offer guidance on how the data should be analysed and the areas where conclusion and insights should be offered.

Building a development Database (Part 2)

- Go to the World Bank data site http://data.worldbank.org/ and find GDP, GNP and GDP per capita figures for the following countries:

- Australia

- China

- Romania

- Ecuador

- Italy

- Thailand

- Uganda

- USA

- Enter the data into a spreadsheet.

- Produce a list showing the countries in rank order based on GDP per capita.

- Choose two countries with a marked difference in GDP per capita and see if you can find out what factors cause the differences in their GDP per capita.

- To what extent do you think the list from question 3 gives an accurate picture of the living standards of the respective population?

In Section 2.1 you came across some of the problems of using GDP and GNP data as reliable indicators of welfare and living standards. We saw that increases in population will reduce per capita GDP and per capita GNP figures, suggesting that living standards may have fallen because national income is divided between more people.

Similarly, inflation will increase the value of GDP in nominal terms, but not in real terms. Indeed, if the rate of inflation is growing faster than the countries' national income, then real GDP figures will fall and possibly reduce peoples' living standards. However, even using real GDP figures as an indicator of economic development and welfare is not without its problems.

Limitations of using GDP to compare welfare

We need to be careful when looking at growth and what it tells us about an economy. Simply because a country appears to be getting wealthier does not actually mean that it is. Indeed, using national income figures, such as GDP, as measures of living standards may be inappropriate. An increase in real GDP denotes an increase in the output of goods and services of the economy, but does this necessarily lead to a corresponding increase in welfare?

We need to be careful when looking at growth and what it tells us about an economy. Simply because a country appears to be getting wealthier does not actually mean that it is. Indeed, using national income figures, such as GDP, as measures of living standards may be inappropriate. An increase in real GDP denotes an increase in the output of goods and services of the economy, but does this necessarily lead to a corresponding increase in welfare?

When comparing economic growth or GDP figures between countries consider:

- What the figure measures, e.g. GDP per head per year.

- How the GDP is distributed.

- The type of economy under consideration, e.g. developed or developing,

- The costs of basic commodities in certain economies, e.g. housing in UK against an housing in Uganda.

- How taxes are charged and who actually pays them.

- What level of social benefits are paid, and to whom.

- Life expectancy, protein intake and years in education.

- Access to basic amenities, such as clean water.

- The proportion of goods and services that are not traded, e.g. home-grown food, bartered services. The presence of these can distort national income figures significantly as they are not recorded in the data. As we shall see later, many developing countries have large informal sectors, where the goods and services are produced without government knowledge and/or control.

- The problem of comparing national incomes expressed in different currencies and the use of the official exchange rate for this purpose.

- The composition of the output, e.g. in terms of armaments and welfare services.

- The extent to which additional output has generated negative externalities, which may affect the quality of life.

Comparing welfare

Allowances for differences in purchasing power when comparing welfare between countries

We saw in the previous section that GDP alone is not a completely adequate measure of the standard of living, though it is often used as a proxy for it. If we do use GDP as a measure of standard of living, then we also need to take account of differences between the purchasing power of GDP. If you have travelled much, you will be aware that prices of goods in other countries often appear cheaper / more expensive. This may appear the case to us as tourists, but not always to the people living there. This may be the case for a number of reasons. Certainly, changes in the exchange rate will affect purchasing power of foreign visitors, but other economic factors are at play.

It may be that a lower GDP per capita will provide the same standard of living compared to a country with a higher GDP per capita, because the same level of income can buy more in that country - in other words real prices are lower. So when comparing GDP between countries it is necessary to adjust for the purchasing power of the GDP. Differences in purchasing power often relate to exchange rate differentials. Although purchasing power is one factor affecting exchange rates, there are many others as well and a country's exchange rate may well be out of line with what is called the purchasing power parity (PPP) exchange rate.

Purchasing power parity (PPP) exchange rates are used for currency conversion allowing for differences in price levels between countries. Normally they are given in national currency units per US dollar. We begin the process by identifying a set basket of goods and comparing the cost of this basket between countries and then using this comparison to adjust the official exchange rate. If, for example, this basket costs $100 in the US and 1000 rupees in India; it would indicate that one dollar provides exactly the same purchasing power as 10 rupees. The purchasing power parity (PPP) exchange rate is, therefore, defined as US$1=10 rupees.

This method more accurately compares incomes across countries. It converts income in each country from that country's domestic currency to US dollars using purchasing power parities rather than the usual method of using official exchange rates or market exchange rates. Purchasing power parity adjusts official exchange rates for cost-of-living differences between the US and the country in question.

When comparing GDP levels we should always compare GDP per capita translated at purchasing power parity rates.

GNI per capita (purchasing power parity) 2007

You may find the following world Bank publication helpful in understanding purchasing power parity.

Building a development database (Part 3)

- Return to the World Bank data website site and find GDP, GNP and GDP per capita figures for the following countries expressed in terms purchasing power parity and add them to your economic development spreadsheet:

- Australia

- China

- Romania

- Ecuador

- Italy

- Thailand

- Uganda

- USA

- Explain the effect of valuing GDP, GNP and GDP per capita in terms of purchasing power parity (PPP), rather than simply expressing them in US dollars.

- Identify the values which are greater and whether this is the case for all countries.

- Produce a list showing the countries in rank order based on GDP per capita (PPP).

- Are the figures the same? Which countries show the largest variation between the two values? Can you offer some reasons why this might be the case?

- How does it compare with the list expressed in terms of GDP per capita (US dollars) Is the rank order the same? If not, why do you think this is?

Alternative single indicators

We have identified the problems of using GDP and GNP figures as the basis for comparing living standards and economic development between countries. The quality of life comes from a combination of many factors, such as:

We have identified the problems of using GDP and GNP figures as the basis for comparing living standards and economic development between countries. The quality of life comes from a combination of many factors, such as:

- Access to health care - a good measure of this is doctors or nurses per 1,000 people, though there are others.

- Infant mortality - what proportion of children live beyond their fifth birthday?

- Maternal mortality - how many mothers die in childbirth?

- Life expectancy - how long are people expected to live and are there differences between genders and/or regions?

- Access to safe water - is the water supply safe and how far do people have to travel to get to obtain water?

- Agriculture as a percentage of GDP - many developing economies are heavily reliant on their primary sectors.

- Child malnutrition - how much nutrition are children receiving in their diet? Although difficult to quantify, this is a vital indicator of the standard of living.

- Environmental measures - emissions, air quality, pollution indicators, cleanliness of water supply, quality of beaches and so on.

- De-forestation rate - how rapidly is an economy using up its resources?

- Expenditure on social security - social security is a vital safety net for the less well-off, but many developing economies have very poorly developed social security systems, if any.

- Food aid - how much food and other overseas aid is being received?

- Households with electricity - this is a useful measure of how well developed the infrastructure is.

- Transport infrastructure - transport is vital to economic development and trade.

- Poverty - how many people are living below the poverty line?

- Access to education - one measure is the pupil/teacher ratio (number of teachers per 1000 etc.), but we could also look at the proportion of the population enrolled at primary, secondary and tertiary levels of education.

- Leisure - access to leisure services, Internet connectivity and so on.

To this standard of living list can be added political factors such as:

- Open government

- Democracy

- Accountable government

- Civil rights

- Rights of women and minority groups

We have to be careful not to confuse the cost of living with the standard of living. The cost of living depends on the rate of change of prices and the standard of living will partly depend on income levels combined with the factors considered above.

As you can see, GDP alone is a fairly inadequate measure of welfare - other factors need to be considered and be even more important.

Building a development database (Part 4)

- For the following countries find out the values for indicators relating to the relating to development and living standards and add them to your database. There are often a number of different indicators that you could use so choose one you consider appropriate. A list of possible measures is included below.

- Australia

- China

- Romania

- Ecuador

- Italy

- Thailand

- Uganda

- USA

- access to health care

- nutrition

- infant mortality,

- maternal mortality,

- life expectancy,

- access to education,

- access to safe water,

- Outline how these indicators differ from the GDP per capita (PPP) data you found earlier.

- Analyse the reliability of GDP per capita (PPP) as an indicator of development.

- Prepare a rank ordered list of the countries in terms of their level of economic development. Discuss the problems you found in doing this.

Perspectives on development (videos)

For some interesting insights and perspectives into development and how data can be used to show how development is taking place across over the world and over time you may want to have a look at these two clips of Hans Rosling professor of global health at Sweden's Karolinska Institute. Follow the links below the videos to open them in a new web window.

http://www.ted.com/talks/hans_rosling_shows_the_best_stats_you_ve_ever_seen.html

http://www.ted.com/talks/hans_rosling_reveals_new_insights_on_poverty.html

Pause for thought

Clearly there are a number of ways of "measuring" development. What criteria could we use to determine whether a particular way of measuring development is effective or not? Talk this through with other people in your class. Is there agreement? If not, why not?

Gapminder data

Having looked at the videos you may want to explore the dynamic data sets that Rosling has developed using the excellent comparative data Gapminder site mentioned in section B6. Why not have a look at the site in the window below and the first comparison made by Rosling between life expectancy and fertility rates?

Alternatively, follow the previous links to open the site in a new window.

When looking at the site, click on the either the Gapminder world or data tabs to start. Bear in mind the following:

- each bubble represents a country

- the position of the bubble is determined by the indicators on the axes

- the size of the bubble represents the population of the country

- the colour represents the country's geographic region by default, but it can be changed to show indebtedness or income group instead

To help you understand the data and appreciate what is being shown, why not try:

- Clicking on a bubble(s) to view a particular country or countries

- Drag the timeline at the bottom to view how the data has changed (or press the play button)

- Change the variables you are viewing to compare different relationships (see some suggestions below)